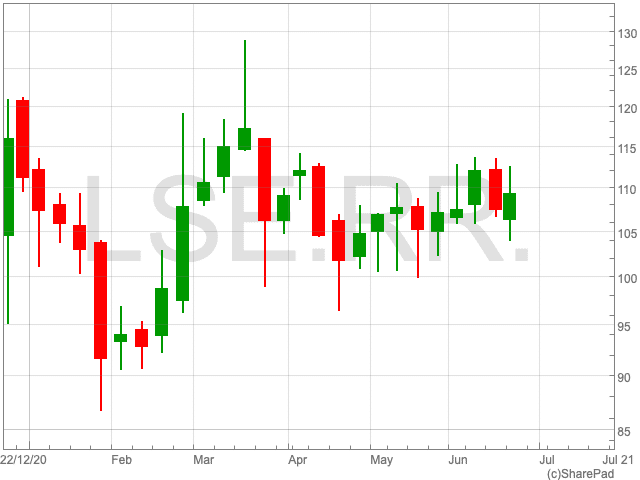

Rolls-Royce Share Price

Despite some peaks and troughs along the way, the Rolls-Royce share price has remained pretty much at the same level over the past 12 months. This trend has continued throughout 2021, as the FTSE 100 company sits at 109.14p per share. However, there has been some pretty sharp dips and rises along the way, as investors appear interested, while uncertainty remains over the extent of the recovery. With current lockdown measures at home standing still, investors seem to have given up on the likelihood of foreign travel opening up in the short-term, knocking back the Rolls-Royce share price today.

Outlook

As one of the largest aircraft manufacturers in the world, the Rolls-Royce share price has been significantly impacted by the ongoing pandemic. Not only did many airlines rescind their orders but fewer planes are currently being serviced due to a lack of flights. The company does not expect orders to recover to pre-Covid levels until 2025. In the meantime, much will depend on the success of the continued vaccine roll-outs, and the resumption of international flights. The Rolls-Royce share price continues to react to updates, or lack thereof, regarding travel restrictions.

The news on this front is not great. The Delta variant of Covid-19 is spreading across the continent and threatening to derail plans of a summer reopening. In Portugal, which was initially opened to UK travellers, the variant has seen cases rise to their highest level in 12 weeks.

“If measures are relaxed too soon also for non-vaccinated people, then we may see a rapid rise in cases again,” the European Centre for Disease Prevention and Control director Andrea Ammon said a week ago.

There, its seems plausible that the Delta variant will result in further lockdowns, which will have a damaging impact in the airline industry.

Return to Positive Cash Flow

In better news, following its AGM last month, Rolls-Royce said it is expecting its cash flow to turn positive during H2 of 2021 “as engine activity recovers and cost savings are delivered”.

This announcement is especially important as Rolls-Royce ended last year with debt at £3.6bn as the group took measures to refinance. This came about partly because Rolls-Royce made 1,400 people redundant, saving the company up to £1.3bn a year.

This could give hope to investors who are willing to be patient. Ultimately, the Delta variant may only be a delay, providing further value for those who believe in the Rolls-Royce share price over the long-term. The FTSE 100 company has managed to restructure during the pandemic which could be enticing for investors.