Nvidia has undoubtedly been the world’s most closely watched stock this week.

Earnings released on Wednesday produced a disappointing reaction in the stock, but the results themselves were not a disappointment as they confirmed momentum in demand for chips was intact.

Expectations were high going into Nvidia’s earnings update this week, and anything less than a blowout to the upside was going to weigh on shares.

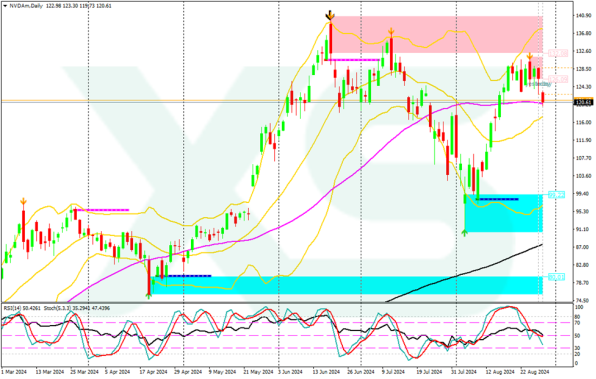

As the stock settles into a trading range, analysts at XS.com have provided technical commentary on the key levels for NVDA shares in the coming trading sessions:

“The better-than-expected report is likely to lead to price fluctuations with an upward bias, but the stock’s decline and breach of the 50-day moving average at $117.70 could result in further weakness,” said Rania Gule Senior Market Analyst at XS.com.

“Looking ahead to the medium and long term, the markets should respect four key technical price levels that may play a role if Nvidia’s shares continue to decline following yesterday’s strong earnings.

“The first support level is at $116. This area may provide initial support near the trendline connecting the May peak and the counter-trend price surge that occurred in early August. A move below this level could push the stock down to the $107 region, a key demand and reversal area on the daily chart between May and August.

“Further decline may lead to a retest of the crucial $99 level, where Nvidia shares are likely to encounter significant support near the March peaks, with the first of these peaks representing the previous all-time high for the stock.

“Lastly, it’s essential to watch the $91 zone, which is a lower price target for the descending column pattern from July to August, identified from the highest point of the recent price channel formation. Should such a move occur, it would confirm a descending channel pattern in the stock and could potentially lead to a retest of this month’s low at $90.70 in the medium term.”