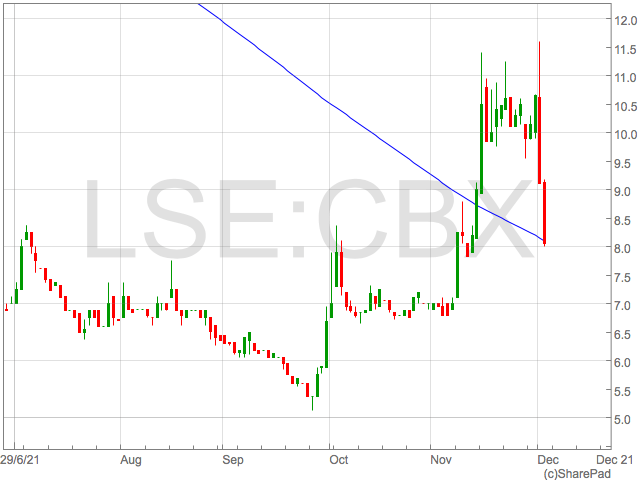

Cellular Goods have dropped for a second day in a row after the CBD company launched their inaugural product ranges and ecommerce platform.

Cellular Goods shares gave up another 11% on Thursday morning as the market continued to react to the announcement by selling shares.

The David Beckham-backed CBD company floated at 5p in February and exploded higher in a heavily oversubscribed IPO. Shares traded as high as 28p in Cellular Good’s early days as a listed company.

Since then, shares steadily have declined touching lows around 6p, before staging a rally into the product launch announcement.

The product launch has wiped off over 20% of the company’s value in two trading sessions as investors either sell on a ‘buy the rumour, sell the fact’ move, or are simply disappointed with the new products, and are voting with their feet.

Either way, Cellular Goods still has a valuation of £40.1m and have only just started generating revenue in a highly competitive CBD market with a number of established brands.

Alexis Abraham, Chief Executive of Cellular Goods, commented:

“Today is a major milestone for the Company with the launch of the UK’s first CBG skincare products on a best-in-class ecommerce platform. Leading with CBG sets us apart from the competition, and to also be able to offer consumers CBD ingestibles at the same time delivers on our vision to become the first true cannabinoid company.

“We have taken less than a year from a standing start to put Cellular Goods at the forefront of the cannabinoid and wellness industries, and as of today, we have started a new chapter in our growth by entering a revenue-generating phase. Consumers are now familiar with CBD, and we believe there is a substantial and growing demand for a more innovative and premium brand offering clean, green, and compliant products and look forward to delivering on our potential.”