Defiance ETFs has launched the first NFT Focused ETF, NFTZ, to provide investors with exposure to the burgeoning NFT marketplace.

NFTs, or non-fungible tokens, have grown on popularity through 2021 with the world’s leading auction houses overseeing multi-million dollar sales of NFTs and company including Visa getting on the action by acquiring the digital art in the form of a ‘Crypto Punk.’

NFT sales hit $2 billion in the first quarter of 2021 and a raft of companies are scrabbling to get in on the action.

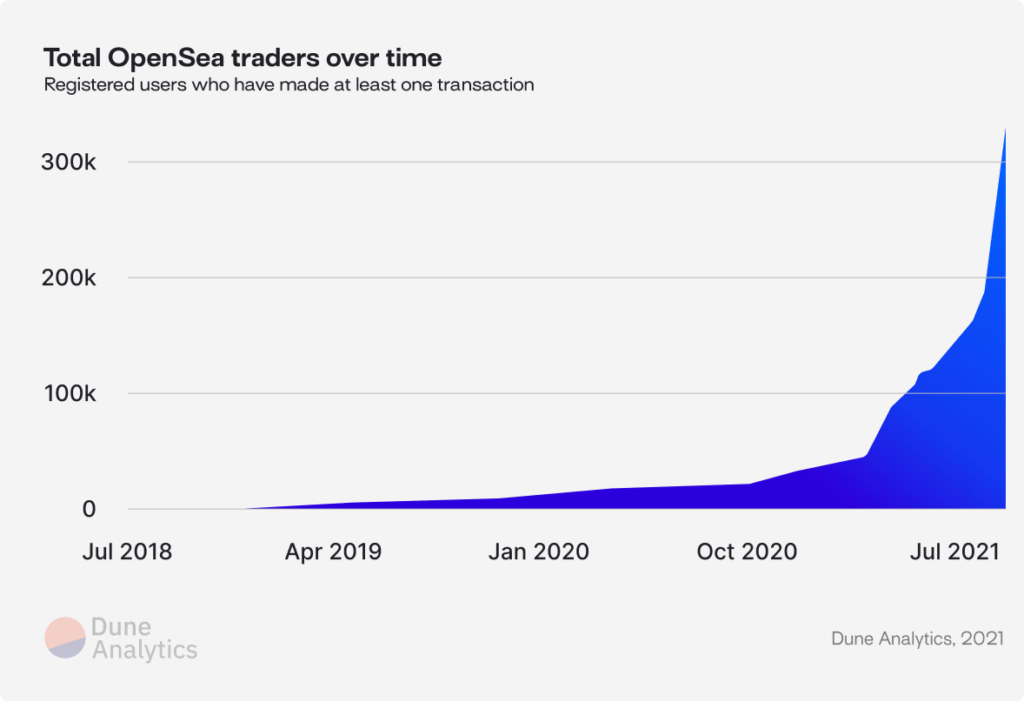

One of the original, and most popular NFT platforms, OpenSea, can illustrate the explosion in NFT activity with the number of their users making at least one transaction.

The latest thematic ETF from Defiance will give investors access to basket of companies at the forefront of the digital economy and NFT innovation. The ETF is passively managed by Defiance ETFs and is comprised of 39 publicly listed companies.

NFTZ Top 20 Holdings

| SILVERGATE CAP CORP |

| PLBY GROUP INC |

| CLOUDFLARE INC |

| NORTHERN DATA AG |

| MARATHON DIGITAL HOLDINGS INC COM |

| BITFARMS LTD/CANADA |

| SBI HOLDINGS INC |

| COINBASE GLOBAL INC |

| HUT 8 MNG CORP NEW COM |

| CLEANSPARK INC |

| RIOT BLOCKCHAIN INC |

| HIVE BLOCKCHAIN TECHNOLOGIES |

| CANAAN INC |

| VOYAGER DIGITAL |

| EBAY INC. |

| ARGO BLOCKCHAIN PL |

| DEFI TECHNOLOGIES INC |

| SQUARE INC |

| FUNKO INC |

| ROBINHOOD MKTS INC |

Crypto trading platform Coinbase is included in the portfolio, as is digital innovation bank Silvergate.

Coinbase floated earlier this year and was seen by many as a watershed moment for the cryptos and the digital economy.

US retail trading platform Robinhood is also in the index with its crypto trading facilities. Investor will also gain exposure to London-listed Argo Blockchain.

Whilst the focus is on NFTs, this ETF will provide substantial exposure to Cryptocurrencies and Blockchain Technology.

NFTZ is listed in New York and has an expense ratio of 0.65%.

The NFTZ ETF adds to Defiance ETFs’ range of thematic ETF that target markets such as Hydrogen, Psychedelics and Biotech.