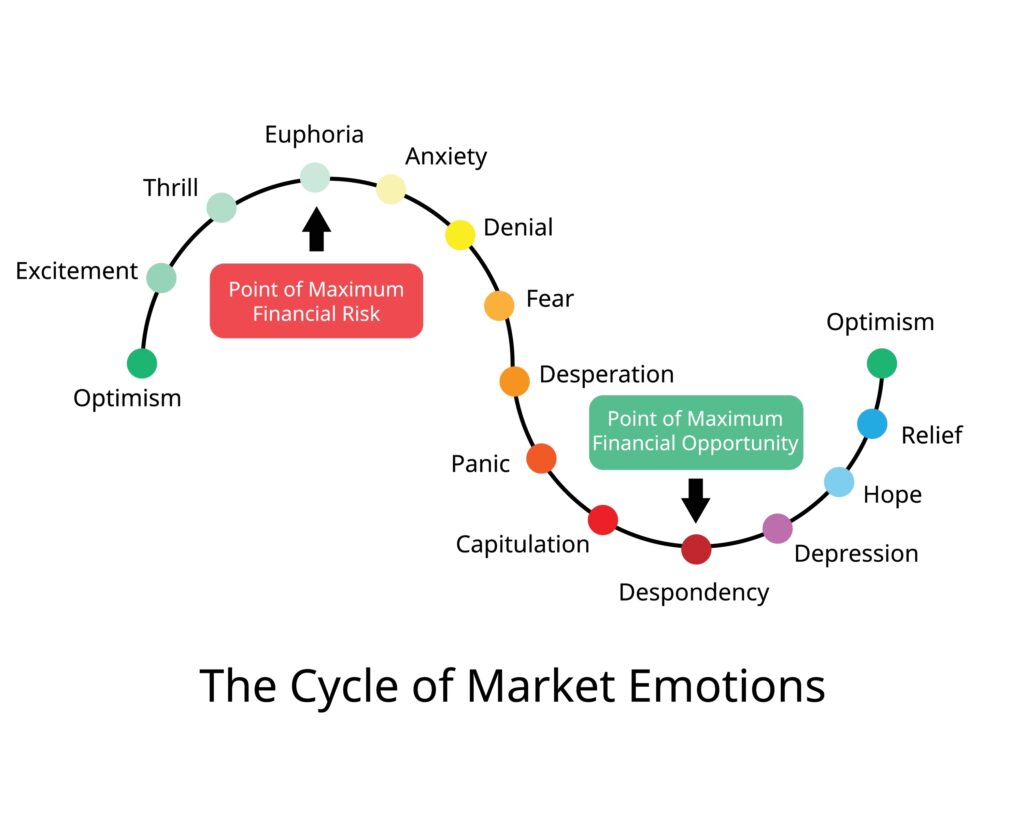

The point of maximum despondency in any financial market cycle is the point at which investors and traders have the maximum financial opportunity. However, many fail to take advantage of this opportunity due to despondency with their investments.

It is now clear the euphoric conditions during the pandemic were the worst time to invest in the broad FTSE AIM All-Share that peaked above 1,300 in late 2021.

Fast forward two years, the index has nearly halved, and the AIM has more or less completed the down leg of market emotions. We outline five reasons why AIM is near the point of maximum financial opportunity.

Interest rates have nearly peaked

The Bank of England hiking cycle has killed AIM. The natural revaluation of equity due to a higher risk-free rate has dented valuations, and this is particularly felt at the small cap end of the market.

Predicting the Bank of England’s next move has proved a fool’s errand, with the Monetary Policy Committee consistently surprising markets with rate decisions. Nevertheless, there is an abundance of evidence suggesting we are near the end of the hiking cycle.

While the BoE may hike again this year, markets are pricing only one or two more rate hikes before a period of plateauing rates.

This period of steady rates will provide the opportunity for investors to regain their confidence and reassess their finances. Such a period favours high-growth opportunities, and the eventual rate cut could provide a catalyst for significant inflows into small cap shares.

Consumer confidence is improving

Day-to-day liquidity in London’s AIM is driven predominately by UK-based private investors.

The propensity of these private investors to invest their savings in high-risk/high-reward opportunities is highly cyclical, and their perceptions of the economic landscape and general mood have as much of an impact on London’s AIM as the underlying fundamentals of constituent companies.

