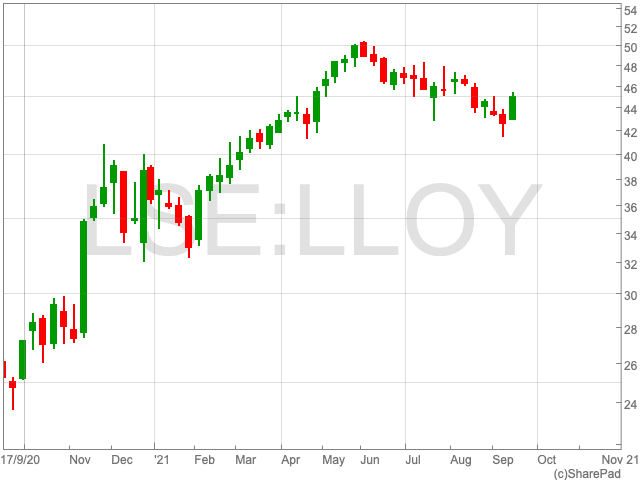

Lloyds Share Price

Heading into June the Lloyds share price (LON:LLOY) was in a good place, approaching its level from before the pandemic. However, having reached a high of 50p per share, it is come down over recent weeks, and now sits at 44.9p, with its future outlook looking uncertain.

It is a far cry away from years gone by, for example, in February 2019, when the Lloyds share price was above 60p and investors received a bumper dividend. While then, shareholders would have been smiling, now it may not be so. This calls into question the long-term credentials of the major UK bank.

Having said that, one analyst sees potential for Lloyds to get back to its level in early 2019.

Analyst’s View

Out of all the UK banks, Lloyds is the most deserving of an upgrade, according to UBS.

UBS has given Lloyds a ‘buy’ recommendation and said it is the standout option in the sector.

“We expect strong deposit growth; rebounding consumer credit; and rising interest rates to lead to substantial growth in UK net interest income in the next two years which is not captured in consensus nor current valuations,” analyst Robert Noble said in a note.

The note comes as authorities in the UK consider updating banking rules, which could involve easing restrictions on the sector.