Index over-discounting budget and interest rate concerns

2026 seen as year of outperformance for the junior market

- AIM now appears to be over-discounting current budgetary and interest rate concerns. TPI is projecting the junior index to outperform the benchmark FTSE All-Share for the whole of 2026.

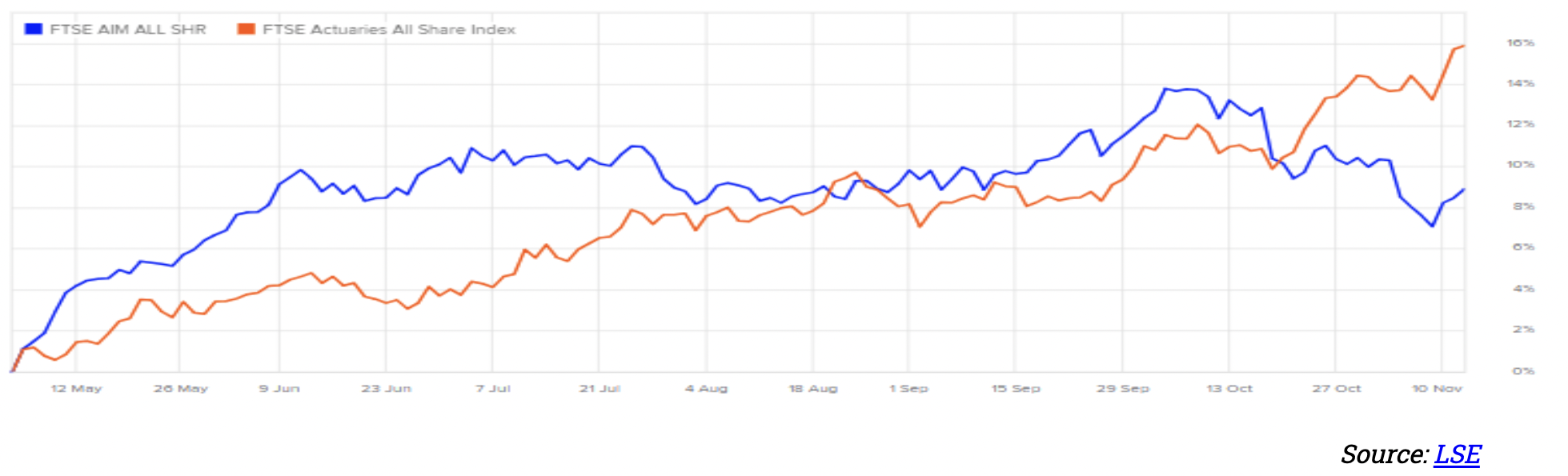

- AIM had in fact been outperforming nicely until October, when it hit a rather unexpected ‘bump in the road’. You may recall back at the beginning of May 2025, TPI stuck its head above the parapet with its forecast that the junior index would outperform the FTSE All-Share between then and the year end. All was looking very good……until the wheels came off in mid-October, when it became clear that the Bank of England (‘the Bank’) had become so nervous about no. 11’s confused messaging that it was about to slam the brakes on its all-important rate-cutting cycle, leaving the market to fester as it pondered what more the Chancellor could do to impact it. The resulting sell-off turned what had been as much as a 8% relative gain over the session into a similar loss. In absolute terms the AIM All-Share has risen c.5.0% since 1 May 2025.

- Sell on the rumour, buy on the news! Partly by design and partly by default, it now looks like AIM will in fact be a net beneficiary of the forthcoming Budget. Widely expected to refocus on growth (to the detriment of value), Rachel Reeves is likely to offer greater certainty for unlisted securities by sustaining benefits already in place through for the Enterprise Investment Scheme (‘EIS’) and Venture Capital Trusts (‘VCT’), while scotching rumours of further restriction of Inheritance Tax (‘IHT’) Business Relief on qualifying shares (such as capping or removing it entirely). While there remains reasonably high expectation that higher taxes will be imposed on dividends, AIM of course has never been a destination for income and so can be expected to bypass any hit taken by the other, more senior UK markets.

