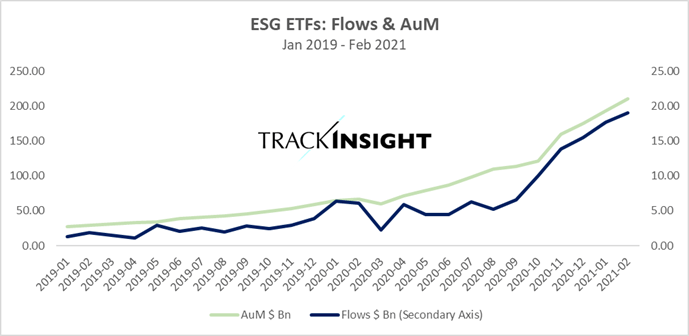

ESG ETFs see new high of $210bn assets under management

ETFs (Exchange-Traded Funds) have reached a record high of $8trn assets under management (AuM) as investors scour the market for options that meet ESG (environmental, social and governance) standards.

This is according to data collected in February by trackInsight, a global Exchange-Traded Funds analysis platform.

Funds listed in North America saw over $95bn flow in last month, nearly a 50% increase month-on-month. 3,200 ETFs are now listed on North American exchanges with $5.9bn in AuM.

February was the single large month in history for ESG funds, which saw $19bn coming in, to reach a new high of $210bn.

Bitcoin ETFs also reached record highs in February with nearly $0.25bn flowing in. Bitcoin is tracked via ETFS by $4.5bn worth of assets, a small but increasing portion of its $1trn market cap.

In contrast, Gold funds lost their lustre over February as flows went negative, losing $5 Billion for a total of $186 Billion of AuM. However, Cannabis ETFs made up seven of the top ten best-performing funds this year.

Anaelle Ubaldino, head of research and investment advisory at TrackInsight, commented on the company’s findings:

“The flexibility of the ETF wrapper means that an ever-increasing range of ideas, from actively managed strategies to ESG and thematic investments like disruptive tech and Bitcoin, are now easily available to all investors, and many are taking the opportunity to gain exposure to asset classes and strategies that were previously unavailable to them.”

“However, the proliferation of choices, not just in areas like ESG or Bitcoin, but across ETFs in general means investors are faced with a paradox of choice. So investors must do their homework and look beyond the headlines and media hype when picking an ETF as products that are similar on the surface may be very different when you look under the hood.”