Mid and Small cap momentum continued from Tuesday with the FTSE 250 and AIM trading up 0.8% to 19,548 and 952, respectively, as investors continued to buy into the heavily over-sold indices.

CLS Holdings shares rose 7.3% to 206.5p as the REIT announced that it will maintain a progressive dividend policy, with a dividend cover of 1.2x to 1.6x EPRA earnings compared to 1.5x to 2x.

Watches of Switzerland shares gained 6% to 908p as momentum continues from Monday when the group announced that trading in the final quarter was in line with expectations and Goldman Sachs raised its rating from ‘neutral’ to ‘buy’ whilst upgrading its price target from 1,265p to 1,330p.

TP ICAP shares were up 4.6% to 119p following the company’s announcement of a 15% rise in total revenue from £483m to £556m due to growth in Global Broking and Energy & Commodities.

Global Broking generated revenue of £332m, up 3.5%, as a result of increased market volatility and robust performance in Rates, Credit and FX & Money Markets said TP ICAP.

TP ICAP reported a 5.9% rise in revenue to £107m in the Energy & Commodities segment as growth in the US in Oil and Power & Gas counterbalanced lower volumes in Europe.

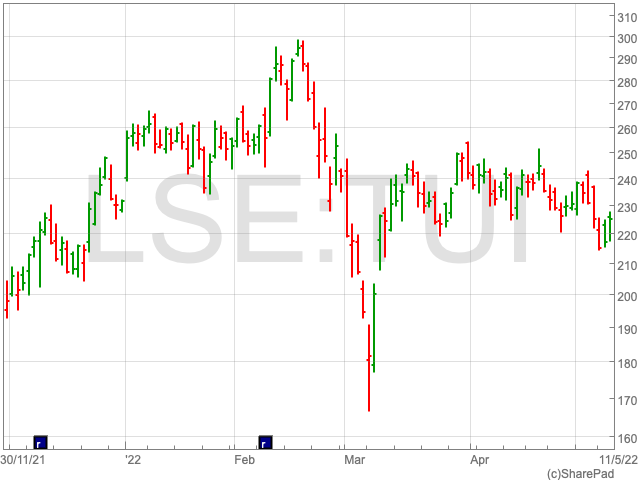

TUI shares rose 4.3% to 226.5p as the travel agent said it expects to return to “significantly positive” underlying EBIT in 2022 as the travel industry recovers.

Tui reported a pretax loss of €871m in H1 2022, which was reduced by half from €1.54bn in 2021.

“The big problem with TUI and many other travel companies is that they have large debts to pay down and costs are going up. So, while demand is picking up, getting their finances into better shape might take even longer,” said Russ Mould, Investment Director, AJ Bell.

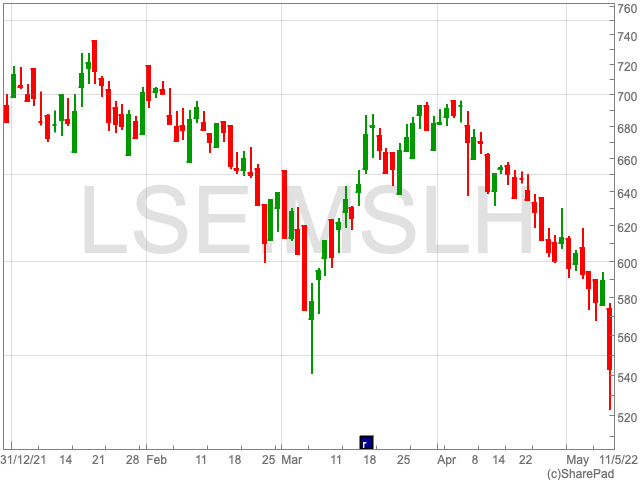

Marshalls shares sunk 8.3% to 540p after the group announced that it took out a new four-year term loan of £210m to help fund the acquisition of Marley. Marshall’s also entered into a new RCF of £160m which will mature in 4 years to support future investments.

However, Marshalls did report a 7% rise in group revenue to £201m in 2022 as sales increased by 5% due to the implementation of price increases in 2022. The group also said that the order book is healthy due to strong customer demand, however, installer capacity faced a decline as a result of more holidays being taken in 2022.