- Starting on 18 December, a series of 25bp base rate cuts (from the current 4%) look almost certain to commence once again. This is key to confidence in AIM investment. With the UK’s GDP growth tumbling to just 0.1% in Q3 2025 and unemployment rising to 5% (Q2 2025: 4.7%) during the same period, the Bank’s current 2026 projection of just 1.2% economic expansion is now looking a bit stretched. So it will be forced to use the only tool it has to deliver an immediate boost to domestic confidence amid the UK’s ongoing political turmoil; as many as four more consecutive 25bp cuts could be needed to ward off a recession in 2026, with base rates even then being at a good premium to the ECB’s present Main Refinancing Operations (‘MRO’) level of 2.15%.

- Chartists will also be interested to note the fact that the AIM All-Share has rebounded decisively no less than ten times from the 685 (±2.5%) support level over the past 15 years, suggesting significant downside protection

FTSE AIM All-Share Data

Index Level: 737.41

Net Market Cap: £41,170m

No of Constituents: 549

52 week high/low: 796.52/624.42

Past 7-months return: 4.84%

Constituent Sizes and Yield

Ave. Market Cap: £74.58m

Medium Mk Cap: £14.00m

Largest Mk Cap: £2,608.52m

Smallest Mk Cap: <£1m

Index Yield: 1.94%

AIM All-Share – 15-year Performance Chart

AIM – Had been outperforming nicely ………until it hit a mid-October’ ‘bump in the road’

TPI stuck its head above the parapet back at the start of May 2025, with its forecast that AIM would outperform the FTSE All-Share between now and year end. Analysis suggested the Index was about to emerge from the ‘perfect storm’ it had encountered since peak Pandemic, with the interest rates finally heading downwards amid expectation of an extended series of cut, while UK-focussed equity fund outflows were slowing and the halving of the inheritance tax exemption also appearing to have been just about priced in.

AIM All-Share had Consistently Outperformed the FTSE All -Share Until Mid-October 2025

The scenario worked well for the following 5 months, allowing the Index to chalk up relatively consistent outperformance (of almost 10% at one stage), only to then hit a ’bump in the road’ in mid-October. This rapidly reversed AIM’s hard-won gains to now sit a similar amount below the benchmark. This coincided with the release of cautionary UK macroeconomic data including slowing GDP growth accompanied by stubbornly high CPI, resulting in a stalling of further interest rate cuts. With signs of sharply declining productivity, the Government’s escalating deficit will force the Chancellor to address a funding ‘gap’ estimated to be between £20 billion and £50 billion in her forthcoming budget. Given that this is almost certain to be affected through further punitive attacks on wealth, AIM‘s overwhelming dependence on the domestic economy meant that it was no surprise when investors chose to lock-in profits to date.

Sell on the rumour, buy on the news

UK markets have been trading under the shadow of 26 November for some time now. This is perfectly illustrated by nearly £7.3bn having been withdrawn from equity funds by UK-based investors since July, the largest outflow ever recorded in a four-month period. Not surprisingly, many were seeking simply to crystalise gains prior to, or in anticipation of, the imposition of new punitive taxes from April 2026.

UK Equity -Net Fund Flow

With such a dull picture being painted, it is not surprising that the UK continues to trade at relatively deep discounts to both the US and EU markets. The FTSE 100, for example, is presently valued at c.13-14 times earnings, or roughly half the 22 to 27 level S&P 500 enjoys even if this can be partly explained away by its traditional sector mix weighting heavily toward financials, energy and materials as opposed to high-growth technology shares. Since the COVID Pandemic peaked at the end of Q1 2021, AIM has tumbled by an extraordinary 67% relative to the FTSE All Share leaving it trading c.42% below its 10-year average.

