by Max Ziegler

2020s: The Great Reset

Ten years from now, the world might look back on Covid as our ‘great reset’ moment, similar to how Americans describe their “Pearl Harbor moment” in the 40s, which marked a moment in US history which saw dire adversity, and it sparked innovation to address the era’s biggest problems.

At the time of Pearl Harbor, artilleries were mainly horse drawn – 80% of the German military depended on horses and the majority of the US artillery was horse drawn. Take a moment to let this sink in: In 1941, major artilleries depended on horses. Yet, by the end of the war, the world had entered the atomic age. The continued threat of ever evolving weapons, and increasing tension like the cold war, which is similar in its continuity to the threats pandemics and climate change pose to us now, gave way to an incredible period of innovation and economic growth. ‘History doesn’t repeat itself, but it often rhymes’, as Mark Twain put it, and the electric car industry could be one of the more interesting horses to place bets on this decade.

Riding the EV trend into 2035

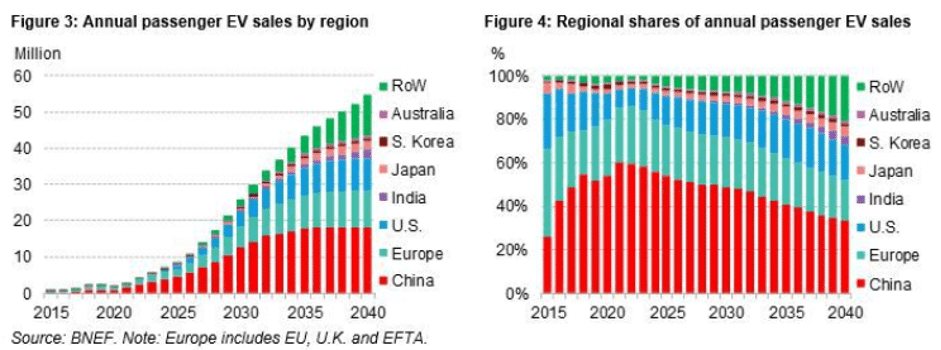

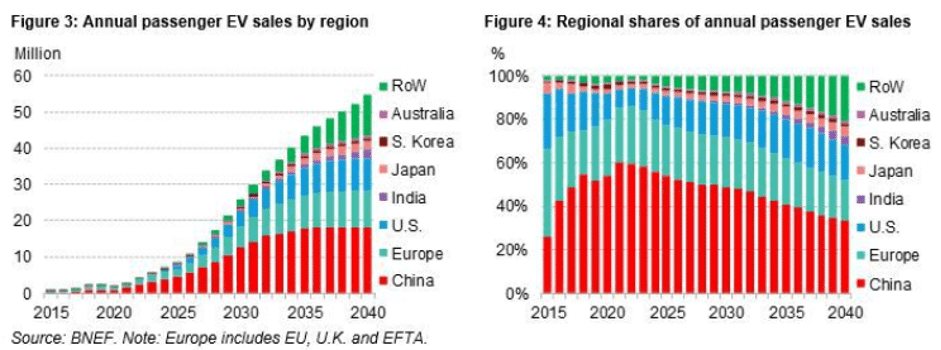

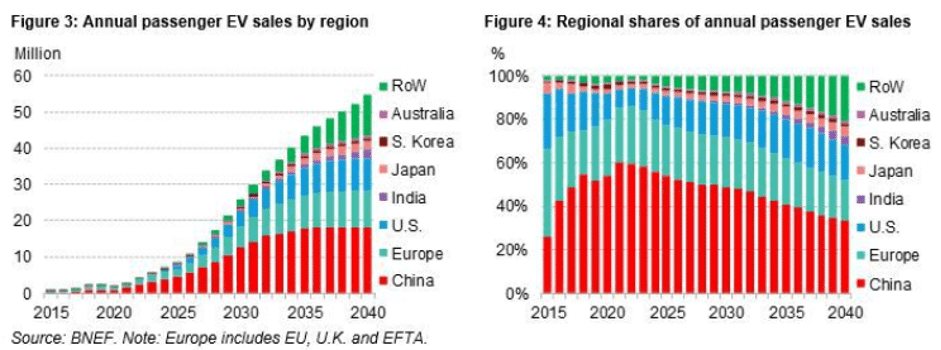

One of the most outspoken and iconic ‘problem solvers’ Elon Musk, is looking to make us a multi planet species, deploying rockets to Mars, and, most notably to traders, his company ‘Tesla’ had a meteoric rise in 2020. As per the BNEF 2020 forecast below, the trend of electric vehicles becoming the first choice for transport is deemed to continue this decade, however, please bear in mind, past performance is not indicative of current of future performance as investments can go down as well as up.

