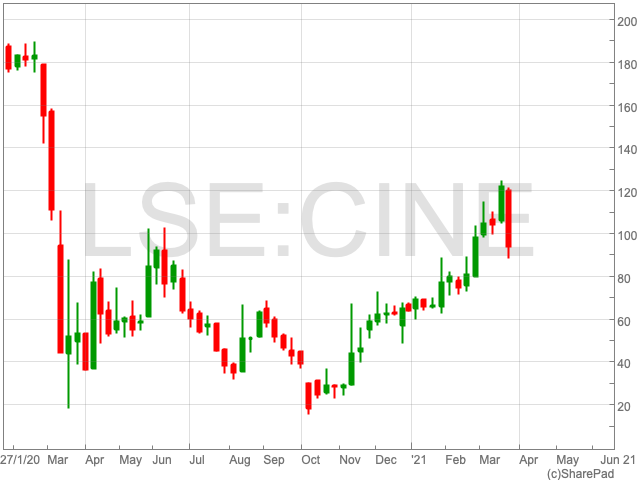

Cineworld Share Price

Cineworld (LON:CINE) shares fell by 9.32% on Thursday to 92.68p per share, a way off its recent high of 122p. However, the company is up by 57% over the past 12 months, after making a solid recovery since its inevitable crash when lockdowns begun. With its earnings release being announced and economies gradually opening up, now could be a pivotal time for investors looking at the leisure group.

Cineworld Reopening

The good news is that Cineworld has set firm dates for its reopening. The FTSE 250 company has said it will open a number of sites in its biggest market, the US, in early April, ahead of the Godzilla vs Kong opening. While it plans to open in the UK, its next biggest market, in early May.

The company confirmed that capacity restrictions will allow occupancy of 50% or more in most US states. CEO Mooky Greidinger says that this means “we will be able to operate profitably in our biggest markets.”

Of course a emergence of Covid-19 in Europe or America could threaten the company’s reopening.

Performance

Cineworld confirmed a $3bn loss for the financial year gone as the devastating impact of lockdowns on the cinema chain became clear. The FTSE 250 company’s revenues plummeted by over 80% to $852m, down from $4.3bn the year before. The chain also posted a pre-tax loss in 2020 of $3bn, a swing from a profit off $212m if 2019. Cineworld’s board confirmed it had raised an additional $213m to see it through to when cinemas are able to reopen in April, so now the company’s net debt stands at $8.3bn.

Risks

While news that Cineworld is opening up its venues across the world is positive, there are reasons to suspect that consumers may not flock to cinemas in their droves. The group penned a deal with Warner Bros to secure the release of its films in its cinemas for 45 days before the studio can load them on to its streaming platform HBO Max. Put simply, this shortens the cinema’s exclusivity window, and creates an incentive for film lovers to wait until their favourite movies are on streaming platforms. Morgan Stanley said that it “cements an industry-wide shortening of the window, a negative for exhibitors and reflecting of increased premium video on demand/streaming risk”. However, it is better than Warner Bros films going straight to streaming service and people well have a strong appetite for going to the movies after being locked down for so long.