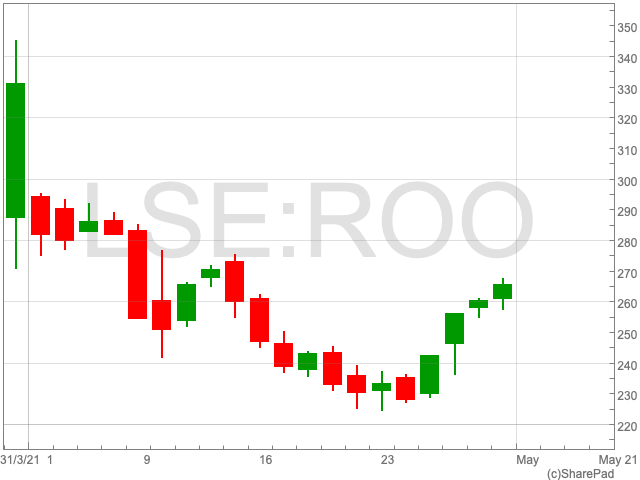

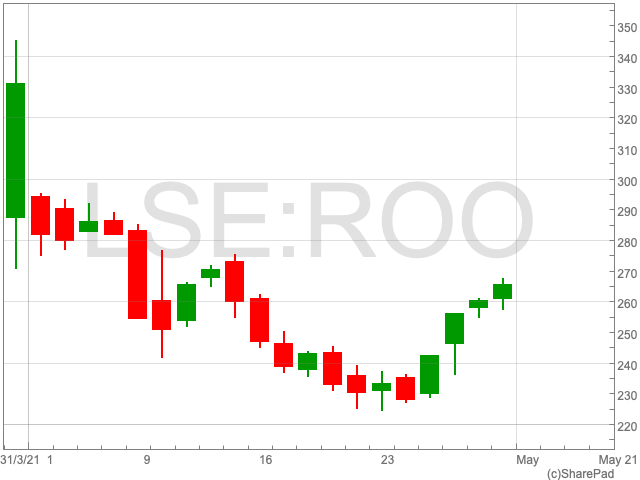

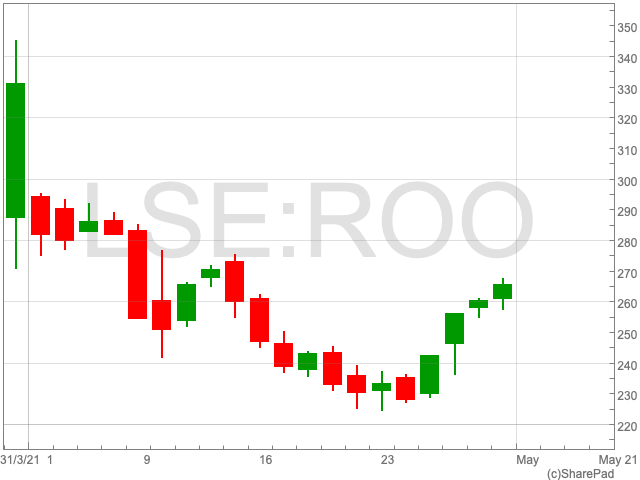

Deliveroo Share Price

Deliveroo suffered one of the worst debuts in London history as its shares fell by 26% when the food delivery company came to the market at the end of March. According to data from Refinitiv, Deliveroo was trading as low as 271p within the first 20 minutes of trading, way lower than the offering price of 390p. The UK-headquartered company priced 384.6m shares at 390p each, the bottom of its target range, meaning Deliveroo was valued at £7.6bn, which is the highest in London since Glencore in 2011.

Since that day it has been more of the same. On 26 April Deliveroo shares were valued at 228p. However, over the past few days the company has regained some ground, moving up for four consecutive days. This follows Deliveroo entering a two-year partnership with Waitrose to deliver groceries. The question now is whether or not Deliveroo can sustain this investment and entice investors.

Waitrose

After a successful trial of the service, Waitrose and Deliveroo came to an agreement over a two-year partnership for rapid home deliveries. The British supermarket confirmed it would be growing Deliveroo’s service from 40 to 150 stores across the country before the end of summer.

The new partnership comes on the back of an overall increase in the number of home deliveries of groceries during the pandemic, as such orders now make up 14% of the market, up by double since the beginning of 2020. Waitrose customers will be able to order from an increased range of 750 to 1,000 products and have them delivered in 20 minutes to addresses from London to Scotland.

Outlook

In mid-April Deliveroo posted healthy Q1 results, including a fourth consecutive quarter of growth. While its orders were up by 114%, compared to the same period a year before, up to 71m. While the IPO wasn’t overly successful, the funds raised will go along way to securing its near-term future, as will its recent results and the Waitrose news.

However, the company is expecting a slowdown once lockdowns are gone, while it still expects customer spending on its food delivery app to grow by 30-40% in 2021. Other issues ongoing disputes between the company and its workers over labour rights. The company is facing increasing pressure over its employment practices, which could put investors off.