The BBC recently published an article that highlighted the infrastructure inversion that is currently happening in relation to charging cars. The narrative went from ‘you will never be able to charge your car with electricity anywhere’ to ‘you might not be able to fill your car with petrol or diesel by 2035’. The 2020s have been hauled as the great reset, and the electric vehicle industry is one industry to watch.

The next step: Battery stocks

Electric car stocks are those of companies that focus primarily on manufacturing electric cars. However, companies that manufacture the components used in electric cars — like batteries – are also part of the wider electric vehicle industry and could outpace the car manufacturers this year. Question is, how are the prices related, and are we in a super cycle rotation right now?

Bullish catalysts for battery stocks

1 Installation of charging station at home

You can have a charging station installed in your garage at home for your electric vehicle, which can usually be done within 8 hours. So, you can leave your car plugged in and wake up in the morning to have it ready.

2 Long battery lifespan

Research has shown that the average electric vehicle battery will retain at least 90% of its battery life after six years and six months of usage. Most electric vehicle manufacturers offer a service warranty of 8 years to 10 years for their batteries.

3 Battery swap technology

Tesla and other car manufacturers offer battery swap technology that allows one to swap batteries in less than 2 minutes. That way, you do not have to spend extra time charging your battery.

4 Regenerative Braking

Some electric vehicles have regenerative braking, whereby the car brakes by converting its kinetic energy to another form of energy that can be stored until when it is needed. This reduces friction on the tires, elongates the lifespan of the braking system, and makes for energy efficiency.

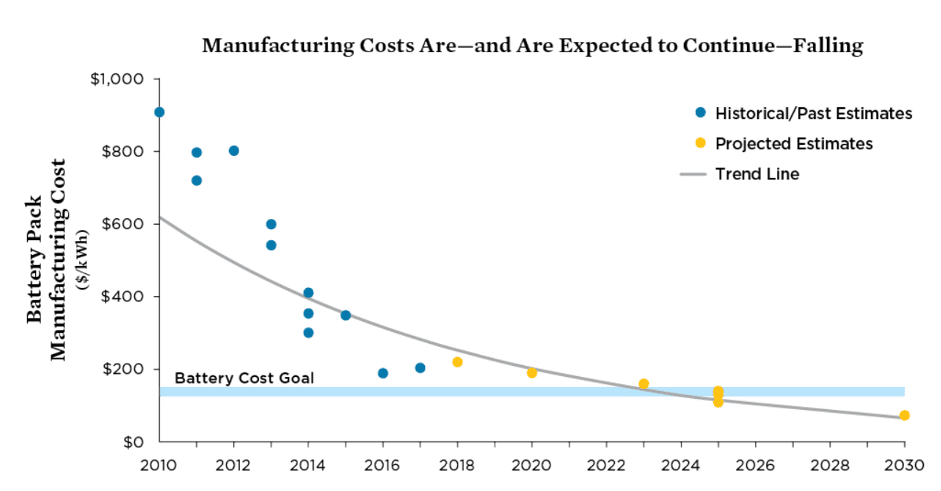

5 Battery price

The batteries of electric vehicles are expensive. Battery price amounts to about 25% of the cost price of an electric vehicle.

