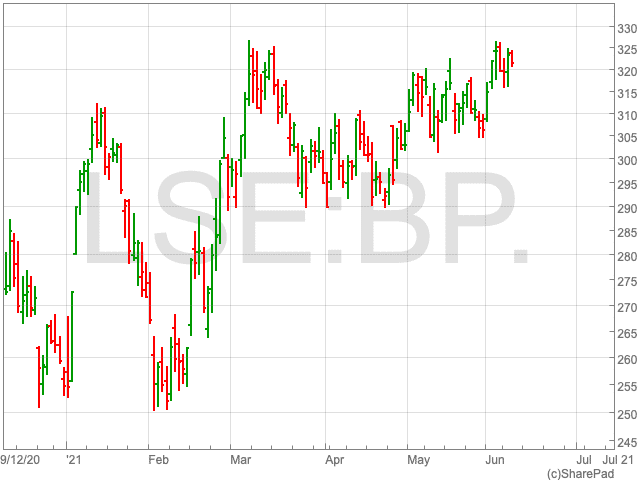

BP Share Price

2021 has been a strong year for the BP share price (LON:BP) so far. Since the turn of the year, the BP share price has gained 26.29%. Having dived at the beginning of the pandemic as demand dried up, and again towards the end of 2020 as oil prices dropped, the FTSE 100 oil giant has showed a great deal of resilience. As the world economy has further to go on its path to recovery, and BP continues to plan for the future, now could be an opportune time for investors to buy.

Green Transition

BP, as with a number of its fossil fuel competitors, announced its plans to move towards renewable sources of energy last year. The UK oil company plans to increase its low-carbon investments by 1,000% by 2030. BP also invested in a number of solar projects across the US to the tune of $220m, in addition to renewable assets in Europe.

Additionally, BP is continuing to divest away from oil assets, honouring its commitment to sell up to $15m worth by 2020. By 2025 the oil major could sell $25bn worth of assets.

While BP’s move away from fossil fuels and into renewables appears coherent and is on track. It remains a highly competitive industry, while timing is of the upmost importance.

Barclays

Barclays have high hopes for the BP share price over the coming months. Analysts within the investment banking arm of the UK bank feel that 475p is a realistic price target for BP during 2021. This would bring the oil company back around its levels before the pandemic struck.

Analysts at Barclays feel the oil company’s cash flow is a key strength over its competitors, despite BP easing away from some of its ‘upstream’ activities.

‘Our analysis shows the cash flow generation of the business as having the ability to support a 10% cash return to shareholders in the form of dividends and buybacks in a US$60 per barrel environment, which would be the highest in the sector,” Barclays analysts said in a note.

Of course, this is dependent on the ongoing recovery of the world economy. However, this is something BP can do little to influence. The company appears to be handling its transition well, while its finances are in check and the vaccine roll-out is continuing apace. This, as Barclays argues, bodes well for the outlook of the BP share price.