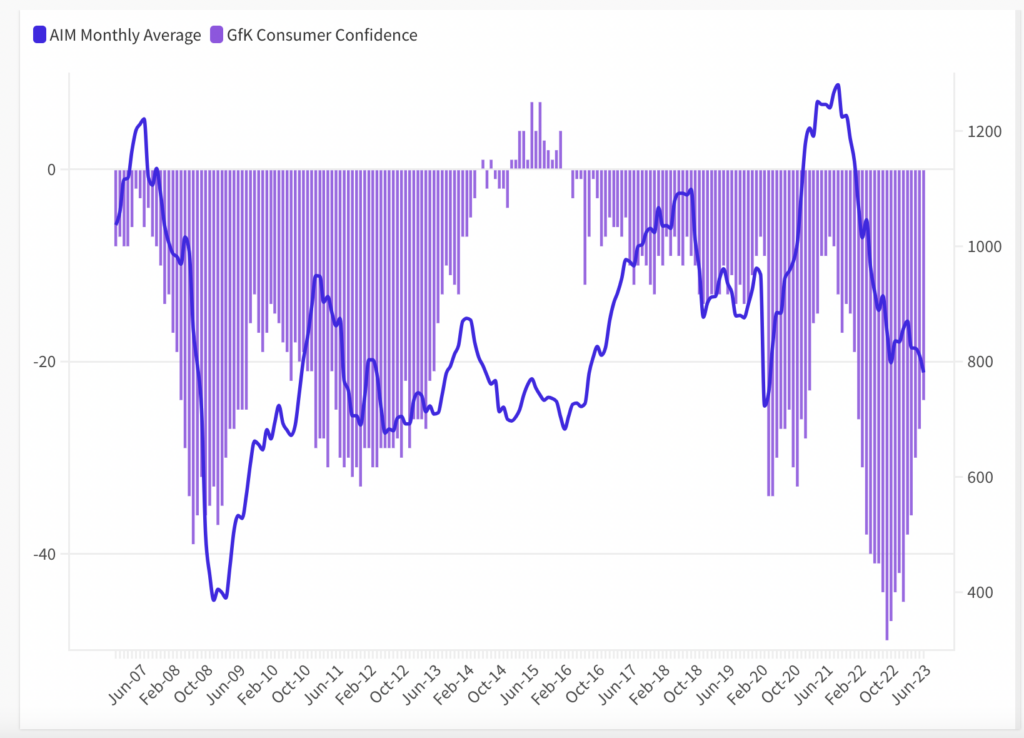

One of the biggest predictors of London’s AIM has long been UK consumer confidence, and GfK’s monthly reading has a strong correlation with AIM’s performance.

GfK’s consumer confidence reading has traditionally been an early predictor of a turn in London’s AIM. Each significant move in AIM since 2007 has been preceded by a shift in GfK Consumer Confidence, although there is a variable lag in AIM’s performance.

In the 2008 financial crisis, consumer confidence fell in line with AIM but since then, a turn in GfK’s reading has preceded a turn in the AIM by periods ranging from a month to a couple of years.

Consumer confidence has been gradually improving since October last year, while AIM has continued to decline. If history is anything to go by, one would expect a rally in AIM before long.

IPOs have dried up

Capital markets activity is dead. There has been a dearth of AIM IPOs this year as companies push back listings to await more favourable conditions.

Historically, capital markets activity peaks near market tops and a trough in activity occurs near the bottom of the market cycle. It is difficult to imagine capital markets activity getting any worse, and the aforementioned considerations around consumer confidence and interest rates may well spur companies to push ahead with listing.

The relationship between new issues and market emotions is highly correlated, although one would hesitate to claim one causes the other.

Nonetheless, when companies start floating their shares on AIM again, it will lift the mood and mark another step forward after a period of depressed activity.

Good news is being taken badly

There are countless examples of AIM companies issuing good news only for their shares to be met by selling. The market is destroying those releasing bad news.

This is representative of the general despondency of market participants and reflects the underlying pessimism among investors.

Of course, exceptionally good news still propels AIM stocks higher, but there are still questions about whether their share prices are reaching their full potential.

This is symptomatic of underlying investor despondency and reinforces the need for many AIM constituents to improve their communication with the market.

67% of AIM constituents are negative year-to-date

The fifth and final reason AIM could be near the point of maximum financial opportunity is the simplistic performance of constituents this year.

Roughly two-thirds of AIM constituents are trading negatively since the beginning of 2023, highlighting the market’s poor performance in general.

Poor performance is by no means a precursor to positive performance. However, statistical mean reversion would suggest individual constituents are due a rally.

For two-thirds of the index to be down on the year is a clear demonstration of investor despondency, and while things could deteriorate further, one would think the worst is behind us.

Important considerations

As we have outlined five reasons why AIM could be approaching the point of maximum financial gain, it is important to balance these arguments with potential risks.

Firstly, interest rates could continue to rise if inflation doesn’t fall materially. This would negate our first two points.

In addition, we haven’t yet had out-and-out capitulation in the AIM. There has been steady selling, but the bottom hasn’t completely fallen out of the market during severe volatility. However, one may argue the extent of the declines since AIM’s 2021 high more than compensates for highly volatile capitulation.