Disclaimers:

This publication is intended to be of general interest only and does not constitute legal, regulatory, tax, accounting, investment or other advice nor is it an offer to buy or sell shares in the Company (or any other investments mentioned herein).

Nothing in this publication should be construed as a personal recommendation to invest in the Company (or any other investment mentioned herein) and no assessment has been made as to the suitability of such investments for any investor. In making a decision to invest prospective investors may not rely on the information in this document. Such information is subject to change and does not constitute all the information necessary to adequately evaluate the consequences of investing in the Company.

The shares in the Company are listed on the London Stock Exchange and their price is affected by supply and demand and is therefore not necessarily the same as the value of the underlying assets. Changes in currency rates of exchange may have an adverse effect on the value of the Company’s shares (and any income derived from them). Any change in the tax status of the Company could affect the value of the Company’s shares or its ability to provide returns to its investors. Levels and bases of taxation are subject to change and will depend on your personal circumstances.

Past performance is not a reliable indicator of future returns. Any return estimates or indications of past performance cited in this document are for information purposes only and can in no way be construed as a guarantee of future performance. No representation or warranty is given as to the performance of the Company’s shares and there is no guarantee that the Company will achieve its investment objective.

Over the fourth financial quarter, the Net Asset Value (NAV) rose by +7.1%, bringing the return for the year to +8.3%.1 Investment performance is therefore ahead of the run rate implicit in the CPI+4% objective over both the quarter and for Majedie’s financial year as a whole. Returns were driven by bottom-up positions in areas as diverse as Chinese and European equities, specialist credit, and supply-constrained commodities. We believe this combination of nonconsensual fundamental ideas, sourced through our proprietary ideas network, makes Majedie a high-quality, repeatable, and complementary proposition for its shareholders.

Majedie’s portfolio holdings are marked-to-market regularly; its distinctive ‘liquid endowment’ approach does not include any allocations to private equity, venture capital or other hard-to value illiquid assets.

With major stock-market indices now fully valued, we believe the most attractive opportunities lie in overlooked international markets, select credit situations, and targeted real assets where structural imbalances exist between supply and demand.

Market Commentary

In many respects, the quarter had an old-fashioned feel, with corporate earnings and central banks setting the tone. Most asset classes posted gains: global equities, as measured by the MSCI ACWI, rose +7.3%.