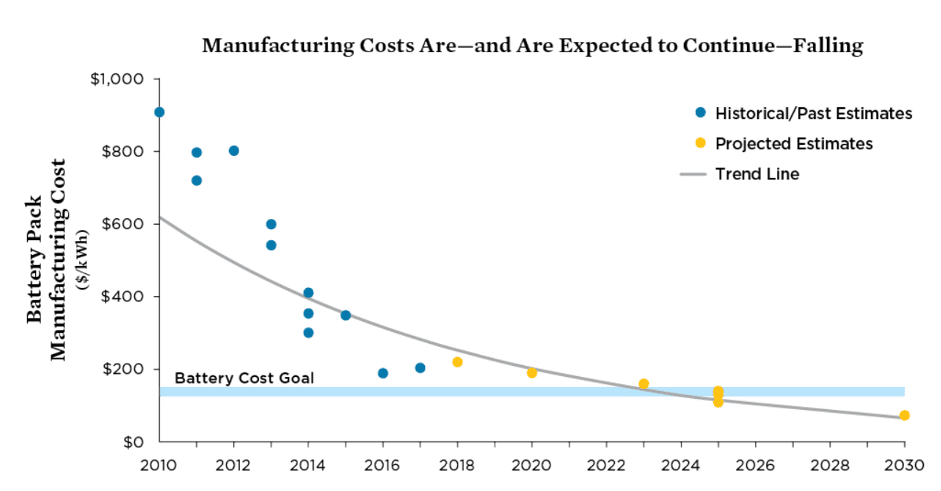

Yet, private and government researchers are working on reducing the prices of these vehicles. A lot of progress has been made on this. According to IHS Markets, the average price of batteries dropped 82% from 2012 to 2020. Based on its data, by 2023, when batteries are expected to cost less than $100/kWh, the drop will be 86% in a decade. Mass production of batteries and improvements in battery technology will drop the costs further.

6 Reusable batteries

Electric vehicle batteries can be reused for home energy storage, backup for large buildings, electric bikes, electric scooters, backup power for data centres, backup power for telecommunication base stations, etc.

The residual capacity of these batteries is still very valuable.

7 Recyclable batteries

Old batteries from electric vehicles can be recycled. The batteries could also be reduced to constituent metals and elements for usage elsewhere.

Potential risks for battery bulls

1 Global chip shortage

The global semiconductor chip shortage that has hit automakers around the world and constrained vehicle production will easily drag into next year, the chief executive of the world’s No. 4 automaker, Stellantis warned, which could hamper production and profitability of electric vehicle makers.

2 Cost and environmental impact of raw materials

Materials for battery production are of finite supply. The chemicals and processes used in mining lithium create air, water, and soil pollution; Less than 5% of lithium-ion batteries are recycled. If thrown in landfills, EV batteries can leach chemicals into the ground and into water, potentially causing serious environmental damage, or even cause toxic chemical fires.

3 Governments slow to create infrastructure

While governments have pledged to employ funds to build up the infrastructure, actual progress has been slow, and Biden’s multi trillion dollar infrastructure plan only ended up with a fraction of the originally pledged amount for electric vehicle infrastructure.

4 Competition Risk

As for with most emerging industries, there is a risk of betting on a company that will lose out to the competition.

5 Risk/reward ratio

When stocks have risen quickly, there is always a risk of pullback, and battery stocks are no exception to this.

6 Competition pressure on prices

Prices for batteries are expected to keep falling, which will be good for profit margins. However, there could also be increased pressure to offer batteries cheaply, which would decrease profit margins for the battery stock firms.

