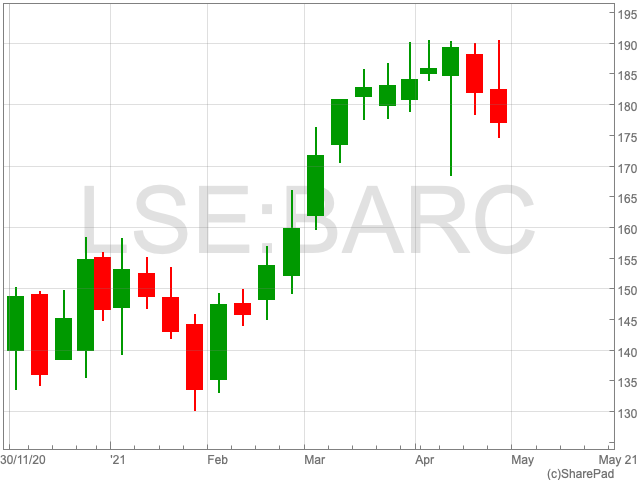

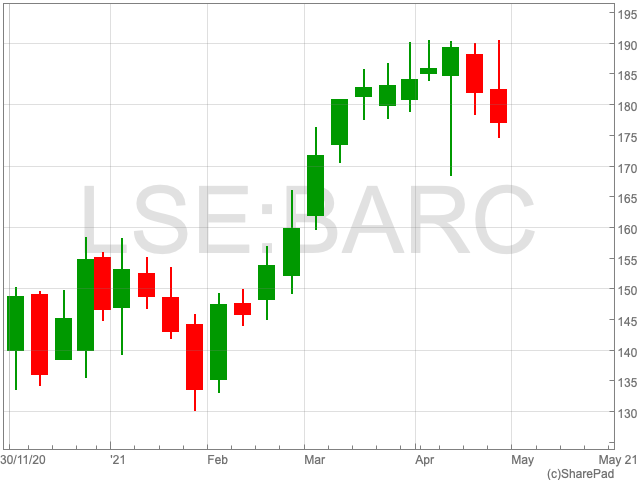

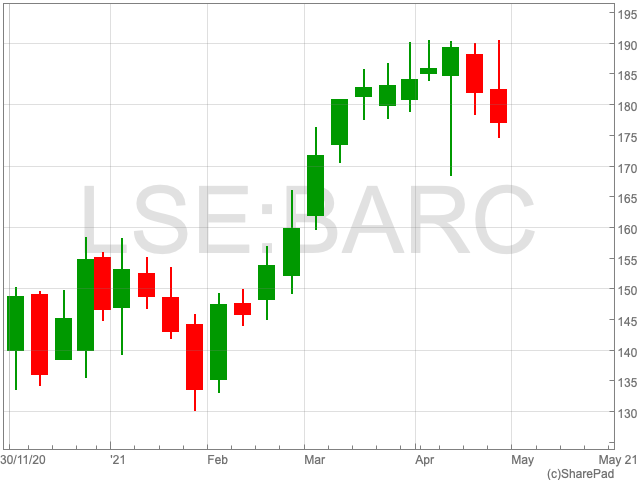

Barclays Share Price

The Barclays share price (LON:BARC) dived by 6% on Friday as the FTSE 100 bank released its quarterly results. The dip follows what has been steady growth since the beginning of the year, which it began at 143.52p. Now, it is at 177.5p, around the same level it was at when the major bank’s share price crashed in February 2020. While there was good news within Barclays’ recently published results, the fall in its share price shows a level of distrust from investors.

Results

Barclays confirmed on Friday that its profit before tax reached £2.4bn during the first three months of the year, well up from £923m over the same quarter the year before. Barclays well exceeded average forecasts from analysts who predicted a pre-tax profit of £1.76bn. It was the bank’s highest quarterly profit in ten years, as well as being three times higher than they were during the same period a year before.

“Since the early days of the pandemic last year, our diversified business has demonstrated the resilience critical to ensuring Barclays’ financial integrity,” Jes Staley, chief executive of Barclays, said in a statement.

While other banks, including Natwest, received a lift by releasing cash from loss provisions, amassed during the pandemic, Barclays decided against doing the same thing. The bank added £55m to its credit provisions in the quarter, compared to expectations of a credit impairment of just over £500m.

“As we enter the next phase of this pandemic, we remain resolute in our commitment to support the economic recovery,” Staley said. “From our spend data, which captures UK economic activity across our cards and acquiring businesses, we are already seeing encouraging early signs of recovery in some sectors, including those hit hardest by the crisis.

“While evidence of recovery is encouraging, we have continued to take a cautious view of the impact of the pandemic on the business.”

The overriding message from the bank’s CEO is that the UK is on the verged of the largest economic boom since the post-World War Two era. However, it is possible that investors anticipated the optimism based on the generally positive outlooks coming from the UK’s major banks, and other factors. This could help to explain why the share price fell on today’s news.