Alien Metals is diversified metals explorer with projects across Australia, Mexico, and Greenland. Their broad portfolio of assets hold deposits of iron ore, platinum group metals (PGE), palladium, gold, copper and Zinc.

The nature of their portfolio means the company not only has exposure to battery metals and the growth in demand for EVs and renewable energy, but also the safe haven characteristics of gold, and silver’s manufacturing applications.

The Alien has recently acquiring the remaining stake in what is thought to be one of Australia’s largest platinum group metals (PGE) deposits and has enjoyed bumper results from scoping studies at the Hamersley Iron Ore project.

Having such a broad range of asset means there are plentiful opportunities to de-risk the portfolio and Alien may start to see revenue from production in the not too distant future.

Alien Metals is undertaking a series of concurrent studies across their portfolio of assets and promises a steady flow of market updates throughout 2022.

Alien Metals currently has a market cap of £28m which one may argue doesn’t fairly reflect the strength of their portfolio of assets, when compared to other junior miners of a similar valuation. Indeed, analysts at WH Ireland gave Alien Metals a 2.7p price target in April.

Alien Metals in Australia

In March 2022 Alien Metals deepened their exposure in Australia with the acquisition of 100% interest in Munni Munni Platinum Group Metals and Gold Project in the West Pilbara, Western Australia. The Munni Munni project is held in high esteem and thought to be one of the most significant PGE resources in Australia.

The Munni Munni non-JORC resource points to 24Mt @ 2.9g/t Platinum Group Element (PGE) and gold for 2.2Moz PGM3. In term’s of PGEs, Munni Munni includes 1.14Moz of palladium, 0.83Moz of platinum, 152koz gold and 76koz of rhodium.

This resource was revealed using the now non-compliant 2004 JORC standards, so one of the first jobs at Munni Munni will be to conduct a JORC 2012 compliant study.

Iron ore

Australia is also home to the Hamersley Iron Ore asset that borders licences held by Fortescue Metals Group, Hancock Prospecting, BHP Billiton, Hope Downs and Brockman Mining.

A recent study found the project to hold 10m/t of “high-quality product with very little adverse deleterious minerals’. The costs associated with bringing the asset into production are also highly attractive. Hamersley benefits from low capital requirements aided by adequate infrastructure and access to the Port Hedland Public Ore Terminal.

The ability to employ surface mining techniques helped to achieve low estimates of $60 per tonne Free on Board costs for Alien’s iron ore offtake. Spot prices for Dalian 62%-grade iron ore have been having around $130 per tonne.

Bill Brodie Good, Alien Metals CEO, said they were working to ‘get this project into production within a very short timeframe.’

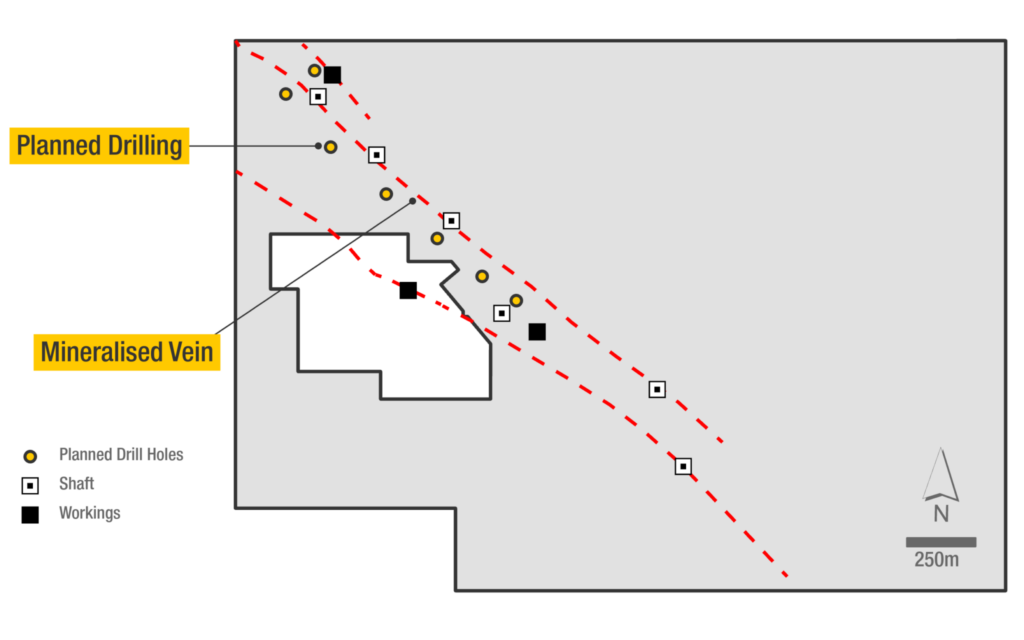

Elizabeth Hill

The high-grade Elizabeth Hill Silver Project has ben undergoing evaluation and recently received the final results from the 15 RC drill holes that included 8m @ 4,233 g/t Ag (149oz/t Ag) in one drill hole and 2m @ 1,550 g/t Ag (55oz/t Ag) in another.

The campaign also revealed encouraging assay results for copper, cobalt, lead and zinc.

Mexico

Alien Metal’s Mexican assets focus on silver with the Los Campos and San Celso projects. In addition, Alien is set to begin a drill campaign at Donovan Copper/Gold project.

Los Campos and San Celso projects are located in areas that have seen significant levels of past silver mining activity and San Celso is home to two historic silver mines.

The Los Campos project is located in Mexico’s largest silver-producing region and holds two high grade epithermal silver veins that were previously found to have grades of 14g/t Au Equivalent.

Greenland

Alien Metals obtained a license to begin exploration in Greenland in a 208 km2 exploration area in the close vicinity of what is thought to be one of the largest lead/zinc deposits in Greenland.

The Citronen zinc-lead project owned by Ironbark Zinc Limited has a JORC Resources of 131.1 m/t @ 4.5% Zn + Pb.

The Alien Metals share price was 0.61p at the time of writing.