3 battery stocks that are worth a look

- Tesla

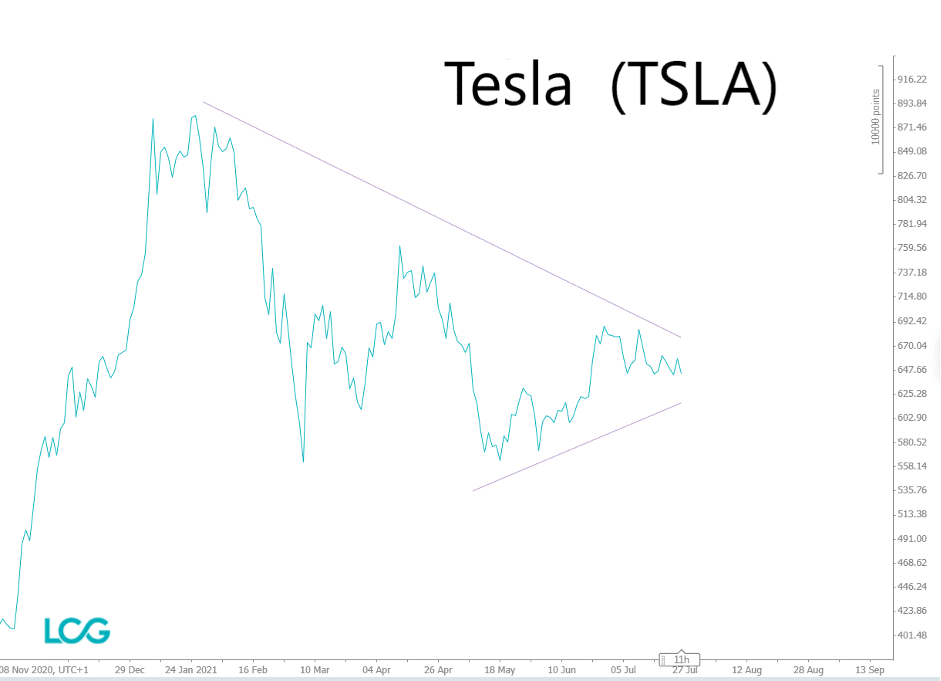

Tesla is not only producing cars but is also heavily invested in the production of batteries. The Q2 earnings report revealed that, in short, Tesla managed to get some progress done, yet they still have more work to do before achieving any volume production on their batteries.

