FTSE 100 edged up 0.8% to 7,445 on Wednesday with support from mining and banking stocks such as Fresnillo and Lloyds.

The FTSE 100 was lifted on Wednesday by various trading updates for companies like Fresnillo, WPP, Lloyds Banking Group and London Stock Exchange Group.

“On the UK stock market, higher commodity prices saw miners bounce back from their recent losses and advertising agency WPP also impressed off the back of a decent set of first quarter results and an increase in 2022 guidance,” said Russ Mould, Investment Director, AJ Bell.

Oil gained 0.3% to $105 a barrel as news of Russia cutting off its oil supply to Poland and Bulgaria made headlines. The rise in oil prices aided Shell’s 0.2% gains and BP’s 0.17% rise.

Mining Stocks

Rio Tinto shares rose 1.7% to 5,544p, Anglo American shares gained 1.3% to 3,355p, and Antofagasta shares were trading up 1.4% to 1,489p, as mining stocks rebounded from Monday’s large sell-offs.

Fresnillo shares rose 0.3% to 775p after the company confirmed its annual outlook on “a solid first quarter’s production, in line with expectations,” despite a sharp fall in gold output and labour concerns.

Banking Stocks

HSBC shares rebounded from yesterday’s selloff with a rise of 3.3% to 489p on Wednesday as the company expects to hit targets despite facing a $1.1bn drop in profits due to rising inflationary pressures from the Russian war.

Lloyds shares gained 2.6% to 47p after the bank reported an increased margin outlook for 2022 due to its “solid” performance despite noting a drop in profit from £1.9bn to £1.6bn as it built its credit reserves in its Q1 trading update.

“Lloyds’ first quarter update reveals a lot about the state of the UK economy. The country has been getting back on its feet, which is reflected by an increase in lending and savings deposits for Lloyds. However, the outlook is less than rosy,” stated Russ Mould.

FTSE 100 Pharmaceutical Stocks

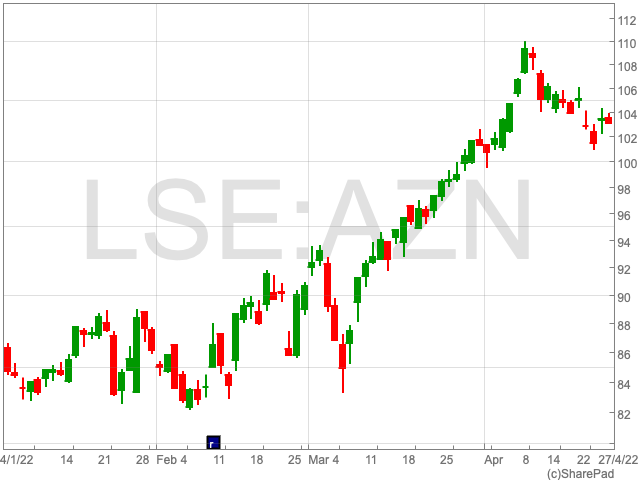

AstraZeneca shares rose 0.6% to 10,397p after the company announced that its breast cancer treatment, Enhertu was granted another Breakthrough Therapy Designation by the FDA on Wednesday.

GlaxoSmithKline shares gained 0.6% to 1,765p following the company’s Q1 report where the group noted a 32% jump in revenue to £9.78bn and reported a 78% climb to £2.6bn in pretax profit.

Hikma Pharmaceutical shares were trading down 1.9% to 1,966p and Dechra shares increased 0.5% to 3,590p in early morning trade on Wednesday.

FTSE 100 Fallers

WPP shares fell 0.3% to 986p despite the company reporting that it was well ahead of internal expectations in the first quarter which led to the 1% rise in its annual revenue outlook.

“Given advertising spend is typically heavily tied to the economy this resilient performance is testament to the changes Mark Read has made since he took over from founder Martin Sorrell in 2018,” commented Mould.

“The company continues to refine its focus, announcing plans to consolidate operations in its media buying agency GroupM. A move which is reflective of the approach under Read which has been to simplify a business which previously had a huge number of moving parts.”

Aveva Group shares tumbled 12% to 2,000p after the company warned that revenue growth in its current financial year is expected to slow and margins are set to reduce amid cost pressures.

Aveva said its revenue will take a hit from sanctions on Russia which would drop through to its operating profit this year, while wage inflation, increased travel costs and investment in the cloud would hamper gains.

Persimmon shares were trading down 1.9% to 2,139p despite it backing its annual volume growth and saying it would maintain “industry-leading margins,” even though the housebuilder faced cost pressures and buyers struggled due to the UK cost of living crisis.

Persimmon’s order book stood at £2.8bn, which declined from £3bn in 2021, however, the housebuilder’s average selling price for homes sold to private owner-occupiers in its forward order book is £266,000 compared to £252,000 in 2021.

Russ Mould said, “Unlike its peer Taylor Wimpey, housebuilder Persimmon did not impress the market with its latest trading statement. Nothing too alarming was revealed but build rates are lagging behind a little and overall, the company seems a little less bullish than Taylor Wimpey.”

London Stock Exchange Group shares dropped 0.8% to 8,016p despite the group claiming it is on track to meet all financial targets despite expecting a hit from actions taken in response to Russia’s invasion of Ukraine.

LSEG did note an 8% increase to £1.75bn in total income excluding recoveries in the first quarter of 2022 and saw a 7.6% climb to £1.59bn in gross profit. The revenue hit from Russia’s invasion of Ukraine is anticipated to be around £60 million in 2022.

London Stock Exchange Group however did say that it had gained £25m in run-rate revenue synergies in March from its acquisition of Data & Analytics firm Refinitiv.

Price Target

Deutsche Bank cuts Diageo to ‘hold’ from ‘buy’ and reduced its price target to 3,900p from 4,650p, sending the group’s shares to decline 0.6% to 3,949p which dragged the FTSE 100.

Melrose Industries gained 1.4% to 115p despite Bank of America cutting its rating from ‘buy’ to ‘neutral’ and reducing its price target to 130p.

Goldman Sachs and JPMorgan raised WPP’s price target to 1,270p and 1,330p respectively.

Aveva was rated as ‘overweight’ by JPMorgan and the group’s price target was cut to 3,625p from 4,500p.

Coca-Cola HBC shares gained 0.7% to 1,608p with Barclays raising its price target to 1,900p although Deutsche Bank cut it to 2,585p.

Land Securities shares dropped 0.5% to 754p after RBC cut its price target to 950p from 1,000p.

RBC also cut British Land’s price target to 475p and Segro’s price target to 1,250, resulting in their shares falling 0.8% and 0.3% respectively.

Amongst housebuilders, Persimmon and Taylor Wimpey’s price targets were raised to 3,110p and reduced to 180p respectively by JPMorgan.

Barclays, Goldman Sachs and JPMorgan cut AB Foods’ price target to 2,300p, 1,775p and 1,940p respectively, however, Associated Britsh Food shares gained 0.3% to 1,553p.

Natwest shares rose 1.4% to 223p as Bank of America raised its price target to 360p from 335p and upgraded it to a ‘buy’ rating.

Credit Suisse cut HSBC’s price target to 515p from 530p.

Anglo American’s price target was raised by DZ Bank from 2,250p to 2,350p.

Intercontinental Hotels’ shares rose 0.4% to 5,094 as Jefferies raised Intercontinental Hotels target to 6,000p from 5,750p.