Opec and allies to restrict oil supply during April

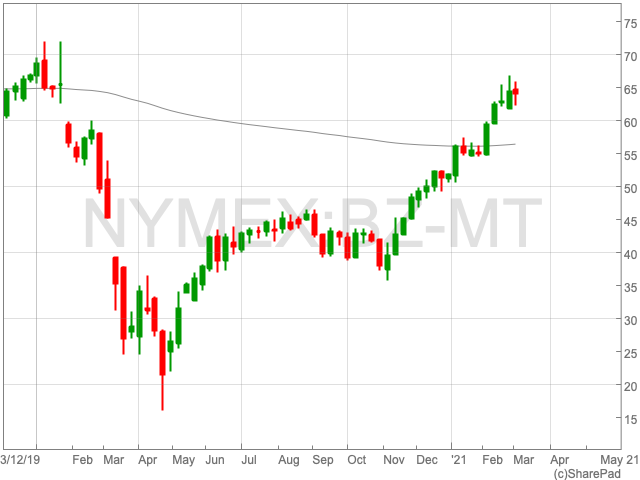

Oil prices have climbed to a 14-month high as Brent crude oil reached $67.85 per barrel today, its highest level since January 2020.

West Texas Intermediate is up to $64.8 per barrel on Friday morning.

The news came as Opec and its allies made the decision to restrict supply during April amid uncertainty around the economic recovery from the pandemic.

Prince Abdulaziz bin Salman, the Saudi Arabia’s oil minister and son of King Salman, warned against complacency over the commodity’s recovery.

“Let us be certain that the glimmer we see ahead is not the headlight of an oncoming express train,” he said, as a meeting of oil ministers began. “The right course of action now is to keep our powder dry, and to have contingencies in reserve to ensure against any unforeseen outcomes.”

bin Salman stated that he favoured a more cautious approach moving forward.

“When you have this unpredictability and uncertainty [I believe in] taking things in a more precautionary way.”

The news has prompted analysts to raise their price forecasts for the commodity. Goldman Sachs raised its forecast to $75 per barrel, up $5 per barrel, for Q2 of 2021, and $80 in Q3.

Having reached an all-time low in April 2020 due to worldwide lockdowns, oil has climbed back to its pre-pandemic level.

The price of oil is looked to as a barometer of activity as the world economy continues to cope with the ongoing coronavirus pandemic.

After worldwide lockdowns first came into effect in early 2020, oil prices plummeted into negative territory. Producers who did not have adequate storage capacity, were paying buyers to take the commodity off their hands.

In the UK, the FTSE 100 has benefited from strong performances from oil companies in recent weeks, in addition to mining firms, relying on both sectors for recent gains.

“Between them they provide a fifth of the index’s market capitalisation and are forecast to provide 31% of total profits and 28% of aggregate dividends in 2021,” according to Russ Mould, investment director at AJ Bell.