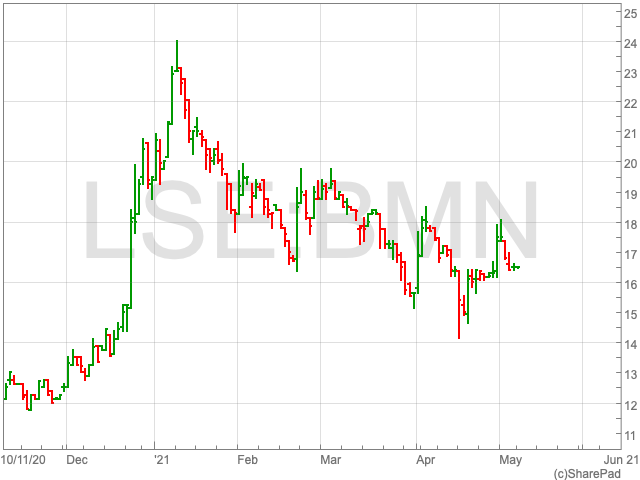

Bushveld Minerals Share Price

Eight days into 2021 the Bushveld Minerals share price reached 22.9p, surpassing its pre-pandemic high of 21.5p. However, since then it has been a rocky few months for the primary vanadium producer, as its share price now stands at 16.92p per share. Following a strike by employees which was quickly resolved in April, investors are curious about what the remainder of 2021 holds for Bushveld. On a positive note, the outlook for the vanadium market over the next year and beyond could bode well for Bushveld.

Strike at Bushveld’s Vametco mine

It was reported back in April that workers at the AIM-listed company’s Vametco mine in South Africa went on a strike to protest an employee participation plan (EPP). The strike came despite employees already signing an EPP with the Association of Mineworkers and Construction Union (AMCU). Days later Bushveld Minerals confirmed that the strike had been resolved and that workers had safely returned to work. “The impact, if any, of these five days of industrial action on production will be provided in the upcoming quarterly production report,” the company said in a statement.

Vanadium

According to the Vanadium Ore Global Market Report 2021, the chemical element is expected to grow from $1.49bn in 2020 to $1.6bn in 2021 at a compound annual growth rate (CAGR) of 7.4%. The growth will come about as companies reorganise their operations and bounce back from the impact of the pandemic, which brought about a number of restrictive containment measures.

The report also identified the emergence of a trend of using vanadium redox flow batteries (VRFB’s) for energy storage. The trend will bring about a transition of how the vanadium market is presently dominated by steel producers.

It is predicted that the increased use of vanadium in the car industry will drive the market for years to come. It utility in reducing the weight and increasing the fuel efficiency of cars, means that 85% of all cars will use vanadium by 2025.