Interventionist measures from the Chinese authorities are having their intended consequence and have stopped the rout in Chinese equities.

The Shanghai Composite rallied sharply last night adding to Thursday’s gains after Chinese authorities imposed selling bans and injected liquidity into the market.

Around half of the stocks listed in mainland China remain suspended leading some to think there is potential for further gains when they resume trading.

The recovery in the Chinese stock market has helped boost commodity prices providing impetus for bargain hunters to pick up beaten down mining companies.

The Greek proposal to creditors has also breathed optimism into the markets, giving investors further reason to buy.

“Greece is also aiding sentiment and traders are expressing the view that ‘Greece is solved, get involved,’ or words to that effect. The new proposals that have been announced in the early Asian session have seen a strong move higher in U.S. futures and our opening European calls also look strong,” said Chris Weston, chief market strategist at IG.

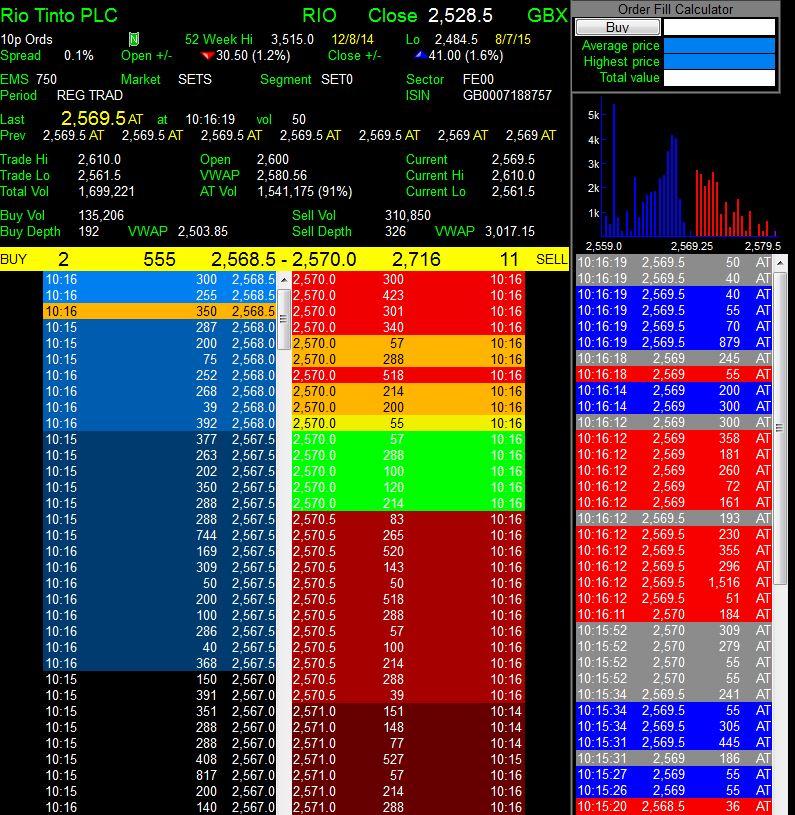

Shares in Rio Tinto (+1.59%), BHP Billiton (2.45%) and Glencore (1.8%) were among the best performers on the FTSE 100 this morning.