Yet, partly by design and partly by default, it looks like AIM will in fact be a net beneficiary of the forthcoming Budget. As well as keeping current investment incentives intact, there is general expectation that the Chancellor will look for new routes to boost overall UK business investment; one such move (likely to be effective from April 2026) could be to reduce the current £20,000 allowance on cash ISAs in an effort to divert money to stock and shares ISAs instead; a further, potentially even more significant, initiative for the junior index was launched on 21 October 2025, whereby twenty of the UK’s largest pension providers and insurers (the ‘Sterling 20’, representing >90% of the UK’s active Defined Contribution scheme savers) voluntarily agreed with the government to channelling of a proportion of pension savings into unlisted UK growth opportunities (including those quoted on AIM), national infrastructure projects, etc. The timing by which AIM might see real inflows as a result remains uncertain, although the aim is to unlock at least 5% of their main default funds (>£25bn) by 2030 for investment in areas such as affordable housing, broadband connections and scale-up finance for early-stage growing businesses.

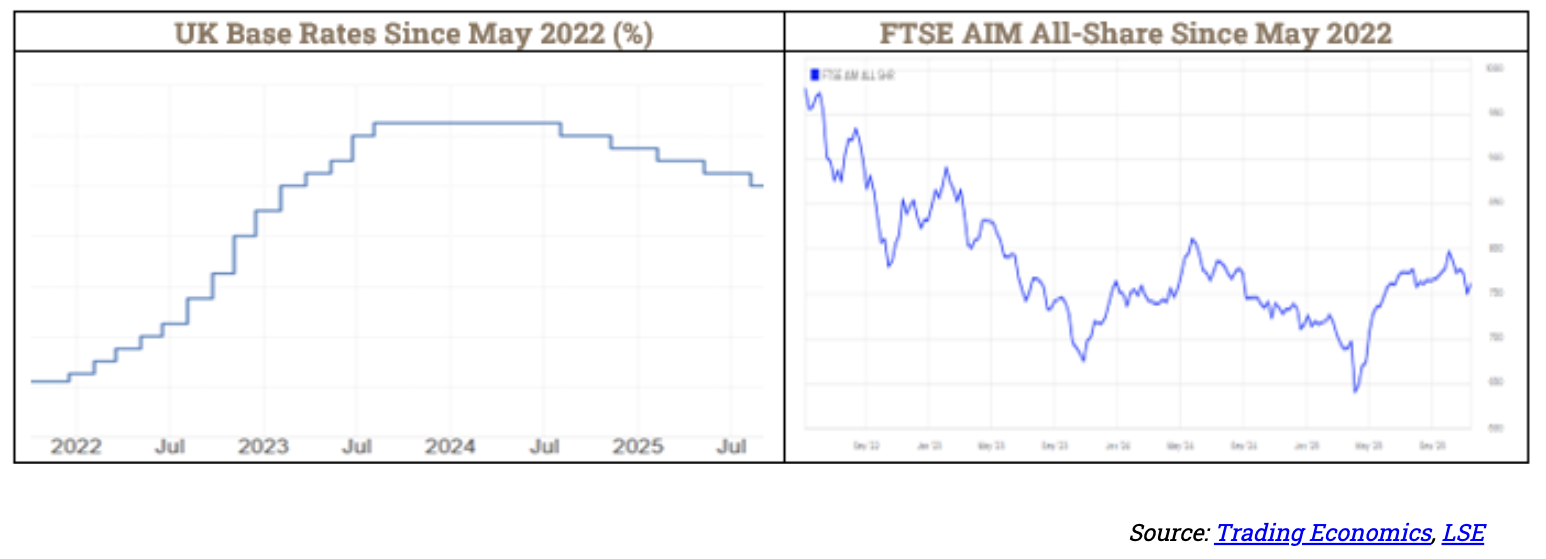

AIM Index Performance – A Mirror Image of UK Base Rate Moves

The charts above demonstrate AIM’s sensitivity to UK base rate cuts. Turner Pope projects the Bank to commence a series of four straight 25bp cuts, starting on 18 December 2025 and continuing through to the end of next year. The Bank recently stated its view that UK CPI has probably already past its peak (having now fallen back to 3.6% in October after plateauing at 3.8% in each of the three previous months) and went on to forecast consumer prices will fall back to about 2.5% next year, before touching its 2% target during the course of 2027. But with Q3 2025 GDP growth having tumbled to just 0.1% while UK unemployment rose to 5% (the highest since the end of the Covid pandemic) over the same period, its current projection that the economy will expand by just 1.2% in 2026 is now looking tenuous. Various pundits are taking bets on the UK falling into recession within the coming 6 months. So, in the absence of any unexpected new ‘shocker’ from the Chancellor just one week from now, an 18 December cut from 4.0% to 3.75% looks almost in the bag. Assuming also that the UK’s current political turmoil continues to compound in the coming months, the Bank will be obliged to do whatever it can to maintain a slither of domestic confidence in the hope of attracting incoming investment.

