The FTSE 100 fell on Thursday following the announcement of new COVID restrictions by the UK government and soaring cases across Europe.

The FTSE 100 was down 0.2% at 7,322 at the time of writing around midday on Thursday.

“The page has been turned on the recovery story playing out on the financial markets this week, with the new chapter turning into a tale of woe for many ‘reopening’ stocks,” said Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown.

“News that fresh social restrictions are being imposed in the UK, amid worries that the new strain is more infectious have put a brake on the rebound of not just travel stocks but bricks and mortar retailers, and hospitality firms.”

Although the FTSE 100 fell, the selling was when mild when compared to the initial volatility in markets when Omicron was first observed.

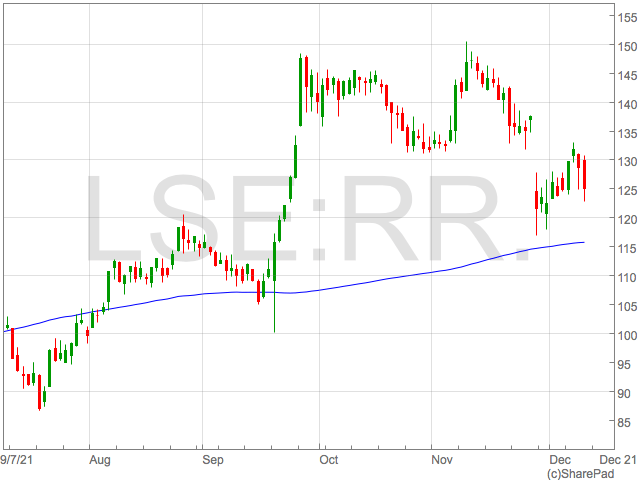

Roll Royces was the worst performer on the FTSE 100 after the engine maker was hit by a double whammy of a disappointing trading update and the prospect of reduced flights in the near term.

“Rolls Royce is the biggest faller on the FTSE 100, with investors disappointed with the progress made, even before the latest Covid storm hit the airline industry,” Street said.

“There continues to be a gradual recovery in engine flying hours, a key metric given its core business is reliant on manufacturing and servicing commercial jet airlines, but it’s still slow progress. They are still at half of normal levels and had been expected to recover to 55% by the end of the year. It shows what a climb Rolls Royce still needs to make to regain its pre-pandemic form and the Omicron variant is clearly another set-back.”

IAG was also a big faller as investors departed from travel stocks across Europe. IAG shares were down 2.8% at the time writing.

Despite the FTSE 100 falling, 41 constituents were positive at midday on Thursday.

DS Smith was among the gainers as revenues jumped 22% helped by their sustainable packaging offering and COP26.

“COP26 has helped DS Smith turn its box volumes up to record levels. The packaging giant has a leading position when it comes to sustainable packaging, so sentiment around the environment and responsible corporate behaviour, which has heightened in recent months, has quite literally paid dividends,” said Sophie Lund-Yates, equity analyst at Hargreaves Lansdown.