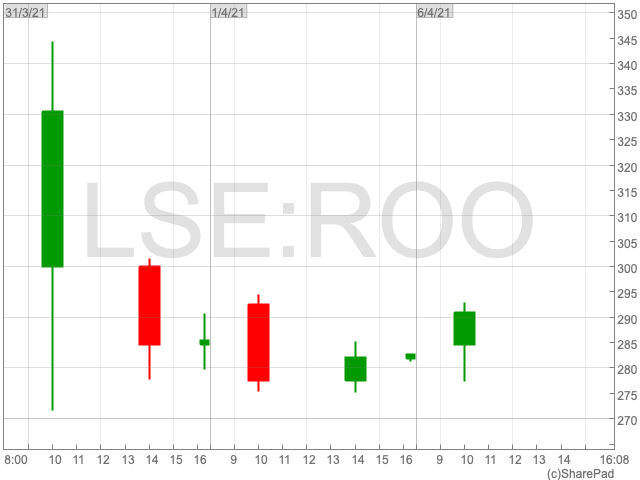

Deliveroo Share Price

The Deliveroo (LON:ROO) IPO turned out to be a huge disappointment as shares plunged 26% in the company’s debut on the final day of March. It has since recovered somewhat although investors who got in early are still well down. The question now is whether the fall represents an opportunity for investors to get value by buying shares in the food delivery company.

Why did the Deliveroo share price perform poorly on its London debut?

There was a number of factors at play according to analyst Neil Wilson of Markets.com.

“In addition to the failure to bring several large funds on board, the dual-class share structure, regulatory uncertainty, general profitability concerns and a miscalculation by the bankers on the pricing in relation to wider demand in the market, it also looks like some hedge funds shorted the stock aggressively from day one.”

The dual-class structure, whereby founders could retain control via enhanced voting rights, particularly appears to have put investors off.

Sacha Sadan, director of investment stewardship at Legal & General Investment Management (LGIM), said that while the ruling is appealing to founders, it alienates investors. “If a client puts £1 in, why should they not get a £1 economic interest? Seems fair.

“It is important to protect minority and end-investors against potential poor management behaviour that could lead to value destruction and avoidable investor loss.”

Looking ahead

Deliveroo is not the first company to experience a rocky start. “Uber stocks fell more than 7% on its debut but, if you’d kept your nerve, you’d be up 20% today,” said Danni Hewson, financial analyst at AJ Bell.

“Facebook had a torrid year or so as a listed business but if you’d hung on from those initial lows your investment would be up by more than 10-fold today,” Hewson added.

Investors saw an opportunity in Deliveroo and the company hasn’t disappeared. It is still a rapidly growing company with ambitions to be a market leader. Now it has a point to prove. Will Shu, who founded the company in 2013 and remains as CEO, needs to show the country’s credentials quickly and publicly.