AIM – Stock picking still the key to winning

With most of AIM’s early-stage constituents remaining cash consumers, there is a wide disparity in terms of their operational risks, market positioning and the underlying quality of their management. This has always

meant that passive Index investing is less effective than a rigorous, active management approach (stock picking) to identify promising companies.

With this in mind, a tabulation has been provided below to detail the performance of a selection of the equity placings TPI has conducted for its Advised companies over the past couple of years, detailing gains registered both at the individual company’s share price peak and at its current level.

Performance Following Recent TPI AIM Equity Placements1

| Name | Equity Placing Date | Amount Raised (gross) | Placing Price (p) | Subsequent Share Price Trading High (p) | %Profit/Loss from Trading High (p) | Current Share Price (p) | %PL on current price |

| Orosur Mining Inc. | Feb-24 | £500k | 2.95 | 29 | 883% | 19.6 | 564% |

| Avacta Group plc2 | Feb-24 | £25.7m | 50 | 82 | 64% | 83.2 | 66% |

| N4 Pharma plc | Jun-24 | £630k | 0.5 | 1 | 100% | 0.63 | 26% |

| Aptamer Group plc | Jul-24 | £2.83m | 0.2 | 1.57 | 685% | 0.90 | 350% |

| Orosur Mining Inc. | Sep-24 | £835k | 2.78 | 29 | 943% | 19.66 | 607% |

| Ironveld plc | Oct-24 | £2.5m | 0.036 | 0.08 | 122% | 0.05 | 39% |

| Orosur Mining Inc. | Dec-24 | £1.25m | 6.6 | 29 | 339% | 19.6 | 197% |

| Theracryf plc | Feb-25 | £4.25m | 0.25 | 0.275 | 10% | 0.21 | -16% |

| N4 Pharma plc | Apr-25 | £1.75m | 0.4 | 1 | 150% | 0.63 | 58% |

| Alien Metals Ltd. | May-25 | £1m | 0.08 | 0.3 | 275% | 0.12 | 50% |

| Metir plc | Jun-25 | £1.75m | 0.65 | 1.49 | 129% | 0.80 | 23% |

| Ironveld plc | Jun-25 | £900k | 0.045 | 0.08 | 78% | 0.05 | 11% |

| Zephyr Energy plc | Jun-25 | £10.5m | 3.00 | 3.3 | 10% | 2.45 | -18% |

| Aptamer Group plc | Jul-25 | £2.0m | 0.3 | 1.57 | 423% | 0.90 | 200% |

| Avacta Group plc2 | Jul-25 | £3.25m | 30 | 83.2 | 177% | 83.2 | 177% |

| Orosur Mining Inc.2 | Oct-25 | £10.6m | 18.09 | 29 | 60% | 19.6 | 8% |

| Futura Medical plc | Nov-25 | £2.75m | 1 | 1.7 | 70% | 1.25 | 25% |

Risk Warning: Past performance is not a reliable indicator of future results.

