Download guide now:

Discover how you can trade a wide range of equity, commodity and FX markets like a share whilst trading on leverage with Societe Generale’s Exchange Traded Products.

>Leverage your performance on equities, commodities and FX

>Trade like a share via your broker

>SIPP & ISA Eligibility

>Not subject to Stamp Duty

>Risk limited to capital invested, never more

>No margin calls

Download this guide now to discover how Societe Generale’s Exchange Traded Products can help you leverage your returns while limiting your risk.

Leverage Your Performance

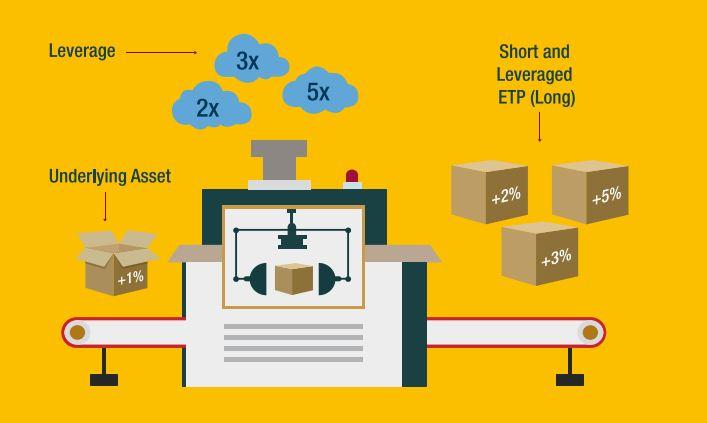

Short and Leveraged ETPs enable you to gain 2, 3 or 5 times the Daily Performance of an index, commodity or currency pair, with your risk firmly fixed at the amount that you invested.

Short and Leveraged ETPs are entirely designed around the daily performance of your chosen Underlying Asset. This means that your profit or loss each day is determined by how much the Underlying Asset has risen or fallen that day. You can hold a Short and Leveraged ETP for more than a day but gains and losses will be compounded over time.

Download your free guide now:

Terms, Risk Warning & Disclaimer:

This communication is directed at sophisticated retail clients in the UK. It is designed to be used as an education tool. For further information and for a full list of risks associated with the Short and Leveraged ETPs please refer to a full product guide; such as Societe Generale’s Guide to Short and Leverged ETPs which can be found on Societe Generale’s Exchange Traded Product Website. By downloading this guide you agree to be contacted by Societe Generale, UK Investor Magazine and Investment Superstore with relevant financial information.