BP’s balancing act between moving away from the oil industry and securing its long-term future is an area UK Investor Magazine has covered for a long time. This has included analysing the various angles from which pressure is building on BP, from investors to regulators, to divest away from fossil fuels and into clean energy.

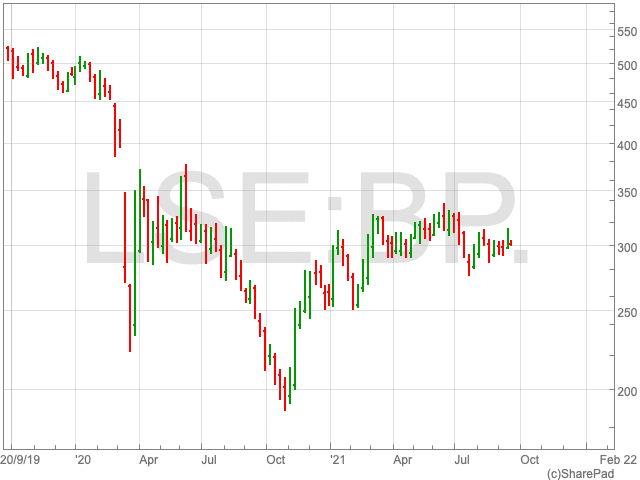

Since the company’s current CEO Barney Looney took office the BP share price is down by nearly 40%. It is the worst performing UK oil major in that period of time. However, what Looney has done, is to develop a coherent strategy for the future.

It seems the more that time passes, the more pressure is ramped up. The UN panel on climate change warned in a recent report that rising temperatures could begin to spiral out of control.

Barney Looney, is of the view that the FTSE 100 company is able to make the transition ahead of its rivals. So far, BP has announced that it will intentionally cut oil production, while it will continue to increase its capacity to generate electricity from renewable sources.

Looney intends to sell $25bn in fossil-fuel assets by 2025, having already sold legacy projects worth about $15bn.

However, Reuters reported that the oil giant is losing tens of millions of dollars from two of its key investments in renewable energy. BP’s UK-based EV charging company, bp pulse, lost a combined $30.8m between 2018 and 2019. While Lightsource, a solar energy company BP has a 50% stake in, lost a combined $81.8m over the same period.

BP does not anticipate these businesses will make a profit until at least 2025. And the losses will not deter Looney’s spending on renewable energy. The CEO’s goal is to increase yearly investment to $5bn by 2030, a substantial increase on current levels.