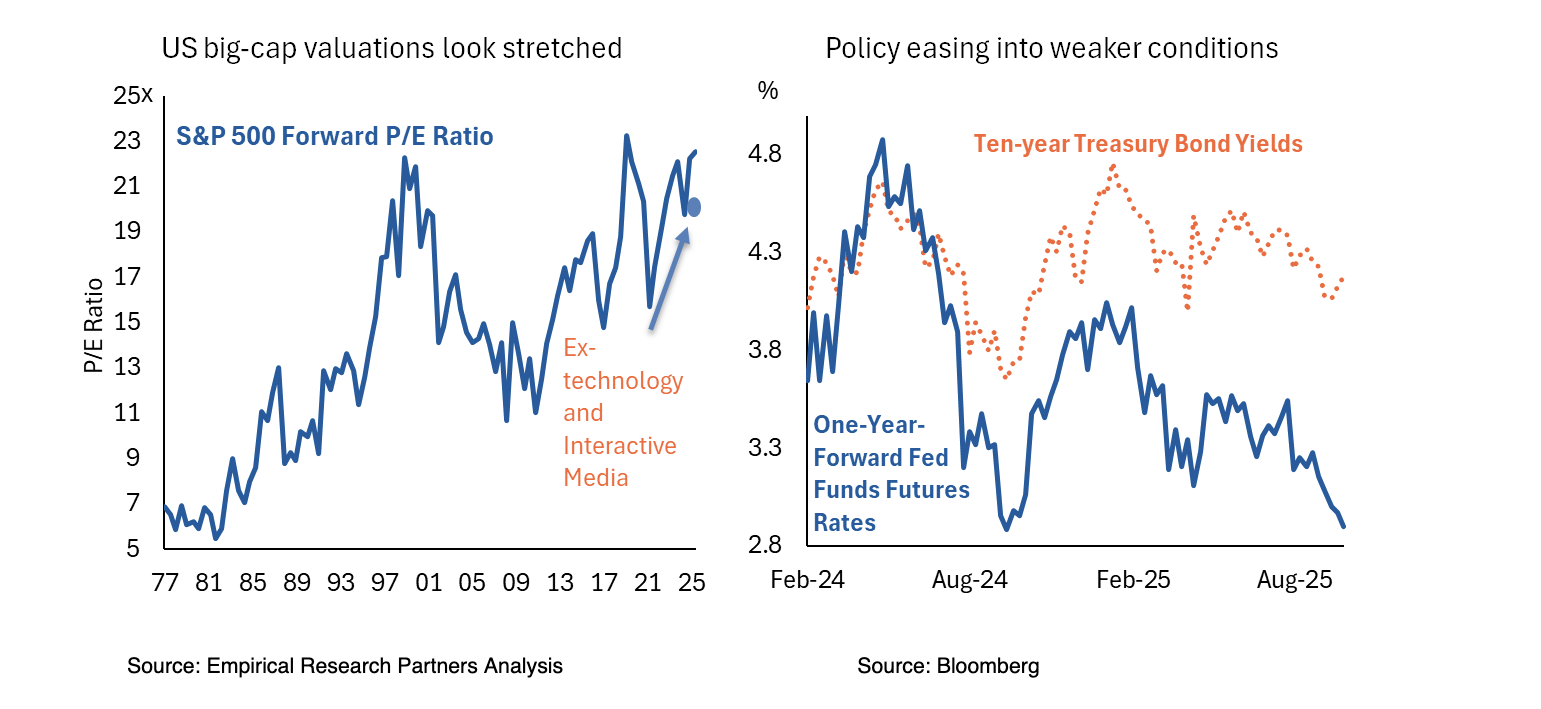

Emerging markets led the way, as China extended its recovery amid signs that stimulus was gaining traction and policymakers reaffirmed the stock market’s importance as a policy tool. Among developed markets, Japan stood out, advancing on the back of robust GDP growth, a weaker yen and a renewed trade accord that saw US tariffs fall from 25% to 15%. In the United States, most of the progress came from multiple expansion rather than earnings growth. With the S&P 500 now trading at 22x forward earnings, valuations once again appear stretched. Growth stocks (+8.6%) outpaced value (+6.0%), and for once small caps fared well as investors began to anticipate rate cuts.

Softer US labour and inflation data duly paved the way for a 25bps rate cut in September – the Fed’s first since 2024. Chair Jerome Powell hinted at further easing, albeit data dependent. In the UK, inflation overshot while growth undershot, sending gilt yields to 27-year highs. France’s budget tensions unsettled bond markets despite the ECB lowering its 2025 inflation forecast to 2.1%.

