The value of rough diamonds sold by Anglo American for De Beers’ third sales cycle in 2022 amounted to $565m on a provisional basis announced Anglo American on Wednesday.

Anglo American is a leading worldwide mining business that uses the newest technologies to explore new resources and to mine, process, move and market its products to its clients, all while being safe and sustainable.

The company aims to be carbon neutral across its businesses by 2040 as a responsible producer of diamonds through De Beers where Anglo holds 85% ownership.

De Beers Group has continued to employ a more flexible approach to rough diamond sales during the third sales cycle of 2022, with the Sight event prolonged beyond its regular week-long period, due to constraints on the movement of people and products in various jurisdictions across the world.

As a result, the provisional rough diamond sales number for Cycle 3 represents the estimated sales value for the period 28 March to 12 April and is subject to change based on final completed transactions.

The sales value of the uncut diamonds for De Beers is $565m on a provisional basis for Cycle 3 2022. In Cycle 3 2021, the actual sales value of the rough diamonds amounted to $450m.

Bruce Cleaver, CEO, De Beers Group, said, “On the back of robust demand for rough diamonds in 2021 and jewellery sales in the first quarter of 2022, and reflecting continued year-on-year growth in consumer demand for diamond jewellery, demand for De Beers Group rough diamonds remained strong in the third sales cycle of 2022.”

“As we head into the seasonally slower second quarter of the year, diamond businesses are adopting a more cautious and watchful approach in light of the war in Ukraine and associated sanctions, as well as Covid-19 lockdowns in China.”

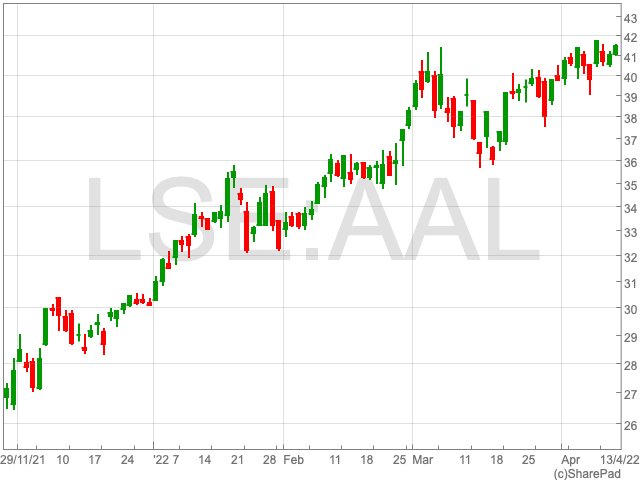

Anglo American shares gained 1% to 4,138p in early morning trade on Wednesday.