The FTSE 250 and the AIM all-share index remained flat on Thursday with the FTSE 250 marginally down 0.02% to 20,979 and the AIM up 0.05% to 1,057.

Movements across oil and gas companies counterbalanced each other whereas airline companies such as Wizz Air and EasyJet helped lift the FTSE 250.

The budget airline, Wizz Air shares flew 7% to 3,098p after the company reported a better than anticipated Q4 performance and expects strong demand over the upcoming summer season.

Wizz Air said thanks to a stronger trading environment, the group expects a net loss between €190m and €210m, which would beat previous expectations in Q4.

“We have been encouraged by demand trends in recent weeks and given the shorter booking horizon expect the bookings for this summer to build significantly after Easter,” said the company.

EasyJet shares lifted 3% to 573p as the airline industry expects growth in demand for travel as the summer holidays approach.

Dunelm shares gained 2% to 1,081p after the leading homeware retailer announced a 69% rise in total sales YoY to £399m and YTD sales increased 25% to £1.2bn in its third-quarter due to the reopening of its stores.

Dunelm says the latest range of analyst forecasts for its pretax profit lies between £195m-£215m, with a consensus at £207m for FY22. The company reported a pretax profit of £157.8m in FY21.

“A big part of the recent transformation of the group has been the development of its online proposition and it is not sitting on its laurels here, continuing to refine and improve things,” said Danni Hewson, Financial Analyst, AJ Bell.

“There may be tough times ahead as the cost of living crisis continues to bite into Britons’ household budgets, however Dunelm and its management look to be doing everything under their control to set the business on the right path.”

discoverIE shares rose 0.8% to 766p as the custom electronics company announced a rise of 36% YoY in group orders for 2021 with an order book of £224m marking a record for the company.

Money manager, Ninety One gained 0.9% to 255p after the company announced assets under management rose by 9.9% to £143.9bn in 2021 compared to £130.9m in 2020.

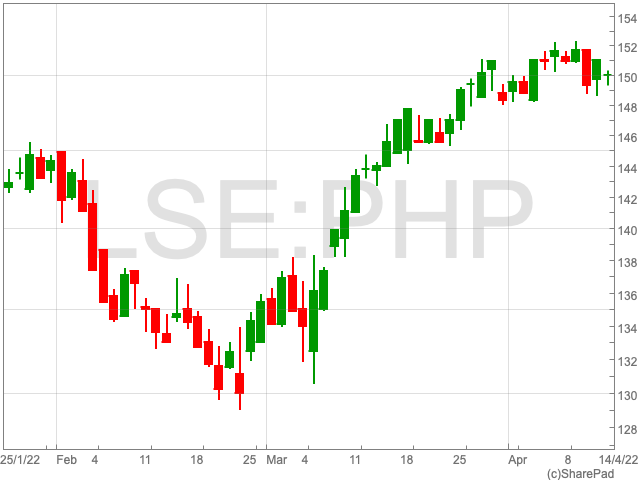

Primary Health Properties’ shares increased 0.4% to 150p as the safety equipment company announced the acquisition of the Chiswick Medical Centre, London for a total consideration of £34.5m.

Countryside Properties fell 2% to 245p after Berenberg cut the company’s price target to 270p from 510p.

Hays shares dropped 1% to 118p after the company reported a £5m hit from pulling out of Russia. The company, however, did note a 32% surge in like-for-like fees over Q3 to Q4, with record-breaking results across 19 countries and its highest-ever monthly fees in March.

Vesuvius, Baltic Classified and Ibstock shares lost 6%, 3.7% and 3.5% marking the top fallers of the FTSE 250.

Oilex shares dropped 14% to 0.2p after the oil and gas company announced a shortage of funds that are required for the C-77H re-frac costs to start up gas production on the Cambay field in India.

Oilex has also negotiated a revised gas sales agreement with Enertech Fuel Solutions for the sale of gas from the Cambay field. The revised gas price is now $7.32/mmBTU compared to the previous gas price of $4.2/mmBTU.

Decontamination company, React shares plummeted over 20% to 1.4p after it announced a proposed placing of 458,333,332 new ordinary shares at a price of 1.2p per Placing Share to raise gross proceeds of £5.5m to strengthen the balance sheet to support the company’s stated acquisition growth strategy and general working capital purposes.

Renold shares soared 31% to 26.5p after the international supplier of industrial chains reported strong momentum in order intake and turnover as it delivered revenue of £195m for the full year, which is an 18% YoY increase on a reported basis, as a result of stronger sales, benefits of cost reduction and efficiency programmes.

Renold’s order intake was £223.7m in 2022 representing a YoY increase of 31.6% on a reported basis. The current order book of £84.1m compared to £53.6m in 2021, which is a record high for the group.

Petrel Resources shares increased 17% to 1.7p as the company’s High Court injunction over the 32.1m shares previously held by the Tamraz Group has been lifted.

Sound Energy, another oil and gas company gained 13% to 2.5p after updating investors on Phase 1 mLNG development of the Tendrara Production Concession in Morocco.

Italfluid has verified purchase orders for gas processing and liquefaction packages, as well as the LNG storage tank, which has been issued. Sound Energy has reassessed its broad exploration portfolio in Eastern Morocco’s Greater Tendrara and Annual exploration licences.

Credible counterparties with the ability to mature alternative or complementary funding to debt and mezzanine finance have expressed great interest. Sound Energy is in talks with farmers near its Sidi Moktar gas field to see if solar-powered electricity may be provided.

By continuing to develop its existing gas projects as well as potential new gas-related opportunities, Sound Energy aims to help the energy transition.

Nostra Terra shares lifted 9% to 0.62p after the oil & gas exploration and production company announced the commencement of drilling operations on its new, wholly-owned Grant East Lease located in the Permian Basin of West Texas.

CareTech Holdings dropped 0.3% to 745p after the company confirmed receiving a revised proposal from Sheikh Holdings regarding a possible all-cash offer for the group of 750p per share with a partial share alternative.

The revised proposal comes after Sheikh Holdings prospective offer of 725p per ordinary share in cash, as well as the initial proposal of 710p per ordinary share in cash, both disclosed on April 1, 2022.