Summary

Over the third quarter, the Net Asset Value (NAV) recovered swiftly from the tariff-related drawdown in late March and early April, delivering a return of +5.2%. Over the same period the share price increased +2.8%, widening the discount from -7.8% to -9.9%.¹

Our resolve amidst the volatility surrounding ‘Liberation Day’ stemmed from familiarity with the portfolio’s underlying holdings, which we believe contain a margin of safety. Long before this episode, we have been finding the most compelling risk-adjusted opportunities in overlooked areas, where fundamentals have potential to surprise on the upside and investor expectations are muted. The added benefit of a high-conviction portfolio built around non-consensual investments is its complementarity; the composition of Majedie’s portfolio bears little resemblance to either the major indices or other investment trusts.

While markets may continue to rally if US interest rates begin to ease, any combination of geopolitics, trade friction, policy shifts, and changing rate expectations could re-test investors’ fortitude over the coming months. We believe Majedie is positioned to withstand further turbulence should it occur and deliver high-quality absolute returns.

So, what did I miss?

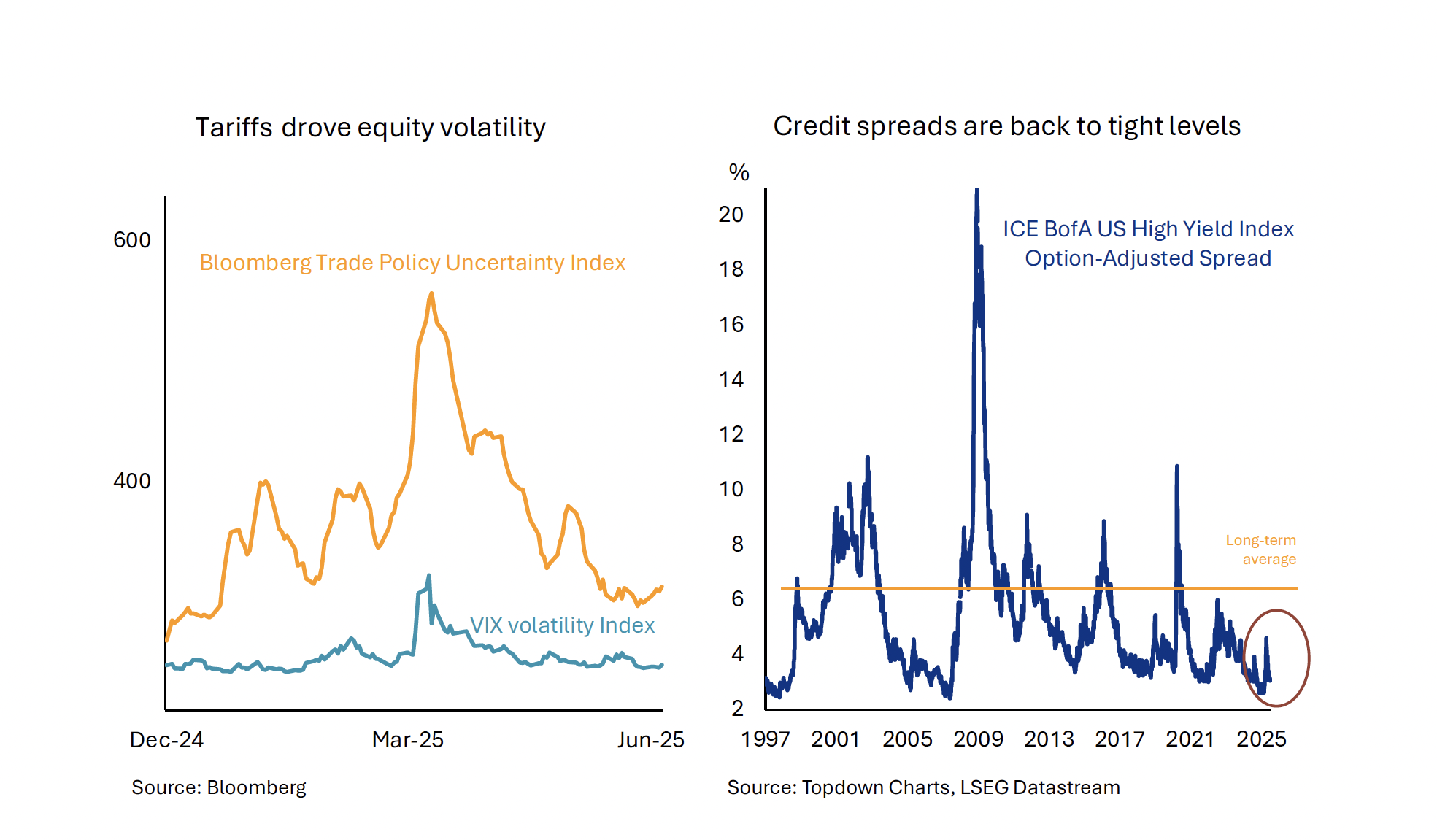

Sometimes, the best course of action for an active manager is to take no action. Following the Trump administration’s pause on tariffs – a restraint imposed by the bond market’s rejection of its policies – the S&P 500 recovered from a -19% peak-to-trough decline, and volatility has subsided. The so-called Magnificent Seven regained their footing on the back of solid earnings and hopes of rate cuts, while credit spreads tightened back towards historical lows and the US dollar stabilised.

There are, however, lessons to be learned from the episode, while one major disagreement remains unresolved. Following the rally, the US equity risk premium has compressed, making equities once again expensive when compared to government bonds. Equity investors assume that a ‘Trump put’ will provide a floor beneath the market and that earnings will soon accelerate.² Yet bond markets are not convinced, as evidenced by a higher ‘term premium’.³ This points to an erosion of confidence in monetary policy, waning demand from central banks, and scepticism that the administration’s policies will address structural deficits.

Part of the dissonance implied by the valuation differential between stocks and bonds derives from the composition of the US equity market, now heavily skewed towards expensive megacap growth companies – many of them seen as primary beneficiaries of the Artificial Intelligence (AI) theme. Consequently, an investment in the market carries an implicit view that either (a) AI stocks will deliver on the hype or (b) earnings growth will broaden out beyond the ‘big growers’

Equity investors’ implicit expectations are less demanding, if one looks beyond the largest index components. Foreign equities, midcaps, and value stocks continue to trade at a discount to their US, large-cap, and growth-stock counterparts. That is why we continue to believe that the most attractive risk-adjusted opportunities are outside the mainstream.

