The Scottish Mortgage share price has been on a good run of form over the past six months, supported by recent gains from the tech-focused Nasdaq composite. The Nasdaq composite closed up 1.55% yesterday, outperforming the Dow Jones and the S&P 500, while the Scottish Mortgage share price followed suit on Tuesday, adding 1%.

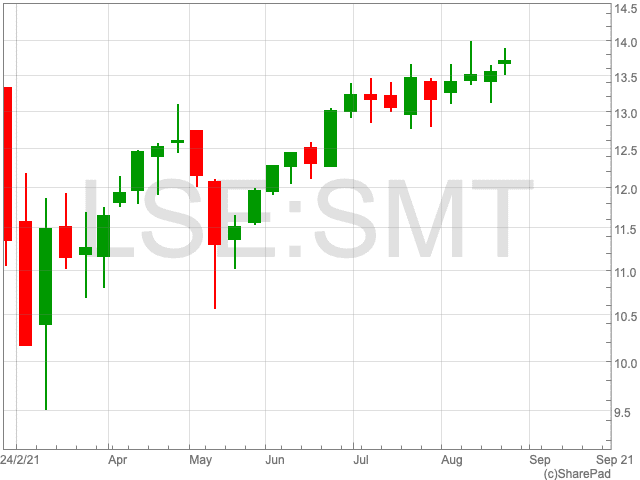

Over the past six months the fund has been on an upward trajectory, increasing its value by 12.61%, despite a bump in the road caused by a crackdown by China on its technology sector. While its holdings in Tencent, NIO and Alibaba remain high, the fund was able to benefit from the news that US Food and Drug Administration approved the Pfizer jab as its first Covid-19 vaccine. Investors in the Scottish Mortgage share price will be hoping the Chinese Communist Party take a more relaxed approach and that the vaccine roll-out proves to be a success.

Scottish Mortgage’s top holding, making up 8.5% of the fund, is Moderna. The American pharmaceutical and biotechnology company saw its share price jump by 7.55% yesterday.

It is though Scottish Mortgage anticipated a move back towards biotech companies, as it shows its impressive ability to navigate tech stocks.

Having readjusted its portfolio following the China crackdown, the Scottish Mortgage share price looks well positioned. However, judging by its top ten holdings, the fund retains faith in the future of the Chinese economy.