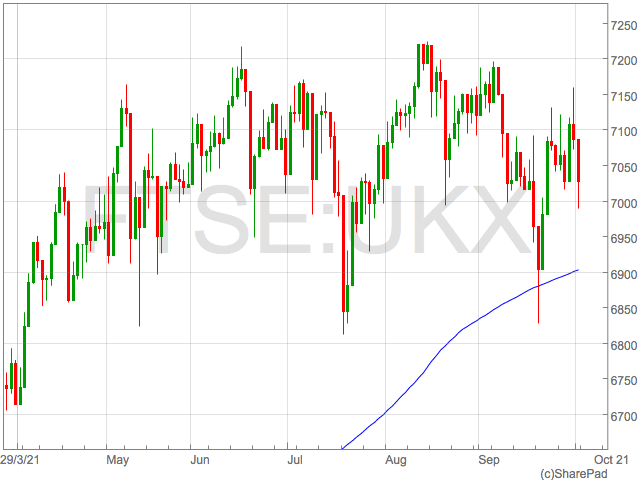

The FTSE 100 starting the week on the back foot as poor Asian data sapped optimism from the market.

“On Friday they fell off the wire as the FTSE 100 started October down more than 1%. This followed a weak session on Wall Street overnight and new factory data from Asia which only added to concern that economic growth is slowing,” said AJ Bell investment director Russ Mould.

The FTSE 100 was trading at 7,028, down 0.58% in mid morning trade of Friday.

Business Confidence drops

Business confidence in the UK added to the dour mood on Friday as the fuel crisis destroyed confidence and the fear of stagflation began to become visible in market participants,

“In the UK there has been an alarming drop in business confidence in the space of a month with the optimism engendered by the vaccine roll-out feeling like a distant memory amid a fuel, supply chain and cost of living crisis,’ Mould said.

“Markets must hope that the current shortage of everything from energy and skilled staff to shipping containers and raw materials eases before stagflation becomes too entrenched and/or central banks are forced into drastic action to tackle rising prices.”

FTSE 100 Top Risers and Fallers

Lloyds share were the top faller early on Friday as investors dumped shares in the lender which is closely aligned to the strength of the UK economy.

Evraz and Hikma accelerated losses through the session and were down 4% and 3.3% respectively.

JD Sports felt the heat of potential stagflation eroding consumer spending power and were over 2% weaker.

Travel shares gained later in the session as they rebounded from recent losses. IAG was the top riser going into the close on Friday, up 4.5%. InterContinental Hotels was up 3.5%.