BT Group addressed a sports broadcasting joint venture with Warner Bros Discovery and noted a 9% rise in annual pretax profit in its full-year results earlier today.

BT Group reported a 2% decline in revenue to £20.85bn from £21.33bn as revenue growth from its Openreach business was offset by a fall in Enterprise and Global, while Consumer, which is its biggest unit remained flat.

The group stated its Openreach broadband infrastructure arm “continues to build like fury”.

The telecommunication company said pretax profit rose 8.8% from £1.8bn to £1.96bn as larger finance expenses were offset by increased EBITDA.

Operating costs declined 4.2% to £18bn in 2022 and the group generated gross annualised cost savings of £1.5bn and rose the target to £2.5bn to be achieved by the end of FY25.

The group’s adjusted EBITDA rose 2.2% to £7.6bn which was in line with guidance of £7.5bn to £7.7bn.

The group noted a 25% rise in Capex to £5.3bn and a 14% rise in Capex excluding spectrum summing up to £4.8bn as BT spent more money on its fibre infrastructure and mobile networks.

BT reinstated dividend payout and added 5.4p as a final dividend resulting in 7.7p as the total dividend for the year. Yearly guidance remains despite difficult economic conditions said the group.

BT and Warner Bros Discovery

BT Group also announced its sports joint venture with Warner Bros Discovery to show sport in the UK and Ireland. The 50-50 JV will see BT Sport and Eurosport combine.

“By bringing together the sports content offering of both BT Sport and Eurosport UK, the JV will have one of the most extensive portfolios of premium sports rights,” said BT Group.

On completion of the deal, the production and operational assets of BT Sport will become a wholly-owned subsidiary of Warner Bros, where BT will receive £93m from Warner and around £540m as an earn-out.

The partnership will also enter into a new agreement with Sky extending beyond 2030 to look after the distribution of the joint venture’s sports content.

Partnership negotiations were first disclosed by BT in February. It hoped to wrap up talks by June 30. Discovery has completed its merger with WarnerMedia, an AT&T spin-off since the talks started. Discovery+ is a streaming service.

“Brave experiment or overly ambitious folly? BT’s participation in the sports rights battle has moved to a new phase as it completes its joint venture with Warner Bros. Discovery,” said Russ Mould, Investment Director, AJ Bell.

“BT entered the fray in 2012 by securing rights to Premier League matches and made a splash a year later by capturing Champions League and Europa League games from under the nose of Sky.

“The promise of top-level sports action was seen as a way of securing subscribers for its wider TV and broadband services.”

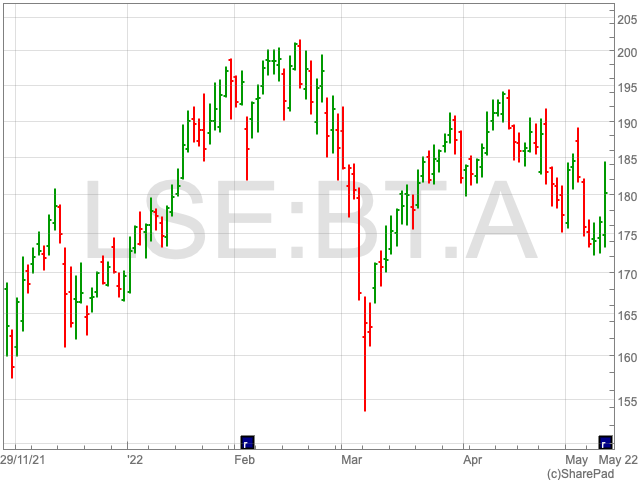

BT shares were trading up 2% to 180p as the company announced ties with Warner Bros and Sky in its annual results.

Outlook for 2023

There were various positive indications for 2022 such as low Ofcom complaints and BT’s highest ever NPS results.

BT anticipates a 4.2% rise in adjusted revenue growth and adjusted EBITDA, amounting to £7.9bn in the next financial year.

Cash flow is expected to be normalised and within the range of £1.3bn to £1.5bn, where capital expenditure, excluding spectrum work, is forecasted to be £4.8bn.

Mould added, “The results which accompanied news of the tie-up were solid enough – crucially customers seem to be sticking with BT despite the cost-of-living crisis and the company has made decent progress on the roll-out of 5G. The dividend is also in line with what was promised, and free cash flow is, critically, better than expected.”

“BT still has plenty of issues to deal with, not least the complex and costly investment in broadband infrastructure and a big pension deficit, but at least it seems to be laying the platform to address these challenges.”