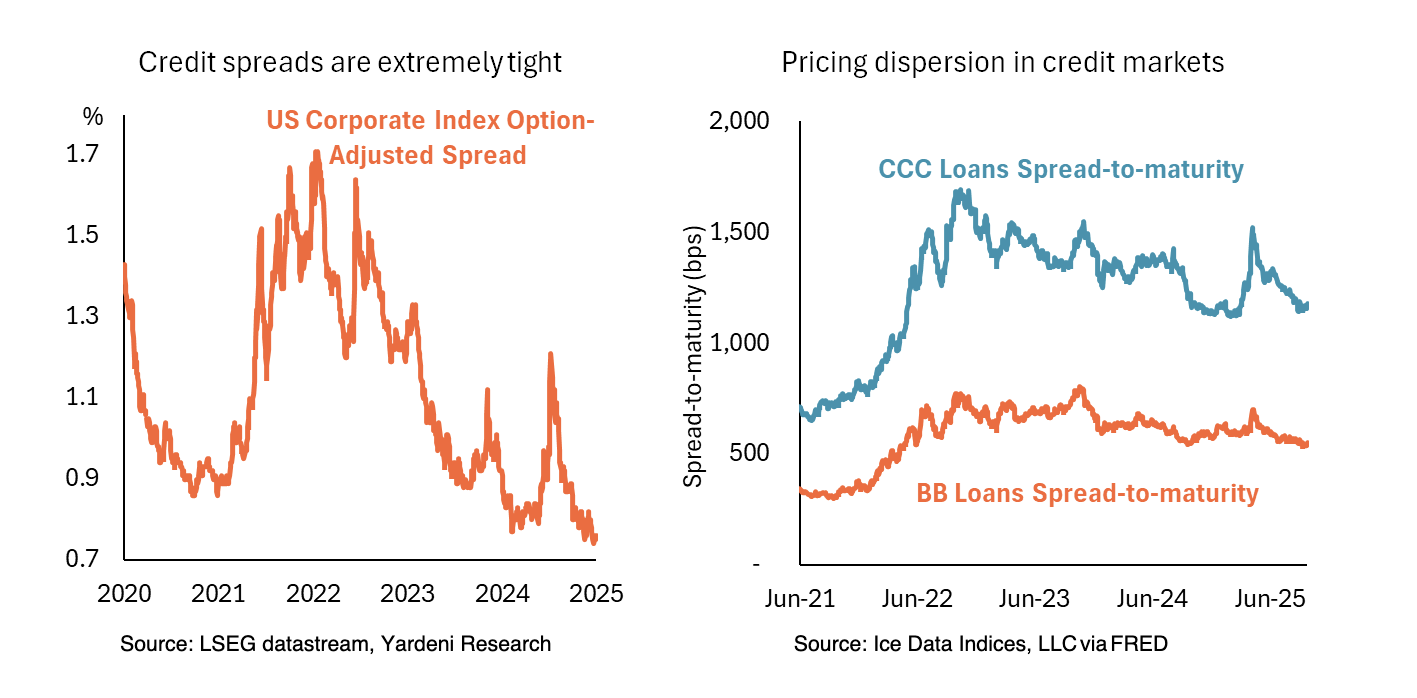

Credit spreads in developed markets have tightened to multi-year lows, while EM debt and Treasuries gained from the easing trend. Commodities diverged: oil and gas weakened, but gold continued its steady ascent. A softer dollar rounded off the quarter, lending further support to emerging-market currencies.

The Portfolio and Outlook

The portfolio is structured with the aim of achieving long-term growth, but returns will depend on market conditions, even as we take a circumspect view of broader markets. The largest constituents of major indices appear expensive and, in our judgement, offer little margin of safety. A generation of investors has grown accustomed to capital gains from the S&P 500 and private equity, sees the US dollar as a one-way trade, and government bonds, or “par” credit, as dependable sources of income and protection. Many portfolios are thus heavily concentrated in these familiar areas. By contrast, the assets we find most attractive remain largely absent from mainstream allocations. Years of under-investment have created scarcity and, with it, opportunity.

Our most rewarding investments have often come from areas where expectations are depressed and fundamentals improving. In such situations, even modest progress can have an outsized impact, because rising earnings often attract higher valuation multiples. Conversely, when starting valuations are stretched, small disappointments can trigger disproportionate losses. Our experience suggests that, especially at valuation extremes, it is the rate of change in earnings expectations that matters more than their absolute cadence. Today, most opportunities lie in a middle ground: neither so cheap as to ensure success, nor egregiously expensive. That is when discipline counts. Rather than rely on subjective judgements about valuation, we (and our external managers) seek situations where the market is mispricing reality, ideally with an identifiable catalyst to correct the anomaly.

We have avoided chasing ‘story’ stocks and other speculative assets that bounced back after this year’s tariff-induced volatility, many of which we feel are vulnerable to negative rate-of change. Our investment approach seeks to minimize the risk of permanent capital loss while aiming for returns independent of benchmarks. We prefer bottom-up opportunities in international markets, midcaps and eclectic value situations where fundamentals are improving from a low base.

Asia: reform and renewal

Low expectations and improving fundamentals are most evident in Asia. Barely a year ago, many allocators had written off China as ‘un-investable’, convinced they understood the country’s structural challenges better than its own policymakers. Today, the same fickle allocators are increasingly fearful of missing out. China’s authorities have acted to revive domestic demand, curb uneconomic competition (‘involution’) and channel investment toward strategic technologies. The country’s massive build-out of AI infrastructure is viewed less as a business venture than investment in a national utility, designed to raise productivity and social resilience. We aim to capture this ‘slow bull market’, which appears to be built on sturdier foundations than the liquidity-fuelled rally of 2015.

Japan remains one of the most compelling reform stories globally. Corporate governance continues to improve, with management teams increasingly responsive to shareholder pressure for efficiency and returns.

Absolute Return Credit Markets

Spreads on conventional investment-grade and high-yield debt sit near two-decade lows, meaning investors have seldom been paid less for taking-on the risk of default. Private credit (to which Majedie’s portfolio has no exposure) may promise higher yields but, in our view, in many cases it does not represent true value.

Our approach to credit is very different. We focus on asymmetric situations where downside should be limited to the recovery of principal, and where upside potential is considerable. Through our longstanding relationships with leading stressed and distressed investors, we seek to capitalise on divergence between the price of credit instruments of differing quality buckets. In US leveraged loans, for example, BB-rated bonds yield only 2.6% more than ‘risk free’ Treasuries of similar duration, whereas spreads on CCC paper are some 12.6%. This differential, twice the level of 2021, creates a very attractive setup for long-short credit managers because it allows them to mitigate market risk inexpensively, while pursuing situation-specific opportunities with higher return potential.

