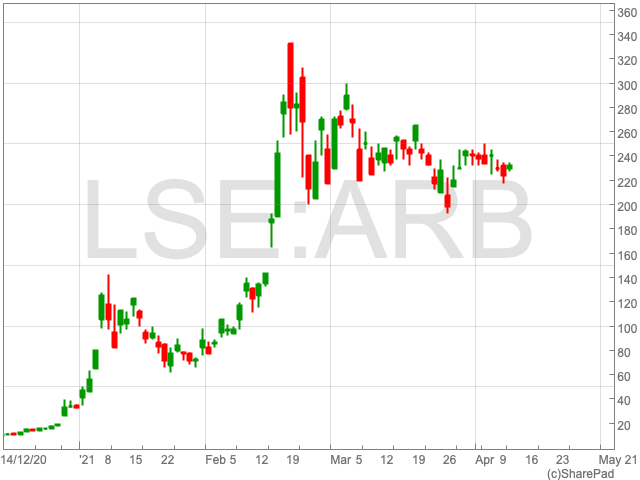

Argo Blockchain Share Price

Since the beginning of 2021 the Argo Blockchain share price (LON:ARB) is up by 597% to 230p per share. It follows the prior 12 months when the company’s share price rose by just under 500% in 2020. However, more recently, over the past two months or so, shares in Argo Blockchain have retreated below its February high of 284p. Following remarkable growth of the company, and the ever-increasing influence of blockchain technology, investors will be closely monitoring Argo’s prospects.

Mining

Last month Argo mined 165 Bitcoin (BTC) or BTC equivalent, up from 129 BTC in February, takin the total amount mined in the first quarter the financial year to 387 BTC. The revenue generated from mining increased by 51% in March rose by over 50% to £6.57m, up from £4.34m in February the month before.

Argo also recently confirmed it had reached an agreement with crypto technology company DMG Blockchain Solutions to start a BTC mining pool totally powered by clean energy. Controversy surrounds the emissions generated by mining processes caused criticism of the industry. Some critics have alluded to the fact that one BTC transaction has a carbon footprint equivalent to 900 Visa transactions, while Bill Gates said BTC was “not a great climate thing”. Argo’s move in demonstrating its climate consciousness could go some way to reassuring sceptical investors and setting it apart from other miners.

Bitcoin

It goes without saying that the Argo Blockchain share price is intimately linked to the performance and adoption of BTC. If the price of bitcoin, which at the time of writing stands at £43,832.49, jumps up again, then the Argo share price is likely to follow suit, and vice versa.

According to Tom Jessop, head of Fidelity Digital Assets, BTC adoption has reached a “tipping point” thanks to an environment of “unprecedented monetary and fiscal stimulus.”

Speaking at the Investing in Crypto virtual event series hosted by MarketWatch and Barron’s, Jessop pointed to “a host of reasons” for the adoption of digital assets to proceed “at an accelerated pace.” “We’re not going to get out of this stimulated environment anytime soon,” Jessop said. “I think we’ve reached a tipping point,” Jessop added.