FTSE 100 dropped 0.46% to 7,526 on Wednesday as news of plans for more sanctions from the EU to ban Russian oil make headlines in the attempt to slow down the war in Ukraine.

Today, a spike in oil prices followed the EU’s announcement of plans to impose a six-month ban on Russian oil imports, putting even more strain on businesses and people.

Brent crude prices rose 3.6% to $108.8 a barrel after European Commission President Ursula von der Leyen announced the EU’s sixth round of sanctions on Russia.

UBS believes the market is undervaluing the risks associated with energy supply and forecasts Brent crude to trade around $115 a barrel. This won’t help ease the price pressures that are pinching profitability and eroding customer confidence.

Shell and BP shares gained 0.7% to 2,231p and 417p on the back of rising oil prices.

The FTSE 100, UK’s benchmark index weakened further as US Fed rates are expected to increase on Thursday.

Investors grip the edge of their seats while waiting for US Federal Reserve to announce its decision on interest rates, where “a half percentage point rise is widely expected” according to Russ Mould, Investment Director, AJ Bell.

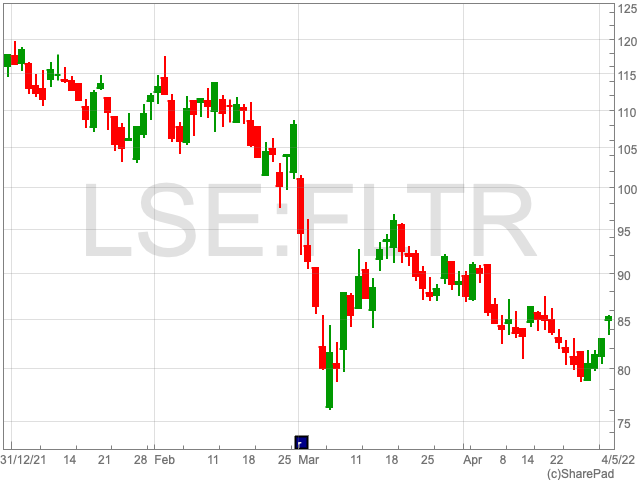

Flutter Entertainment shares rose 7.8% to 8,935p after the Paddy Power owner reported a strong first three months of the year for its US business FanDuel and noted a 6% rise in group revenues to £1.57bn. Flutter also noted a 15% rise in average monthly players to 8.9m.

Entain, Flutter’s rival, saw its shares gain 2.2% to 1,525p.

Mining stocks dragged the FTSE 100 down with Rio Tinto shares falling 2% to 5,532p; Anglo American shares down 0.6% to 3,557p and Glencore shares dropping 0.08% to 483p as an outcome of ratings cut from Liberum weighing on the mining sector.

Retail stocks added to the burden by sinking too. Kingfisher shares fell 6% to 238p, followed by Howden Joinery shares losing 3.5% to 699p, and JD Sports shares trading down 3.2% to 130p.

“Household budgets are constrained and while luxury brands serving the very wealthy usually ride out downturns well and cheaper outlets can attract shoppers who are trading down, more premium high street brands look vulnerable,” added Mould.

Admiral shares lost 3.5% to 2,470p after the car insurer’s rival Direct Line Insurance announced that it’s motor new business premiums increased by mid-single digits early in January and were flat through the rest of the quarter.

National Grid shares dropped 0.5% to 1,189p following the announcement that the electricity distribution business will pay just under £15m to a UK regulator after failing to properly advise some of its most at-risk customers.

HSBC shares rose 1.5% to 520p after the lender launched its planned $1bn share buyback.