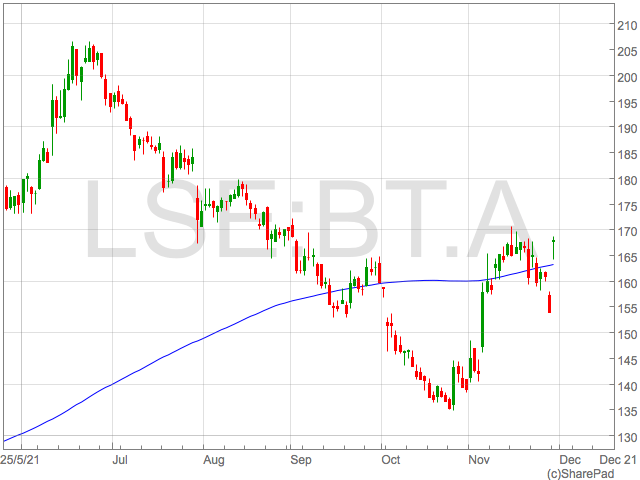

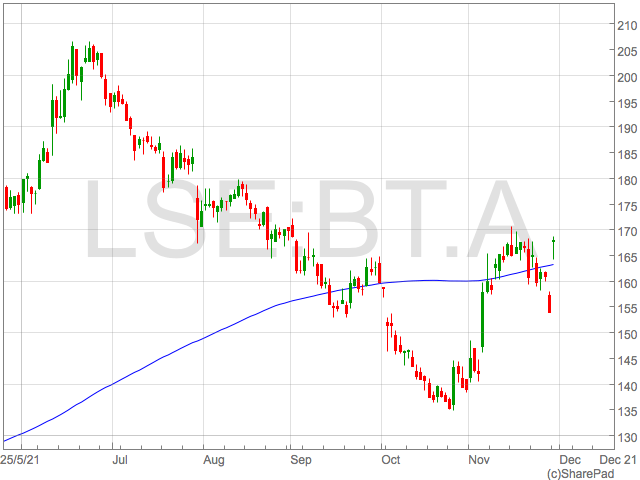

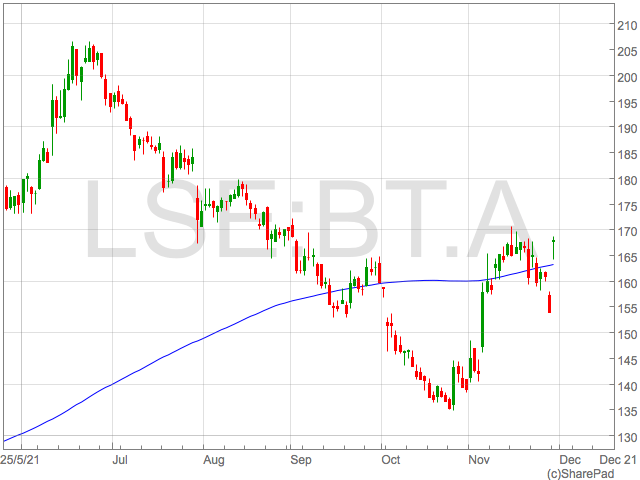

BT shares jumped on Monday following reports by the Economic Times Indian conglomerate Reliance Industries were lining up and offer for the London-Listed telecoms group.

The BT share price rose as high as 167.3p one Monday morning, before easing back as the session progressed.

BT showed signs of turning a corner earlier this month as they released half year results highlighting the impact of cost savings on profitability.

Adjusted earning per share rose 7% to 10.2p and adjusted profit after tax also rose 7% to £1,014m.

The jump in profitability came even though revenue rose just 1% to £10.3bn. It is these steady revenues that are the attraction to Reliance as BT is still dogged by pension liabilities.

Reliance have recently been outbid by a PE group for the Dutch T-Mobile unit and Reliance are reportedly eyeing BT’s Openreach roll out after BT ruling out a joint venture.

“It says something about the shifting dynamics of the global economy that an Indian firm like conglomerate Reliance Industries could be about to launch a bid for control of British telecoms giant BT,” said Russ Mould, investment director at AJ Bell.

“The reports come after a private equity bid for Telecom Italia which suggested the whole sector was in play.”

“Telecoms stocks have been as unloved as a cold caller on Christmas Day, and this is reflected in depressed valuations.”

“Reliance itself was outbid on a deal for control of a Dutch unit of T-Mobile as recently as September, and it may have rivals for its apparent interest in BT. French billionaire Patrik Drahi, the founder of Altice, has been steadily building up a position in BT and Deutsche Telekom already has a sizeable stake.

“It will be interesting in this context to see if this rumoured move by Reliance flushes out other parties and dials up a bidding war for BT.”

“You can understand why BT might attract interest. Despite its substantial pension liabilities and debts and iffy track record, it has a near monopoly position in the UK’s broadband network. And, for all its recent woes, BT has the capacity to generate substantial cash flows.”