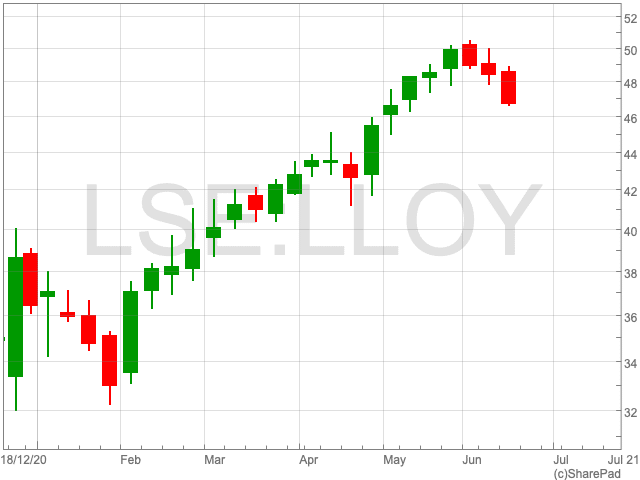

Lloyds Share Price

Despite being down by 3.84% over the past week, the Lloyds share price has been on an impressive run in 2021. Since the turn of the year it is up by over 34% at the time of writing. Despite a bumbling January amid the third UK lockdown, the Lloyds share price has seen a steady progression from there onwards. For the past month Lloyds has been trading between 46p and 50p, and investors are curious about where it will go next.

However, there are a number of factors at play which could influence the direction of the FTSE 100 bank in the near-term. In particular is the matter of when the UK fully reopens and the continued question marks over major central banks’ monetary policies.

UK Recovery

The UK economy appears to be well poised for a recovery. Britain most prominent business lobby on Friday increased its forecast for economic growth this year. The CBI has confirmed that it believes that UK GDP will rise by 8.2% in 2021, this is 1.8% higher than its previous estimate.

This bodes well for the Lloyds share price as its outlook is of course aligned with the overall performance of the UK economy.

Interest Rates

One concern for the Lloyds share price could be the prospect of continued low interest rates. Low interest rates mean that banks find it harder to generate profits on the money they are lending.

It is possible that the Bank of England could raise its interest rates sooner than thought as inflation surged past the central bank’s target for the first time in nearly two years. Furthermore, the US Federal Reserve suggested it may begin increasing interest rates earlier than anticipated.

However, Paul Dales at Capital Economics suggested that interest rates would not go above their 0.1% low until 2024: “There is a greater level of uncertainty about prices at present, with a possibility that inflation will turn out to be higher if staff shortages persist, triggering stronger wage rises, while cost increases continue to be passed on to consumers. However, with price pressures expected to ease next year and inflation to stabilise around 2%, it is likely that the Bank of England will hold fire and not raise interest rates before 2023.”

Price Target

Analysts at both Barclays and JP Morgan raised their price targets for the Lloyds share price earlier this month. Barclays upgraded its price target to 60p, an increase of 5p, while JP Morgan lifted it from 54p to 59p.