ContourGlobal announced the a rise in adjusted EBITDA despite the power generation company noting higher payouts to shareholders in its first-quarter trading update on Friday.

ContourGlobal recorded a 52.6% rise in revenue from $427m to $652m in the first quarter of 2022, however, the group noted a 10.1% decline in net profit from $9m to $8m and 68.2% in adjusted net profit from $15m to $5m.

The group’s adjusted EBITDA rose 15.3% to $208.3m, out of which $11m came from the acquisition of Western Group, $11m from Mexico CHP, $8m from Austria Wind and a negative FX variance of $8m.

The growth in adjusted EBITDA helped ContourGlobal’s cash flow generation with Funds from Operations which saw a 9% rise to $112m in the first quarter, however, is partially offset by payouts to shareholders amounting to $20m and lower interest paid of $12m.

The group’s cash conversion amounts to 54% versus 57% in 2021 due to higher payouts to shareholders.

ContourGlobal’s cash flow and operations along with 72% of adjusted EBITDA are protected from higher inflation, along with, 88% of total debt staying hedged from rising interest as it is secured by fixed interest rate. In retrospect, assets without impact of inflation have long-term fixed interest rate financings.

The group said the process of capitalizing its renewable energy segment in Brazil is moving forward and the previously announced sale of the Brazil hydro assets to Pátria Investments is on schedule to be completed, along with the sale of the Brazilian wind assets progressing as planned.

Technical operational performance fell short compared to the 97.4% in 2021, with an average availability factor of 96.1% throughout the thermal and renewable fleets which was mostly due to a brief involuntary outage at the natural gas-fired plant in Arrubal, as well as scheduled outages at its natural gas-fired plant in Trinidad & Tobago and the hydro plant in Vorotan, none of which had significant financial consequences.

ContourGlobal has a progressive dividend policy where the group pledged to enhance the dividend per share by 10% every year. The group said it will pay a quarterly dividend of $0.49 or $32.2m, on June 10, 2022.

In the first three months of 2022, improved health and safety performance with zero Lost Time Incident Rate said ContourGlobal.

ContourGlobal’s business model is extremely steady and predictable in terms of cash flow.

The current financial year is off to a good start, with general performance exceeding the Board’s expectations and reinforcing the Board’s confidence in continuing dividend increases for shareholders.

Joseph Brandt, Chief Executive Officer, ContourGlobal, said, “Our diversified business remains resilient and well positioned to perform well despite unprecedented turbulence in the global energy markets.”

“We performed ahead of the Board’s expectations during the quarter and I am pleased to confirm the first quarter dividend payment of USD 4.9115 cents per share, representing a 10% year-on-year growth in line with our dividend policy.”

“This is underpinned by strong operating cash flows and a 15% year-on-year growth in Adjusted EBITDA to $208 million. The outlook for the rest of the year is favorable.”

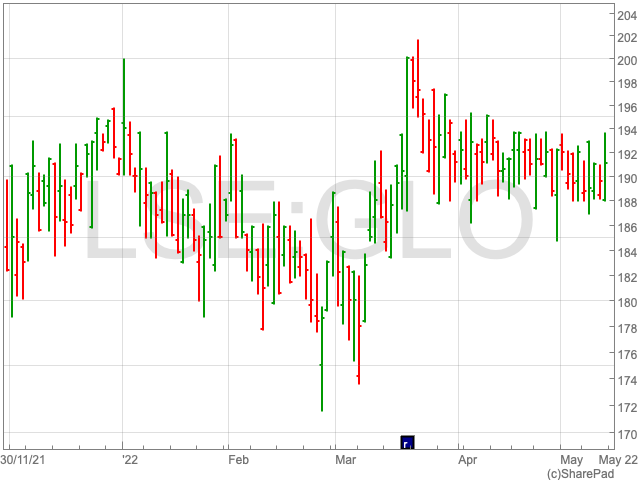

ContourGlobal shares gained 0.7% to 191p in early morning trade on Friday.