The FTSE 100 rose on Tuesday as investors bought into the dip created by fears over the Omicron variant and economic consequences.

The rally was broad with investors stepping into to pick up shares that had suffered over the past week, albeit it in thin volume typical of this time of year.

Housebuilders were among the top risers after a period of selling following the surprise interest rate hike last week. Barratt Developments, Taylor Wimpey, Persimmon and Berkeley Group were up between 2.8%-3.1% at the time of writing.

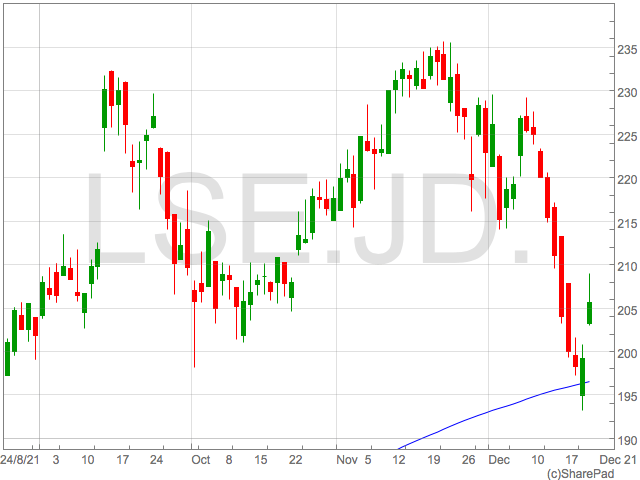

JD Sports was the FTSE 100 top riser rebounding from a torrid month which saw shares give up around 20% of their value after the CMA blocked their acquisition of Footasylum. JD was 3.2% to the good at 205p.

“As we head towards an uncertain festive break the market is swaying about more than someone who’s over-indulged on the sherries on Christmas Day,” said AJ Bell investment director Russ Mould.

“That’s unsurprising as investors still awaiting a full picture on just how disruptive Omicron is going to be – with UK Prime Minister Boris Johnson putting off any decision on further restrictions for now.

“There’s certainly already been signs of a sizeable hit to retail, hospitality and travel businesses as people enter self-imposed lockdowns to avoid having to isolate over Christmas.”

Travel shares were among the risers but were know where near recover their losses since the discovery of the Omicron variant.

IAG shares were 2.4% stronger at 134p and Rolls Royce added 2% to trade at 112p.

As one would expect, defensive shares and those thought to benefit from COVID restrictions fell.

Ocado was off 0.7% and Dechra Pharmaceuticals was the worst performer, giving up 1.4%.