Real Assets: scarcity over sentiment

As long-term investors, we like tangible, cash-generating assets, the price of which depends on fundamental supply and demand considerations. This mindset steers us toward copper and uranium, two commodities that are scarce and strategically vital. They both sit at the nexus of global electrification, AI-related energy demand and essential investment in defence infrastructure.

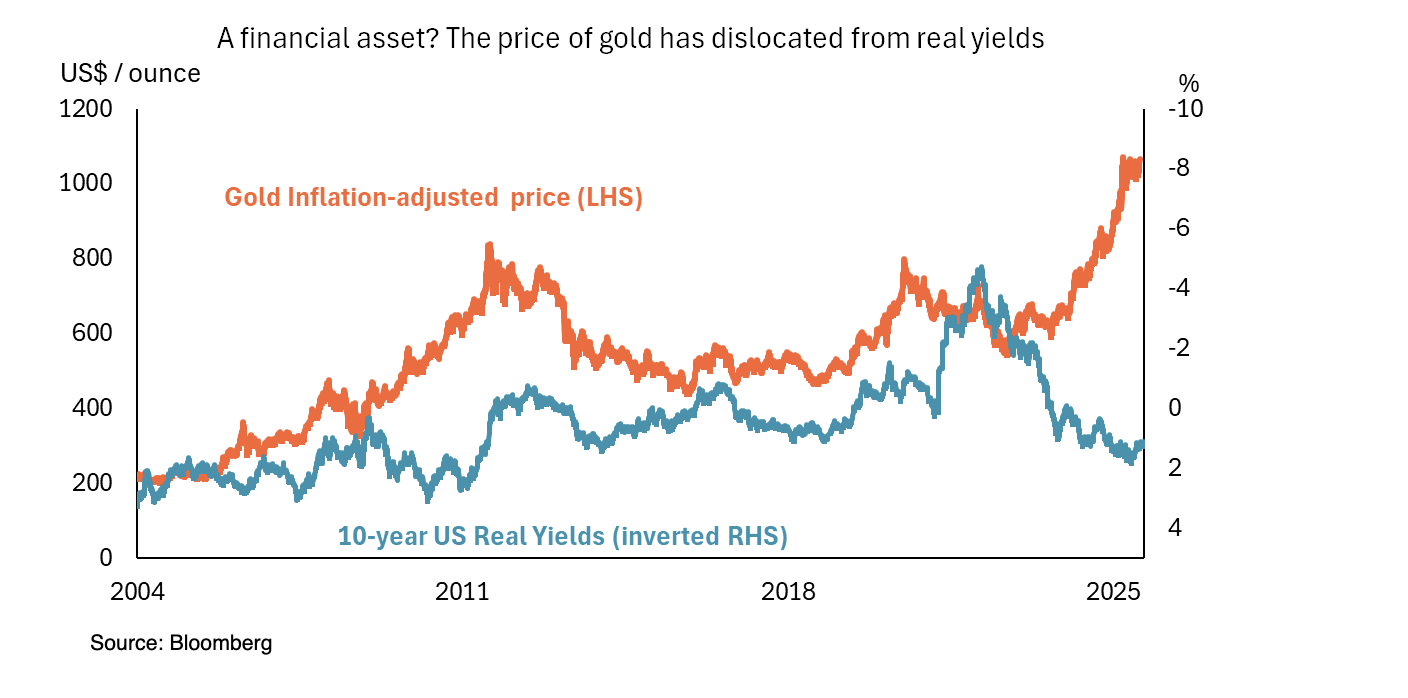

As for gold, we understand its conceptual appeal and recognise that central banks are building reserves as confidence in the Dollar erodes. However, we have always struggled to make a fundamental case for owning an asset that has neither utility, nor cash flow. Interestingly, the historical link between gold and real interest rates appears to have broken down, perhaps reflecting that speculation may be partly behind the price action this year.

Summary

Majedie’s portfolio is built around high-conviction, non-consensual opportunities. In many cases, these can be described as ‘rate-of-change’ situations, where fundamentals are quietly improving but expectations remain low. Just as importantly, we have sought to avoid areas where expectations are so high that even a modest disappointment could be severely punished by the markets.

Whilst undoubtedly challenging, we believe environments like these often produce the most attractive asymmetry between risk and reward. With major indices now appearing fully valued, the most compelling opportunities lie in overlooked international markets, specialist credit, and real assets where structural imbalances persist. Majedie’s differentiated, bottom-up approach is designed to capture these mispriced situations with discipline and conviction.