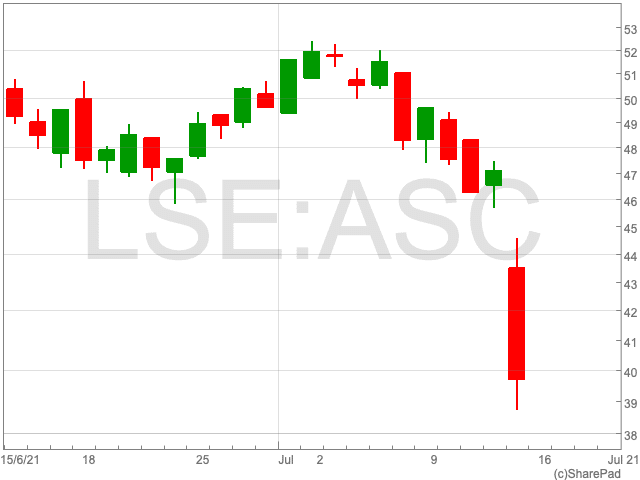

Asos Share Price

The Asos share price (LON:ASC) dived by 16.7% (at the time of writing) on Thursday as the online fashion giant warned of uncertainty over its sales as the pandemic continues. Prior to today, the Asos share price moved sideways for the past few months, as it was unphased by the company’s H2 results. Taking into account today’s fall, it is now down by 18.92% over the last six months. However, with today’s reaction to its Q3 results, investors will be curious about what the implications are for the fast fashion retailer’s future.

Q3 Results

Asos confirmed a 27% increase in its revenue, up to £1.29bn during the quarter ending in June. The company described the figures as “strong” considering the effect of lockdowns and travel restrictions on demand for clothes, in addition to supply chain issues.

Asos said it saw a dip in sales over recent weeks as young people, who make up a significant amount of its customer base, found it difficult to socialise in big groups or go on holiday. “Many young people will spend as much on their holiday wardrobe as they do on the holiday itself,” said chief executive Nick Beighton.

While the lives of young people continue to be disrupted, so will Asos’ sales, as it will be more difficult for young people to make plans.

For the final quarter of the year, Asos is expecting to grow at a similar rate, of 15%, to the same period in 2020.

“The retail sector seems to be following one of two paths. Trading has either remained strong following the initial consumer spending splurge post-lockdown, as witnessed by Dixons and Dunelm; or it has started to lose momentum. Sadly, ASOS falls into the latter camp,” says Danni Hewson, financial analyst at AJ Bell.

Hewson also said that the weather was not to blame for the company’s recent downturn: “Plenty of people were still able to get out and enjoy the Euro football championships, so ASOS is clutching at straws with its excuses. In fact, if it was digging around for excuses, it missed a trick by not blaming the Euros for distracting shoppers.”

“People’s social lives continue to be disrupted; for example, music festivals scheduled for after Boris Johnson’s Freedom Day continue to be cancelled as organisers feel there is too much uncertainty to hold a big event. If plans to meet up with friends and family are suddenly scrapped, is there any point in splashing out on new outfits?”

Hewson suggests that perhaps Asos has lost its touch a bit in terms of catering to the demands of its target market.

“Well, that didn’t stop people during the height of the pandemic, eager to show off their new looks on social media, so perhaps ASOS has temporarily lost its magic touch in terms of selling the clothes people want,” Hewson said.

Lockdowns, travel restrictions and weather conditions are all, hopefully, temporary constraints on the economy. However, if Asos has lost its touch, then investors may become concerned over the future prospects of the Asos share price.