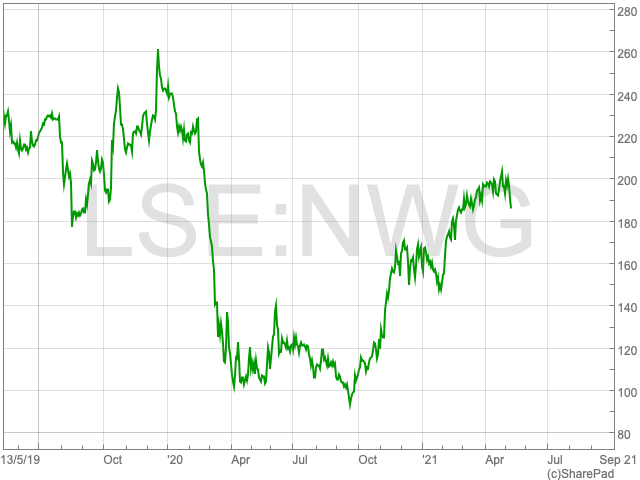

Natwest Share Price

The Natwest share price has fallen for three consecutive days, down to 185.83p per share. The dip, which has come as the UK government announced that it is aiming to secure a buyer for shares in Natwest worth up to £1.1bn, follows a bull-run which lasted since September. Since the beginning of the year, the Natwest share price up by 12.4%, while it is up by over 100% since September 2020. While it seems the FTSE 100 bank is on the comeback in the aftermath of the pandemic, there remains an element of uncertainty over its outlook for the remainder of 2021.

UK Government to Sell-off Natwest Shares

NatWest saw the Government sell £1.1 billion worth of shares to reduce its holding to 54.8%. In this case the bank will likely be pleased as it marks another step in the long rehabilitation of the group from the financial crisis.

580m shares in the FTSE 100 bank were being offered to institutional investors as part of a placing that would bring the government’s holding down to 54.8%.

Analysts are expecting NatWest to be fully returned to private ownership by 2025, almost 20 years after its effective nationalisation.

Ian Gordon, an analyst at Investec, told The Times that the timing of the move was understandable due to the market price being at its highest point in over 12 months. However, he added that there was a long road ahead as the government still has some way to go to shift the remainder of its holding in the bank.

Risks

While it may seem minimal, there remains a risk that the UK’s seemingly smooth economy could unravel. In addition, interests remain on the floor which could limit Natwest’s growth for the foreseeable future.

However, according to Nicholas Hyett, equity analyst at Hargreaves and Lansdown, “investing is a long-term game, and a balance sheet awash with capital should allow NatWest to weather a spell of poor results. The bank that emerges will be both smaller and duller than what went before, but ultimately that may be no bad thing”.