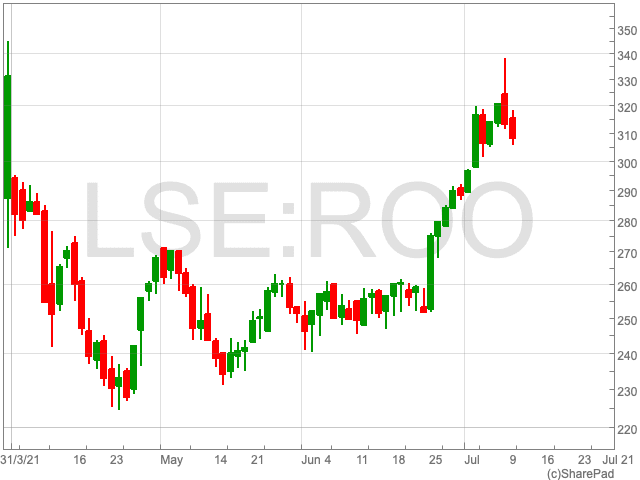

Deliveroo Share Price

The Deliveroo (LON:ROO) IPO turned out to be a huge disappointment as shares plunged 26% on the company’s debut back in March. Investors at the time were concerned about what the food delivery company’s dismal stock market debut meant for its longer-term prospects. However, following a long period of sideways movement, the Deliveroo share price has been on the ascendency over the last couple of weeks, now standing at 308.7p. With a recent spout of good news, the outlook looks brighter for the food delivery company, which is drawing the attention of UK investors.

Court Ruling

While it may not be welcomed news for its couriers, the Deliveroo share price surged towards the end of June as a UK court ruled that the people who deliver the food on bikes are self-employed. The ruling was passed by three judges who came to a unanimous agreement.

“Concern about the company’s reliance on the gig economy model was one of the factors which contributed to its disastrous IPO in March,” said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

However, Deliveroo may not be in the clear just yet, as a European Commission review of how the gig economy operates is now underway.

“Although the gig economy stronghold is for now staying largely firm, over time there may be fresh capitulations as companies tweak their models to satisfy ongoing concerns under the spotlight being increasingly trained on firms by institutional investors,” said Streeter.

Investment

Deliveroo announced this week that it would hire 400 software engineers, data scientists and designers during the next year in an effort to improve its ability to innovate.

The London-listed firm said the growth of its workforce would allow it to improve its logistics, benefitting restaurants, delivery workers and customers.

Sales Forecast

Deliveroo revised its sales forecast up this year after it saw strong sales growth during H1 2021.

The food delivery service believes its sales will increase by 50-60% compared to 2020. This would mean the total value of its transaction would exceed £6bn this year.

While there has been a recent flurry of good news, challenges lie ahead for Deliveroo. As people eat out more as restrictions are increasingly being eased, Deliveroo will need to make sure it retains customers.

While it is expecting demand to fall back to a more normal level, it has been difficult to know how much of its recent growth is down to exceptional circumstances of lockdowns. Perhaps the Deliveroo share price will offer some clarity over the coming months.