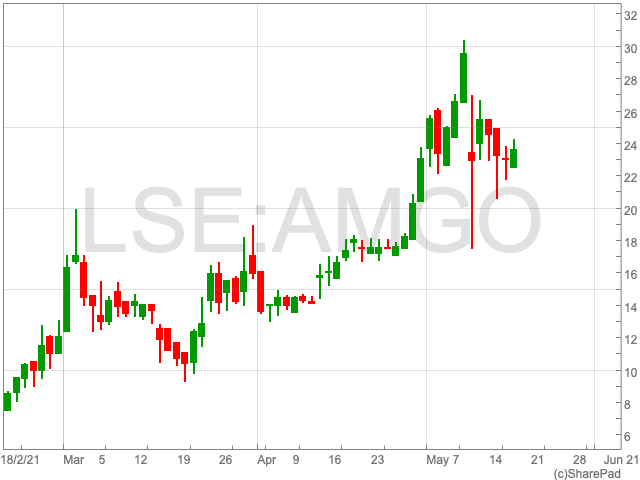

Amigo Holdings Share Price

Over the past few months the Amigo Holdings share price has surged, regularly featuring as one of Hargreaves and Lansdown’s most viewed shares. Since the beginning of the year, the guarantor loan lender’s share price is up by 179%. However, at 23.58p per share, it has more than halved in value from its pre-pandemic level. Over the past few days it has experienced some dips as the company continues its dispute over its rescue plan with the Financial Conduct Authority (FCA). Therefore, now is a useful time for investors to take a look at Amigo Holdings to assess its prospects moving forward.

Rescue Plan

During the final few months of 2020, Amigo Holdings received more than 10,000 complaints about guarantor loans. In response, Amigo outlined a rescue plan, or a “Scheme of Arrangment”, a court-approved agreement between Amigo and its investors, which would cap any potential compensation.

However, it was revealed yesterday that the FCA said it would object to a deal in court. The news caused the company’s share price to tumble, as seen above. It follows the regulator saying in March that despite its reservations over Amigo’s “Scheme of Arrangement”, it would not oppose the plans.

Amigo confirmed it received correspondence from the FCA stating that it believed the rescue plan was unfair and that its intention is to oppose it at a final court hearing at the end of this month. Amigo remains hopeful that the FCA will set aside its objections at the final court hearing and back the deal. This would allow for the rescue plan to go ahead.

At the least, the issue adds risk to investing in Amigo Holdings. Conversely, if Amigo was to go under as a result of the ruling, the consequences could be bad for claimants. Therefore the FCA may not want to overplay its hand. This may work in favour of the Amigo share price looking forward.