While Vietnam continues to battle by far its worst COVID-19 outbreak of the entire pandemic, economic growth is still expected through 2021. Individual investments continue as a result, with the stock market emerging as the most popular destination for retail investors.

Dynam Capital sought to find out more about the characteristics of Vietnamese retail investors and engaged Indochina Research Vietnam – an independent survey research firm – to conduct the first retail investor survey in August 2021. Half of the respondents were investors who have joined the stock market less than one year ago – known locally as F0 investors.

“We truly believe that the more information and trustful data are available, the more Vietnam will be understood for its true potential and attract foreign investments. We are looking forward to the next edition of the survey to consolidate the results with more participants and provide regular updates on retail investors’ behaviour to the community”, says Xavier Depouilly, General Manager of Indochina Research Vietnam.

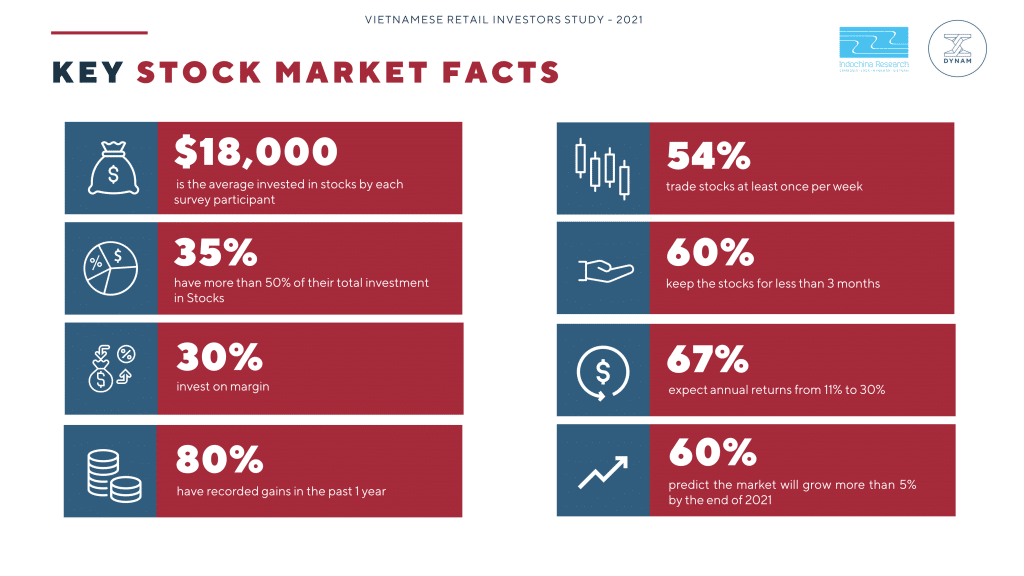

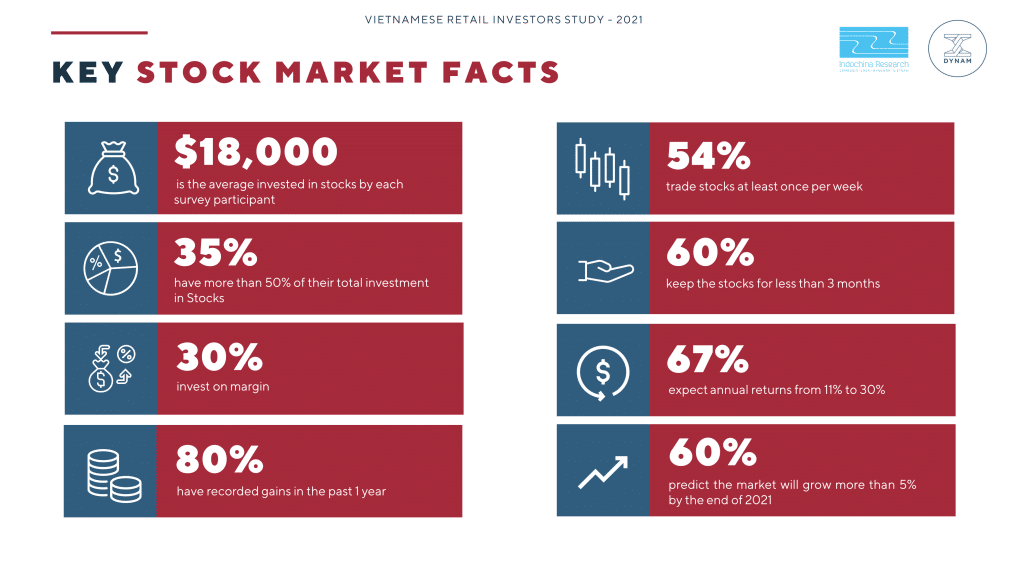

The survey reached 425 participants, out of them 193 were fully validated and analyzed. It reflects that local retail investors, are mostly from Hanoi and Ho Chi Minh City, with a gender balance of 55% female and 45% male. Most respondents are white-collar office workers (53%), with an average overall monthly personal income of USD1,170 and an average portfolio value of $18,000. This place most retail investors surveyed among the medium-high income groups of the two key economic hubs.

The results highlight how stock investors allocate their investment, with 35% having more than 50% of their money invested in stocks and a similar proportion (35%) investing up to $4,500 (up to 100 million VND).

Apart from stocks, bank deposits, real estate and insurance products are the most used placements. Interestingly, the traditional gold is only chosen by 15% while cryptocurrencies are now traded by 2 out of 10 investors.

The majority are very active, meaning they check the stock market index multiple times a day (84%) and 54% trading at least one time per week.

