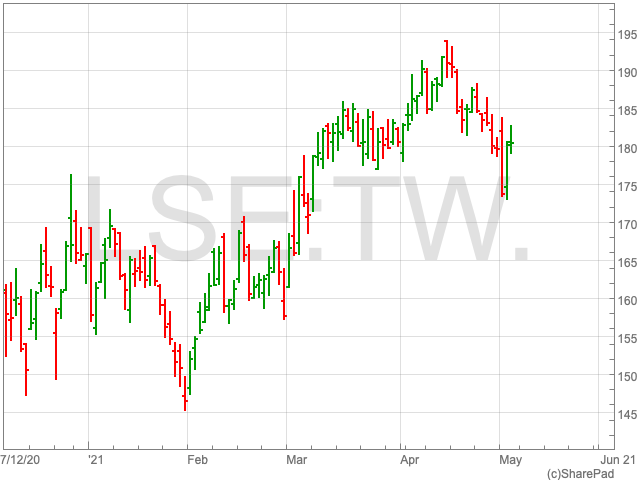

Taylor Wimpey Share Price

The Taylor Wimpey share price (LON:TW) went on a bit of a bull-run from the beginning of February, getting from 152p to 191.7p in mid-April. Since then it has dipped back down, although Taylor Wimpey shares are still up by 9.94% since the turn of the year. The FTSE 100 homebuilder remains some way of its pre-pandemic high of 232.4p.

Demand for Homes

According to Pete Redfern, chief executive of Taylor Wimpey, demand for homes is set to soar and not stop anytime soon. “I have more confidence than at any time in the last 20 years about underlying demand,” Redfern has said.

The Taylor Wimpey boss’s comments came as the company revealed its Q1 results at the end of April. The group revealed a “strong” pipeline, with the the value of its order book reaching £2.8bn, up by £140m from the year before, as at 18 April 2021.

However, concerns remain over the sustainability of these levels as the government is expected to remove some of the favourable policies geared towards the housing market during the pandemic.

Redfern sought to reassure investors who may be concerned about the possible end of the government’s stamp duty holiday, by playing down its influence on the high levels of demand in the housing market.

“I’m still of the view that the stamp duty holiday isn’t a big part of what we’re seeing,” he said. “What we’re seeing is driven by underlying demand.”

Outlook

Taylor Wimpey is expecting its volumes during 2021 to reach 85% to 90%, in comparison to 2019, while it is seeking to bring its operating margins up to 21%-22% over the course of the next two to three years. For this year the homebuilder is seeking a return to between 18.5% and 19%, which is significantly higher than its current margins of 10.8%.