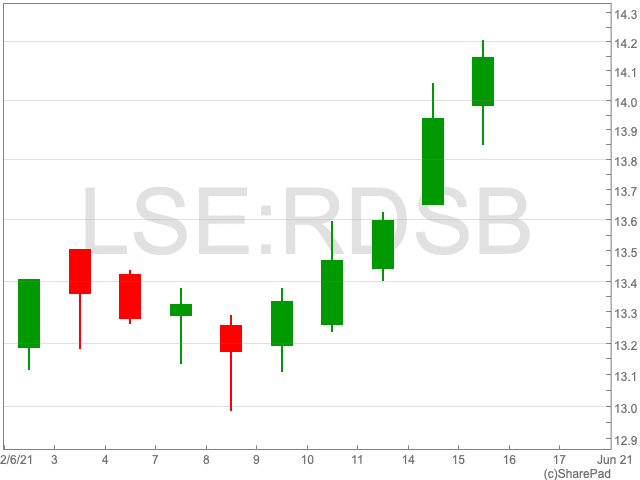

Shell Share Price

The Shell share price (LON:RDSA) has spent the past five days in the green, amounting to gains of 6.92%. The recent move follows a Dutch court ruling that Shell must reduce its worldwide carbon emissions by 45% by the end of 2030. The oil giant remains over 100p short of its highest point so far in 2021 of 1,583.6p.

Since the beginning of the year, the Shell share price is now up by 13.67%, as the energy company has performed well in line with the relatively strong performance of oil prices. Investors have been awaiting news that could influence the FTSE 100 company’s value over the coming months and they may soon be granted their wish.

Permian Basin

Shell has been mulling over its holding in the US’s largest oilfield after pledging to take robust action to reduce its emissions on the back of pressure from activist groups.

The oil giant is analysing its position in the Permian Basin, found mostly in the state of Texas, and could potentially sell its operations at what is one of the most significant oil and gas locations on the planet.

It has been reported that Shell could divest some or all of its holding in the region, with estimates of the oil group’s operations coming in at $10bn.

Shell previously committed to reducing its emissions to net-zero by 2050, although it is facing pressure to expedite this process. While it is clear the move to divest from this oil and gas site would be encouraging to investors and activists who are ESG-minded, it is less clear on what the consequences would be for the Shell share price.

Lydia Rainforth, oil and gas equity research analyst at Barclays, told The Times: “This would mark a departure in strategy, with the Permian having been described in the past as [Shell’s] ‘sleeping beauty’, with the company able to ramp up production and lower break-even over the years,” she said.