LXi REIT shares dropped 5% to 135p as the property investor agreed to buy a Secure Income REIT using a share exchange offer for 53% ownership. The merger will ensure that Secure Income shareholders receive 3.32 new LXi shares. LXi also stated that a partial cash alternative will also be offered amounting to £385m.

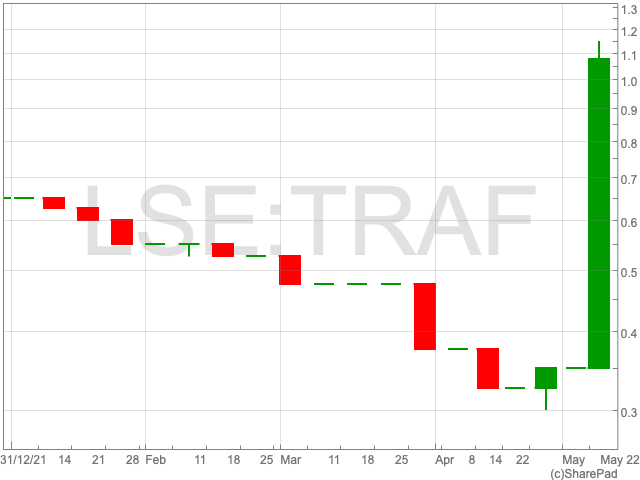

Trafalgar Property Group shares skyrocketed 215% to 1.1p after the group announced the appointment of Dr Paul Francis Challinor as an Executive Director which will take place immediately.

Dr Challinor is an early-stage pioneer and executive manager who specialises in the construction and management of indoor hydroponic vertical farming facilities. His appointment is a “key step in the development of Trafalgar’s long-planned hydroponic division” said Paul Treadaway, Managing Director of Trafalgar Properties Group.

DeepMatter Group shares soared 42% to 0.14p following the software company’s announcement of signing a second multi-year licensing and collaboration agreement with Standigm, which is a drug discovery company, based in South Korea. DeepMatter said the agreement is expected to generate £280,000 in revenue.

Sunrise Resources shares increased 11% to 0.15p after the group announced its application to the California Department of Transport for the conditional approval of CS natural pozzolan to be used in California State infrastructure projects.

IQE shares rose 10% to 31.5p once the group revealed the world’s first commercially available 200mm VCSEL epiwafer which will help expand the market for IQE.

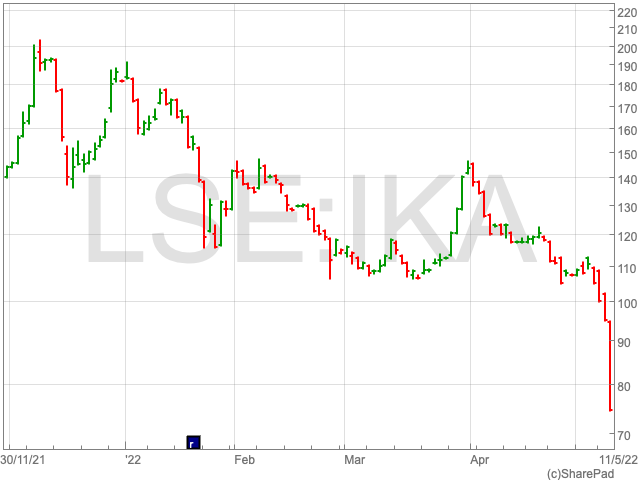

Ilika shares plummeted 21.6% to 74.5p despite the group stating that trading for 2022 in matching management forecasts. The group also said that it expects revenue of £0.5 compared to £2.3m in 2022.

However, on a positive note, Ilika thinks EBITDA loss will narrow from £2.3m to £7m in 2022 and noted a cash and cash equivalence of £23.4m compared to £9.7m in its trading update.

Mirriad, the in-content advertising company, saw its shares lose 17.3% to 20.3p following its trading update where the group reported a decline in revenue from £2.2m to £2m and an increase in operating loss from £9.1m to £12m due to the impact of the pandemic and investment in its growth strategy.