THIS DOCUMENT IS NOT FOR PUBLICATION, DISTRIBUTION OR TRANSMISSION INTO THE UNITED STATES OF AMERICA, JAPAN, CANADA OR AUSTRALIA.

Conflicts

This is a non-independent marketing communication under the rules of the Financial Conduct Authority (“FCA”). The analyst who has prepared this report is aware that Turner Pope Investments (TPI) Limited (“TPI”) has a relationship with the company covered in this report. Accordingly, the report has not been prepared in accordance with legal requirements designed to promote the independence of investment research and is not subject to any prohibition on dealing by TPI or its clients ahead of the dissemination of investment research.

TPI manages its conflicts in accordance with its conflict management policy. For example, TPI may provide services (including corporate finance advice) where the flow of information is restricted by a Chinese wall. Accordingly, information may be available to TPI that is not reflected in this document. TPI may have acted upon or used research recommendations before they have been published.

Risk Warnings

Retail clients (as defined by the rules of the FCA) must not rely on this document.

Any opinions expressed in this document are those of TPIs research analyst. Any forecast or valuation given in this document is the theoretical result of a study of a range of possible outcomes and is not a forecast of a likely outcome or share price.

The value of securities, particularly those of smaller companies, can fall as well as rise and may be subject to large and sudden swings. In addition, the level of marketability of smaller company securities may result in significant trading spreads and sometimes may lead to difficulties in opening and/or closing positions. Past performance is not necessarily a guide to future performance and forecasts are not a reliable indicator of future results.

AIM is a market designed primarily for emerging or smaller companies and the rules of this market are less demanding than those of the Official List of the UK Listing Authority; consequently, AIM investments may not be suitable for some investors. Liquidity may be lower and hence some investments may be harder to realise.

Specific disclaimers

This document has been produced by TPI independently. Opinions and estimates in this document are entirely those of TPI as part of its internal research activity. TPI has no authority whatsoever to make any representation or warranty on behalf of any of the markets or indices mentioned in this report

General disclaimers

This document, which presents the views of TPIs research analyst, cannot be regarded as “investment research” in accordance with the FCA definition. The contents are based upon sources of information believed to be reliable but no warranty or representation, express or implied, is given as to their accuracy or completeness. Any opinion reflects TPIs judgement at the date of publication and neither TPI nor any of its directors or employees accepts any responsibility in respect of the information or recommendations contained herein which, moreover, are subject to change without notice. Any forecast or valuation given in this document is the theoretical result of a study of a range of possible outcomes and is not a forecast of a likely outcome or share price. TPI does not undertake to provide updates to any opinions or views expressed in this document. TPI accepts no liability whatsoever (in negligence or otherwise) for any loss howsoever arising from any use of this document or its contents or otherwise arising in connection with this document (except in respect of wilful default and to the extent that any such liability cannot be excluded by applicable law).

The information in this document is published solely for information purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. The material contained in the document is general information intended for recipients who understand the risks associated with equity investment in smaller companies. It does not constitute a personal recommendation as defined by the FCA or take into account the particular investment objectives, financial situation or needs of individual investors nor provide any indication as to whether an investment, a course of action or the associated risks are suitable for the recipient.

This document is approved and issued by TPI for publication only to UK persons who are authorised persons under the Financial Services and Markets Act 2000 and to professional clients, as defined by Directive 2004/39/EC as set out in the rules of the Financial Conduct Authority. This document may not be published, distributed or transmitted to persons in the United States of America, Japan, Canada or Australia. This document may not be copied or reproduced or re-distributed to any other person or organisation, in whole or in part, without TPIs prior written consent.

Copyright © 2025 Turner Pope Investments (TPI) Limited, all rights reserved.