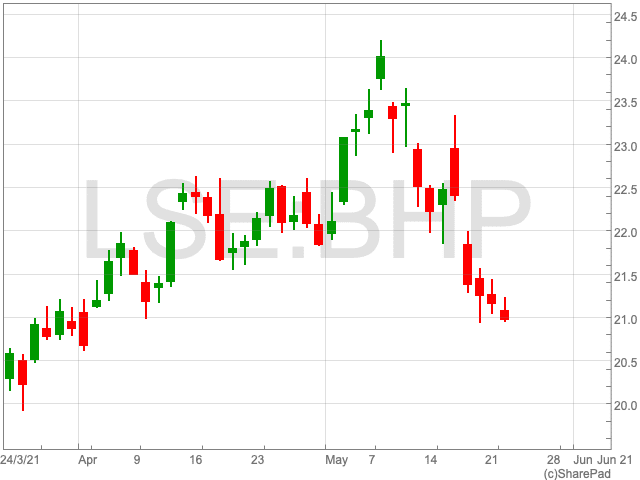

BHP Share Price

The BHP share price (LON:BHP) performed relatively well during the pandemic. The company made a swift recovery and then far exceeded its pre-pandemic level during 2021. Over the last couple of weeks it has seen a substantial dip of 7%, as momentum around commodities markets has stalled.

Production Numbers

Production numbers serve as a useful guide to the true value of the BHP share price. The FTSE 100 mining giant confirmed it achieved record production at Western Australia Iron Ore over the last quarter.

Petroleum output rose by 7% to 25.4m. While copper and iron ore output fell by 9% to 391.4kt and by 4% to 59.9Mt respectively. Energy coal production jumped by 34% thanks to higher volumes at Carrejon due to a strike during the period before.

BHP chief executive, Mike Henry commented: “BHP’s strong safety and operational performance continued during the quarter, with record year-to-date production at Western Australia Iron Ore, the Goonyella Riverside metallurgical coal mine in Queensland and concentrator throughput at Escondida in Chile.”

“We are reliably executing our major projects, bringing on new supply in copper, petroleum and iron ore. The Spence Growth Option and Samarco are ramping up and West Barracouta, in Petroleum, started production this month. First production from Petroleum’s Ruby project is expected in the coming weeks and South Flank, with its higher grade and lump proportion, is on track to begin production in the middle of the year.”

BHP said it is continuing its efforts to decarbonise, in line with the Paris Climate Accord. The company has developed partnerships with three major steelmakers whose combined output adds up to 10% of the global production.

Iron Ore

UK Investor Magazine outlined earlier this year that BHP’s performance would be dependent on the price of iron ore during 2021. The price of iron ore, the ingredient used to make steel, dived on Monday as China suggested that it would aim to calm rising prices amid concerns over inflation.

China’s economic planning agency said it would come down on monopolies in commodities markets, as well as the spread of false information. Following a recent surge, the iron ore composite fell by 6.03% to $161.09 as the announcement by the Chinese government made its way through markets.

While the iron ore price has seen a drop over the past two weeks, it remains up by 20.1% over the past three months. Robert Rennie, head of market strategy at Westpac, anticipates further intervention by the Chinese state. This could represent an issue for the BHP share price moving forward, especially as China is the largest consumer of iron ore.