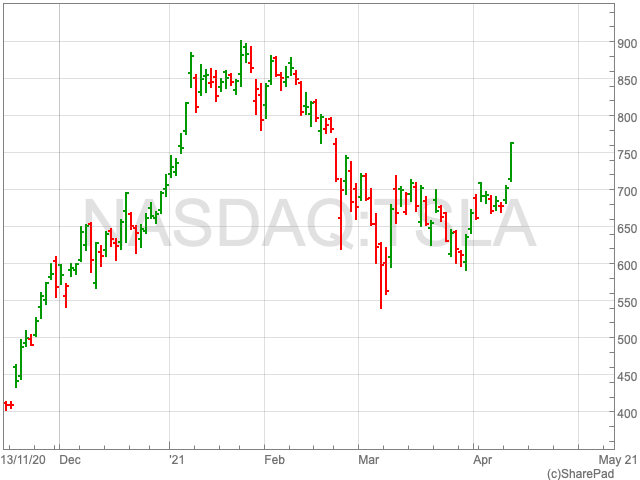

Tesla Share Price

Tesla shares rallied 8.6% on Tuesday, closing at $762.32, its highest point since February 2019. Yesterday’s advance was the largest rise in a single day since March 9, when Tesla jumped by nearly 20%. Since the turn of the year the company’s value is up by 8.03%.

Bitcoin

Bitcoin set a new all-time high on Tuesday, surging above $63,000. The pre-eminent cryptocurrency has been pushing up in recent weeks, and is up by over 7% in the last seven days. This is welcomed news for Tesla after the company confirmed just over two months ago that it purchased $1.5bn worth of bitcoin. Tesla has now doubled its crypto holdings by an amount that far exceeds its maiden 2020 profit of $721m from the sale of its electric vehicles.

The electric vehicle maker has previously outlined how its holding will impact the company’s balance sheet.

“We will perform an analysis each quarter to identify impairment. If the carrying value of the digital asset exceeds the fair value based on the lowest price quoted in the active exchanges during the period, we will recognise an impairment loss equal to the difference in the consolidated statement of operations,” the company said.

“The cost basis of the digital assets will not be adjusted upward for any subsequent increases in their quoted prices on the active exchanges. Gains (if any) will not be recorded until realised upon sale.”

Tesla will not recognise a gain on the value of its holdings unless some are sold. On the other hand, it will acknowledge a loss if bitcoin’s value falls below the price it was purchased for even if the coins are not sold.

While it will not consider its gains on bitcoins as profit, its stock is closely tied to the cryptocurrency, according to Wedbush analyst Dan Ives. “Musk is now tied to the bitcoin story in the eyes of the Street,” Ives told CNBC. “On the downside it’s playing with firecrackers and risks and volatility are added to the Tesla story,” Ives added.