Download the Vietnam Holding annual report

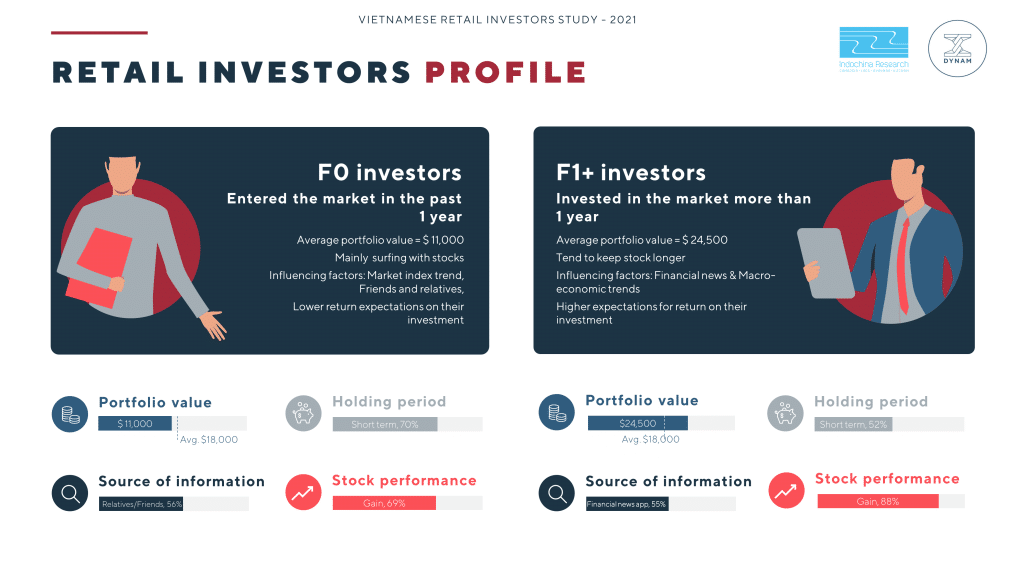

Further analysis describes significant differences between F0 and F1+ investors. F0 investors have an average lower portfolio value ($11,000 vs $24,500 for F1), are more likely to surf stock with shorter positions held and have an overall lower expectation for return on their stock investment compared to the more experience F1 investors.

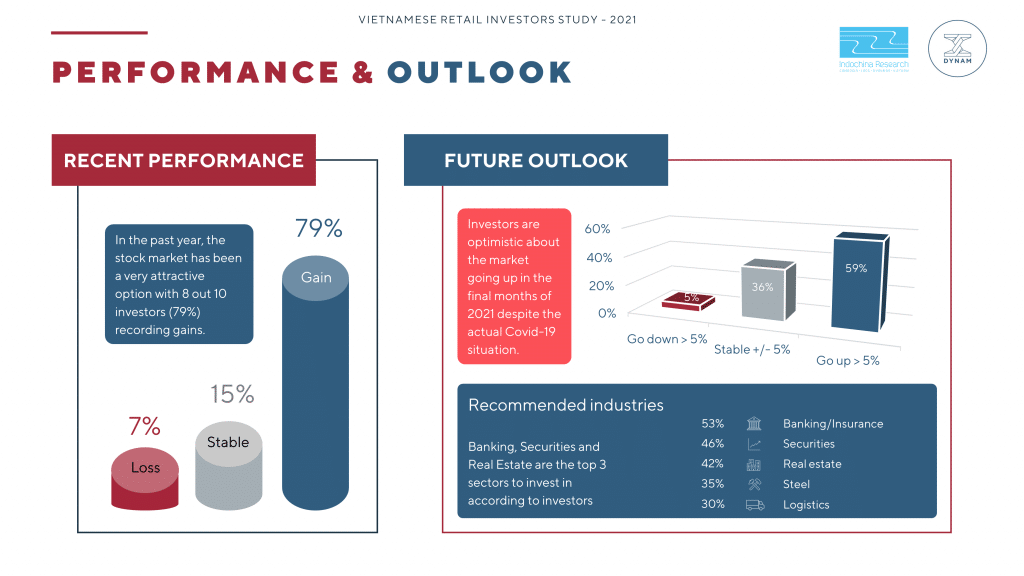

Positively, most investors (80%) have registered gains in the past year, more among F1 investors (88%), and 59% are confident that the stock market will even grow up more than 5% through the rest of this year, even in the face of the outbreak.

Six out of ten (63%) consider the stock market as a source of extra income, by far the most common response, significantly more among F0 investors (71%). About 10% consider the stock market as a retirement / long term investment plan.

These F0 individuals are far from alone.

According to local media, 842,405 securities accounts were opened in the first eight months of this year, more than the number of new accounts in the last three years combined. Bank deposit interest rates remain low, driving increased interest in stocks. As of this June, there were 3.4 million individual stock accounts in Vietnam.

Vietnam has also been likened to Taiwan in terms of potential stock market growth. Currently around 3% of Vietnam’s population has a retail stock brokerage account, similar to Taiwan’s figure in 1986. Taiwan went on to experience a decades-long stock market surge, and Vietnam now has many of the same economic fundamentals in place. The Vietnamese government also wants to see further growth, with goals to increase stock brokerage penetration to 5% by 2025 and 10% by 2030.

Download the Vietnam Holding annual report

The growth in the stock market in Vietnam has been meteoric, the market value of publicly traded companies is close to USD 300 billion in 2021, up from USD 2 billion in 2006 when investment funds such as London-listed Vietnam Holding (VNH) commenced their activity. It has created wealth for some of the new domestic investors, and longer-term investors – such as those in VNH – have seen compound returns of 15% per annum over the last decade, according to public data.

Yet, despite the growth and increased liquidity in the stock market (the second highest in ASEAN), for foreign investors Vietnam is still classified as a frontier market. For the time being, at least, it is the local investors who dominate, and seem to be benefitting most from its growth and development.

Writing credit to Michael Tatarksi and Infographics credit to Indochina Research Vietnam