Airline Industry

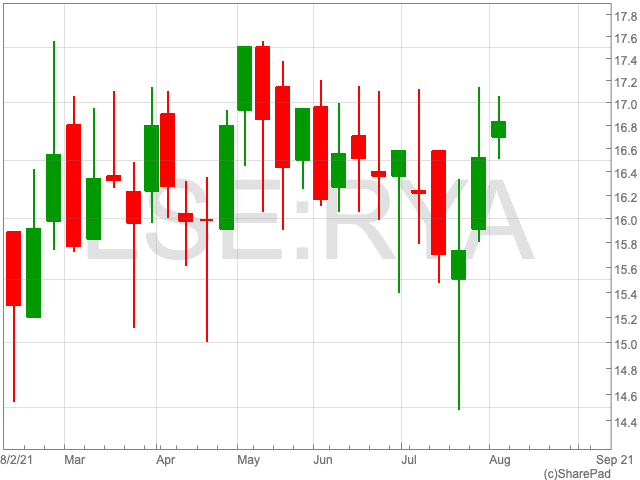

The Ryanair share price (LON:RYA), €16.82 at the time of writing, is set to close in the black for the third week in a row. The recent upwards move follows a positive set of results from the company and a brightening of the outlook of the airline industry more generally. However, while the Delta variant is hampering the global economic recovery, investors remain somewhat cautious about diving back into the stock which has had an up-and-down 2021 so far. This article will provide an update on the airline industry, as well as examining Ryanair’s position moving ahead.

Airline Industry

The mood around air travel has brightened over the past few weeks with passenger numbers climbing and destinations being opened up. However, any optimism is very much cautious as the sector was traumatised by its wort-ever crisis as a result of the pandemic.

It has been a long road, but gradually, the vaccine roll-out has allowed for the easing of some travel restrictions, with the path to full recovery becoming more achievable.

Willie Walsh, who runs global airline trade body Iata, told the Financial Times: “The recovery has definitely started in the second half, there are signs of things improving, restrictions being relaxed or removed, and we have to take positives from that.”

The number of planes in the air has risen to its highest level worldwide since the pandemic began, according to Citigroup.

However, the recovery across the world has been uneven. In addition, the Delta variant has threatened to throw a spanner in the works on a number of occasions in a variety of locations. The UK has significantly eased restrictions on travel for those who have been vaccinated.

Furthermore, people’s desire to go abroad remains very high. “What we are seeing empirically is there is nothing wrong with the consumer,” said Jozsef Varadi, chief executive of Hungary-based Wizz Air. “We think the desire to travel is totally intact.”

There are many reasons for investors curious about the Ryanair share price to be positive about the recovery. However, they must also be aware of the very real risks.

Ryanair

Ryanair confirmed a sharp rise in bookings at the end of last month while the low budget airline raised its forecast for passenger numbers over the coming year as travel restrictions are being eased across the continent.

However, the Irish company posted a €273m loss for the quarter between April and June, as lockdowns meant the majority of flights were cancelled amid ongoing caution.

The low budget airline said its mini-recovery was thanks to vaccinations, as well as the easing of isolation rules for travellers who have taken the vaccine, and the EU’s digital travel pass which the EU introduced at the beginning go July.

These factors have given Michael O’Leary, the chief executive of Ryanair, a degree of confidence over a sustained recovery for the industry, after the pandemic continued to test his company throughout the pandemic.

With a surge in bookings coming from continental Europe, Ryanair will increase its number of flights in operation during the end of summer.

While the airline is still facing challenging circumstances, it suggested that it will end the fiscal year “somewhere between a small loss and breakeven” as restrictions are there to stay for now.

Danni Hewson, financial analyst at AJ Bell, said:

“Could a last minute rush rescue Ryanair’s year? While the summer has been heavily affected by the continued strict restrictions on travel throughout Europe, the company is seeing notably higher bookings both for late summer holiday bookings and the winter,” Hewson said.

“This demonstrates how resilient demand for foreign holidays remains, particularly among the fully vaccinated cohort which now have a little more freedom to travel.”

“If people are booking now given all the uncertainty and hassle involved in flying then you could imagine a more rapid ascent when, hopefully, we finally emerge from the pandemic.”

Price Forecast

Davy, the wealth management company, recently retained its ‘outperform’ rating for Ryanair. The group said its medium-term outlook is “stellar”, and therefore the Ryanair share price is the only one with an outperform rating.

The stockbroker has a target of €18 for the Ryanair share price.