Cadence Minerals have enjoyed a dramatic improvement in the quality of their lithium investments after ‘outstanding’ results from the Cinovec mine in the Czech Republic.

The Cinovec mine is operated by European Metal Holdings which has a 49% in the mine. Cadence Minerals holds 8.7% of the equity in European Metal Holdings.

In an announcement made this week, the Cinovec asset received significant upgrades to the resources that included revisions higher to the annual output and the impact of higher lithium prices.

The most recent feasibility study found it is possible to amend the mining process to incorporate the use of paste backfill which will be instrumental in increasing the mines output by 16%.

As a consequence, the Cinovec mine’s expected output has been increased from 25,267 tpa to 29,386 tpa.

The combination of rising lithium prices and the increased production means the projects NPV8 (post tax) increases from $1.108B to $1.938B. This is based on lithium prices of $17,000 which is significantly below the current market price.

“An increased mine life and a resource upgrade that takes the NPV8 from USD1.1bn to USD1.94bn adds substantial value to Cinovec’s already exceptional potential as a future battery grade lithium supply hub for Europe and the rest of the world,” said Cadence CEO Kiran Morzaria.

“Cadence are pleased to remain shareholders and supporters of EMH, and we look forward to further developments.”

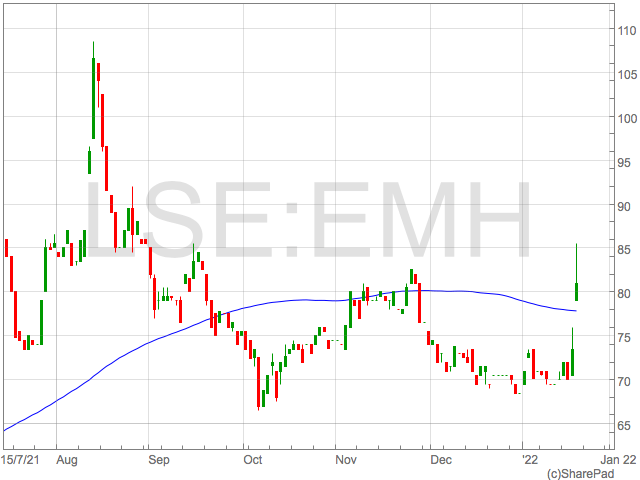

The news has seen European Metal Holdings share soar this week to trade at 81p.

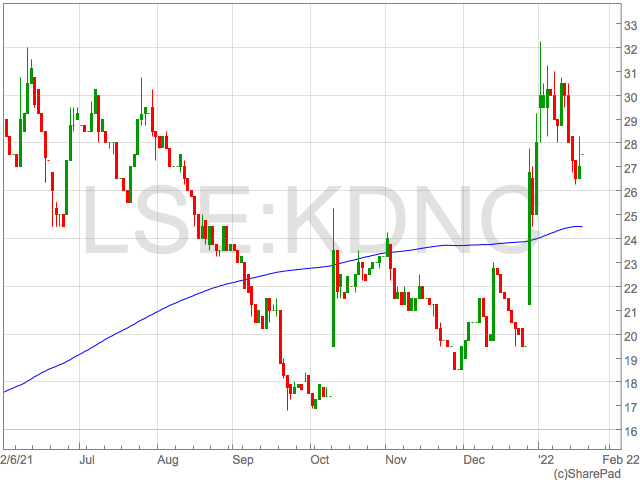

Cadence Minerals owns approximately 8.7% of European Metal Holdings following a placing conducted by European Metal Holdings to raise A$14.4 million.

Cadence Minerals stake is worth circa £12.4m with European Metal Holdings shares trading at 81p.

To put this in to context, Cadence Minerals entire market cap is £41m so the market is effectively currently attributing a value of just £28.5m to the rest of Cadence’s assets.

Cadence Minerals Portfolio

Although the latest developments at Cinovec adds tremendous value to a publicly-traded holding of Cadence’s portfolio, their flagship project is the Amapa Iron Ore project which has targets to produce $725 million iron ore per annum.

Cadence Minerals has additional exposure to lithium at the Sonora mine operated by Bacanora Minerals, as well as interest in Northern and Western Australia.

Cadence also has a 30% interest in the Yangibana Rare Earths project operated by Hastings Technology Metal in Western Australia.