The existential question is whether anyone cares about these situations? In the short term, perhaps not. Price action in today’s markets is driven by trend followers, leveraged trading ‘pods’ within multi-strategy hedge funds, and other fickle participants. By some estimates, 90% of daily volume in equity markets comes from High-frequency trading (HFT), algorithmic trading, and retail trading.⁴ However, there is growing evidence that skilled security selection is now better placed to deliver absolute returns than other approaches. This reflects both the stretched and unbalanced nature of equity indices, and an improving environment for active managers.

Outlook

Looking at the broader economic picture, there’s a reasonable case to be made that the second half of the year will be more benign than the first. In the US, consumer spending has remained resilient despite tariffs, wages are rising steadily, and government expenditure is supportive of growth. US multinationals may benefit from currency tailwinds, while core inflation continues to moderate. Energy prices are softening, and the Fed Funds Rate remains above Core PCE, leaving policy at its most restrictive since 2007. A shift towards easing could act as a catalyst for renewed multiple expansion. In Europe and Asia, there are tentative signs that conditions on the ground are improving, and interest rate policies are becoming more accommodative.

That said, risks to the equilibrium persist. The 90-day tariff reprieve has ended and, paradoxically, the recovery it triggered seems to have emboldened the administration, which has become accustomed to the income generated by import duties in the meantime.⁵ While tariffs have not significantly impacted headline inflation, second-order effects remain a possibility. Labour markets are tight even before any monetary easing, and a resurgence in inflation cannot be ruled out. Meanwhile, the newly enacted OBBB Act imposes a greater fiscal burden than the effects of the CHIPS Act, CARES Act, Infrastructure Law, and American Rescue Plan combined.⁶ Whether this new stimulus can stimulate growth and thus reduce the deficit remains uncertain.

Summary

Our overall stance therefore reflects measured optimism, based on confidence in the quality of our holdings, the judgement of our external managers, and the favourable risk-reward profile throughout the portfolio. The investments are high-quality, attractively valued, and balanced by geography and sector.

¹ As of 30th June 2025. Debt included at fair value. Past performance is no guarantee of future performance. Returns are not guaranteed.

² In April, only 37% of respondents to the BAML Fund Manager Survey expected a soft landing for the US economy; that figure now exceeds 60%.

³ The term premium represents the higher yield that investors demand to compensate them for the risk of owning a long-dated bond, versus a series of shorter-dated issues over the same period.

⁴ Source: Investopedia

⁵ Source: Reuters. US customs duty collections topped US$100 billion for the first time during a fiscal year and helped to produce a surprise US$ 27 billion budget surplus for the month, the Treasury Department reported.

⁶ Source: Bloomberg.