Greatland Gold shareholders will be frustrated by the company’s performance in 2022. The company has announced a series of positive updates on the Havieron gold project, only for the Greatland Gold share price to continue to fall.

The most recent announcement 8th December was arguably positive, but GGP shares were met with selling.

Greatland said good progress was made with evaluating the resource to support further resource expansion. For a long-term holder, this is undoubtedly welcome news. However, short-term traders were evidently perturbed by comments feasibility studies would continue well beyond the end of the year.

Any disappointment with Greatland Gold is a disconnect between investor’s expectations and the realities of mineral exploration.

Many traders would have bought into Greatland Gold on the high-grade discovery at the Havieron project in 2020, most probably hoping for a quick buck. Many would have achieved this, but many have found their short-term trade has turned into a long-term hold.

Greatland Gold shares are down 50% in 2022 and are over 75% lower than all-time highs.

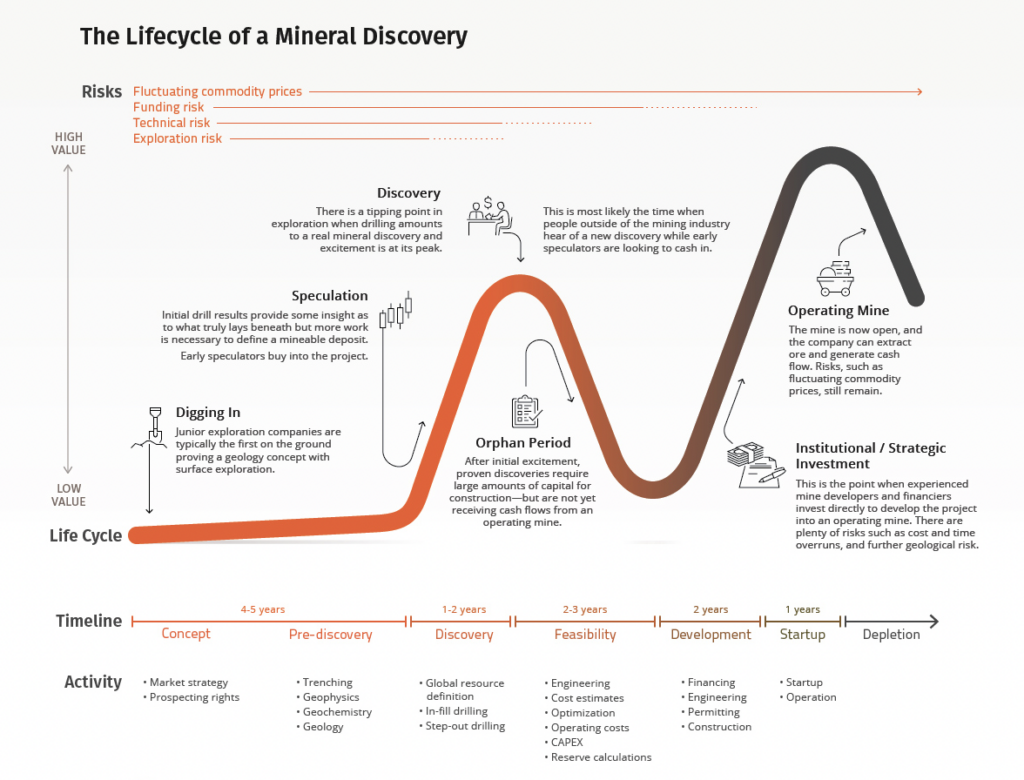

As illustrated by the below graphic by the Visual Capitalist, some traders would have acquired shares at the beginning of the ‘orphan’ stage of the lifecycle. When these short-term traders grow impatient with ‘slow’ progress they sell shares and create an overhang that leads to a period such as Greatland has experienced this year.

Greatland Gold’s exact stage of the lifecycle is subjective, but the speculative rally is well a truly in the rearview mirror.

Quick gains can be made in mining shares such as Greatland Gold. However, this is usually the result of a speculative strategy that will ultimately produce more losers than winners.

Investors that understand the mineral resource lifecycle will now know Greatland Gold shares could face further downside in the immediate future and the real value will not be achieved in the next 12 months.

Greatland Gold have proven reserves through their 30% stake in Havieron. They are now conducting feasibility studies that will take time to complete. Whether Greatland Gold shares recover in 2023 will be dependant on the timing of feasibility studies and patience of investors.

The completion of feasibility studies will ultimately open the doors to mine construction. The Havieron project has already secured financing, a major feat paying testament to the strength of the resource. Despite having financing in place, production is still some time off.

There is inherent value in the Havieron project and the biggest uncertainty is when this value will be unlocked for Greatland Gold shareholders.