Cadence Minerals flagship asset, the Amapa iron ore project in Brazil, is moving towards key milestones in its development.

The Amapa iron ore project was previously valued at $660 million by mining giant Anglo American. Cadence Minerals has a 27% stake in the project and first right of refusal to increase their stake to 49%.

In October this year, Cadence released a mineral resource upgrade that predicts the project will have a mine life of 15 years. The resource was upgraded to Measured and Indicated Resource of 229.48 Mt at 38.76% Fe, up from 176.7 Mt at 39.75% Fe. There was a step change in the Inferred Mineral Resource which increased to 46.76 Mt at 36.20% Fe, up from 8.7Mt at 36.9% Fe.

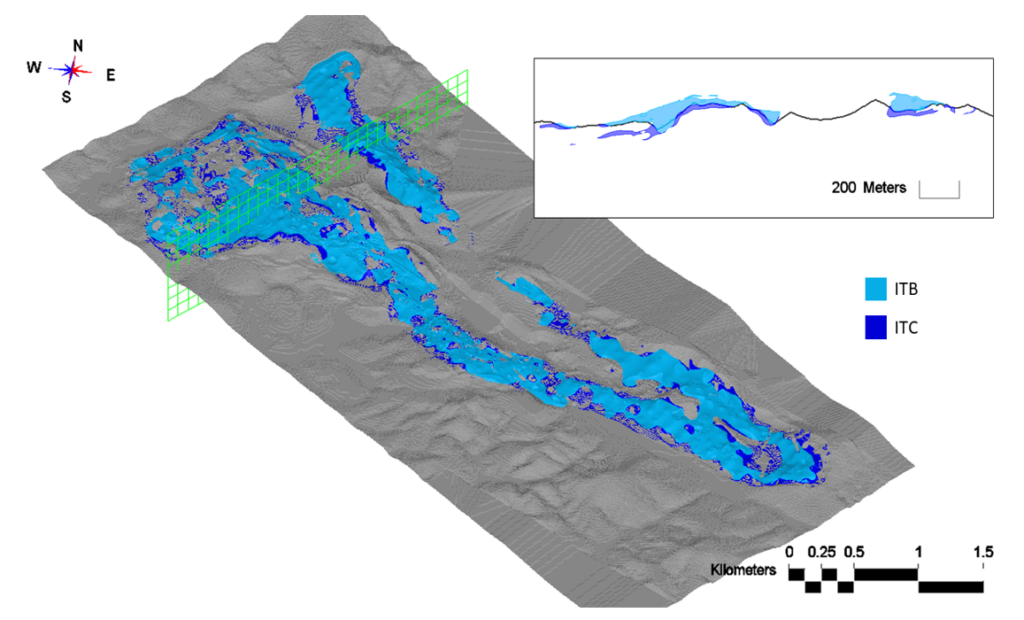

The resource encompasses mineralisation that extends around 6.5km in length and 1.5km in width. The mineralisation is encountered at depths of 100m in some places.

“The results clearly indicate the robustness and consistency of the Amapá resource,” said Cadence Minerals CEO Kiran Morzaria when the results were released.

Amapa PFS

The upgraded resource will be instrumental in the pre-feasibility study (PFS) which is currently ongoing. The PFS is a crucial step in moving Amapa towards production and cashflows to support shareholder value creation.

Pre-feasibility studies typically provide an indication of mining costs and production levels and are highly anticipated by investors. Amapa’s PFS and any subsequent definitive feasibility study (DFS) will attach a Net Present Value to the project based on Ore Reserves and other factors specific to the project.

A PFS and DFS will confirm the economics of a project and can attract larger scale investors to mining projects to provide funding for the final stages of development before production.

These events are now on Amapa’s horizon.