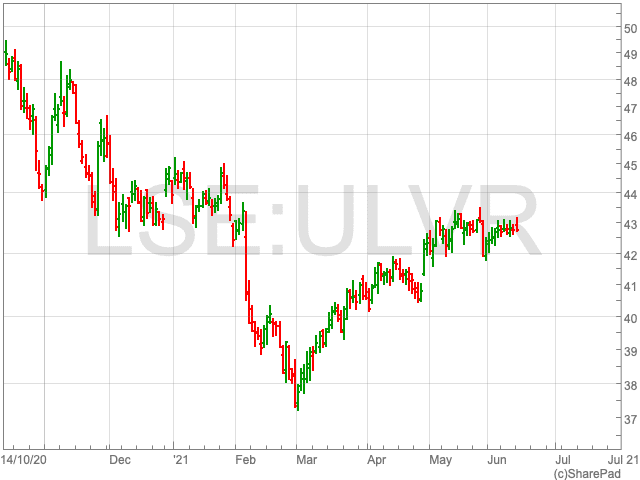

Unilever Share Price

The Unilever share price (LON:ULVR) dropped dramatically in March 2020 to 3,854,5p as lockdowns came into effect. However, demand for consumer goods held steady throughout the pandemic, allowing the FTSE 100 company to surpass its pre-pandemic level, getting as high as 4,450p. Despite some volatile movements over the past 12 months, the Unilever share price is pretty unchanged overall, down 0.41%.

Since the turn of the year, the company has lost 4.23% in the value of its shares. With restaurants, cafes and shops reopening, Unilever is likely to see its revenues grow, and as people head out to socialise, demand will rise again for beauty and personal care products. Therefore investors may be tempted by the staple consumer goods company heading into the summer and beyond.

‘A’ Rating

Firstly, Fitch, the ratings agency, said that Unilever’s competitiveness became more robust in 2020, and expects the company’s sales growth to pick up as life returns to normal.

Fitch asserted Unilever’s Long-Term Issuer Default Ratings (IDRs) and senior unsecured ratings at ‘A’. The rating demonstrates the consumer goods company’s “strong business profile”, as “one of the largest and most diversified” consumer goods and food companies (FMCG) in the world.

“The Stable Outlook reflects our expectation that potential asset divestments are unlikely to reduce leverage as we assume that proceeds will be used for bolt-on M&A or returned to shareholders through share buybacks,” Fitch said.

Meat-Free Market

While Unilever has a vast product line, the company is still expiring new areas to diversify into. The latest is its proposal to bring plant-based meat products to market. The consumer goods giant recently announced a partnership with Enough, a food-tech company, to use a fermentation process to grow a high-quality protein.

The non-meat sector is seeing massive growth across the world as more people consider the environmental impact of meat eating, as well as health implications. It has been estimated that the industry will be worth $290 billion in 2035.

It follows Unilver’s investment of €85m in Hive, a facility for food innovation in the Netherlands, in an effort to support the development of plant-based foods.

Carla Hilhorst, executive vice-president of R&D for foods and refreshment at Unilever, said: “Plant-based foods is one of Unilever’s fastest growing segments and we’re delighted to partner with Enough to develop more sustainable protein products that are delicious, nutritious, and a force for good.

“We’re excited by the potential that this technology has for future innovations across our portfolio, and we can’t wait to launch more plant-based foods that help people cut down on meat, without compromising on taste.”