Past performance is not an indicator of current or future performance

Open a free demo account with charting tools here

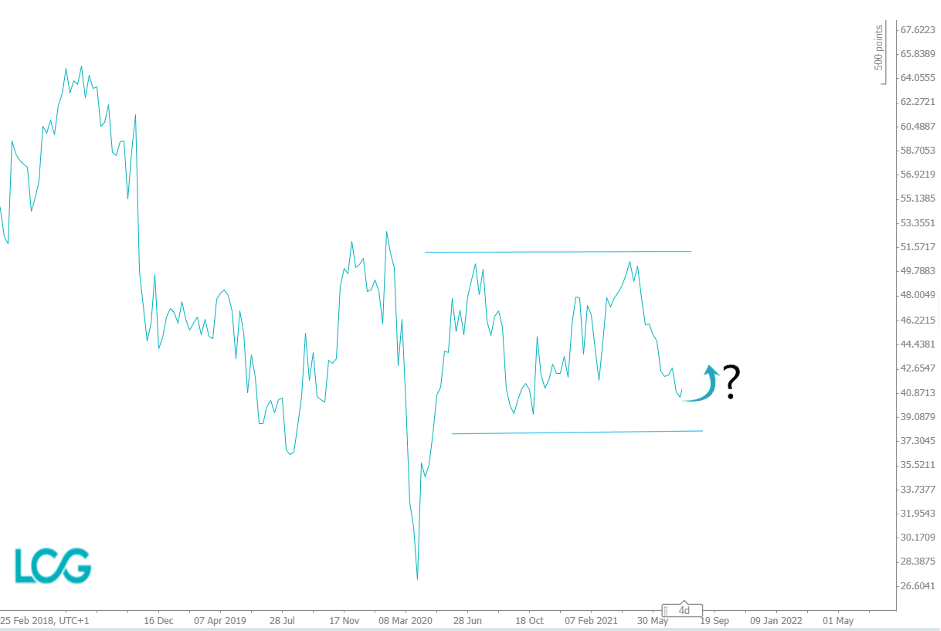

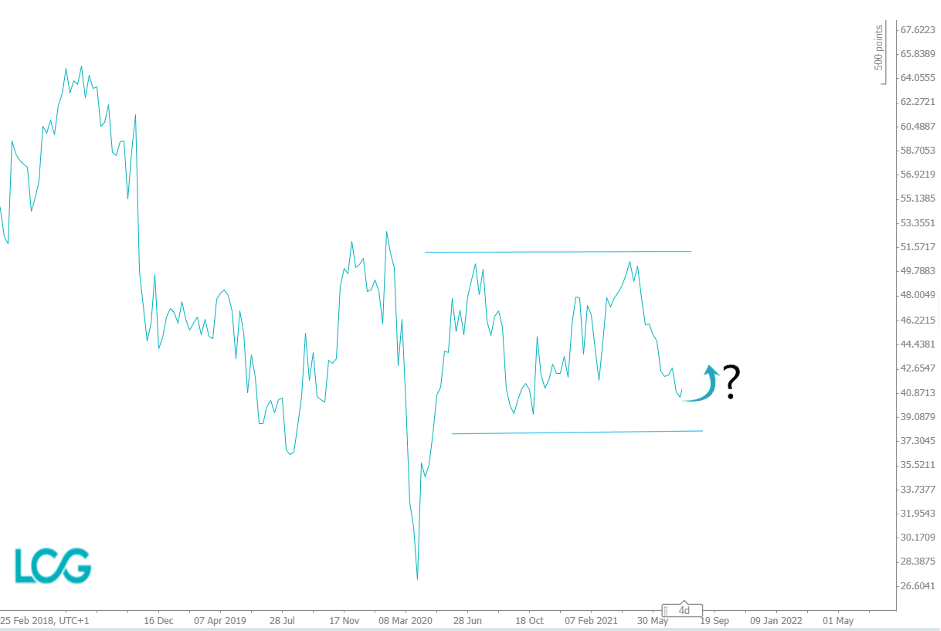

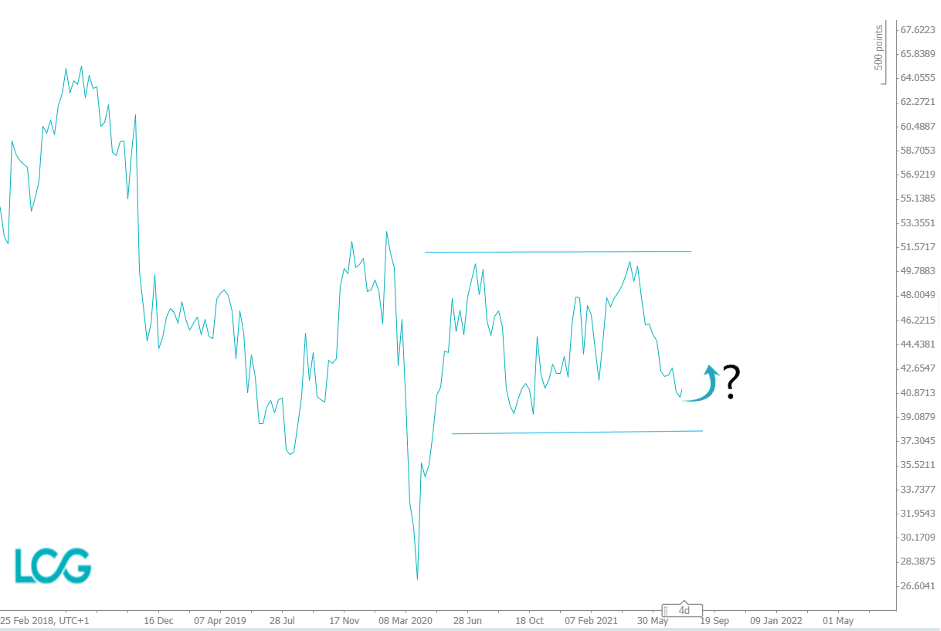

2. Energizer Holdings, Inc. ENR

ENR is a leading manufacturer of batteries and automotive care products globally and produces lithium-ion batteries. Is the share price increasing or decreasing amid the effect of Tesla’s earning call?

Past performance is not an indicator of current or future performance

Open a free demo account with charting tools here

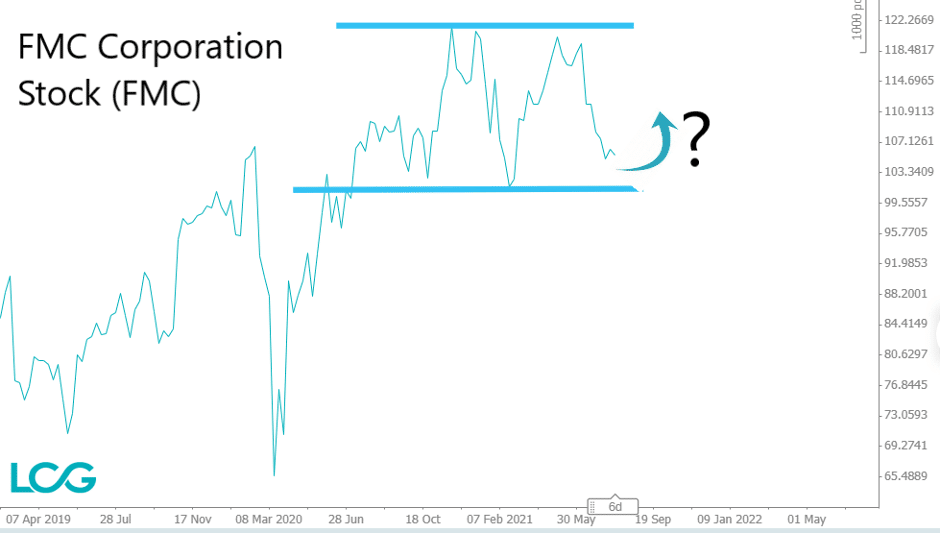

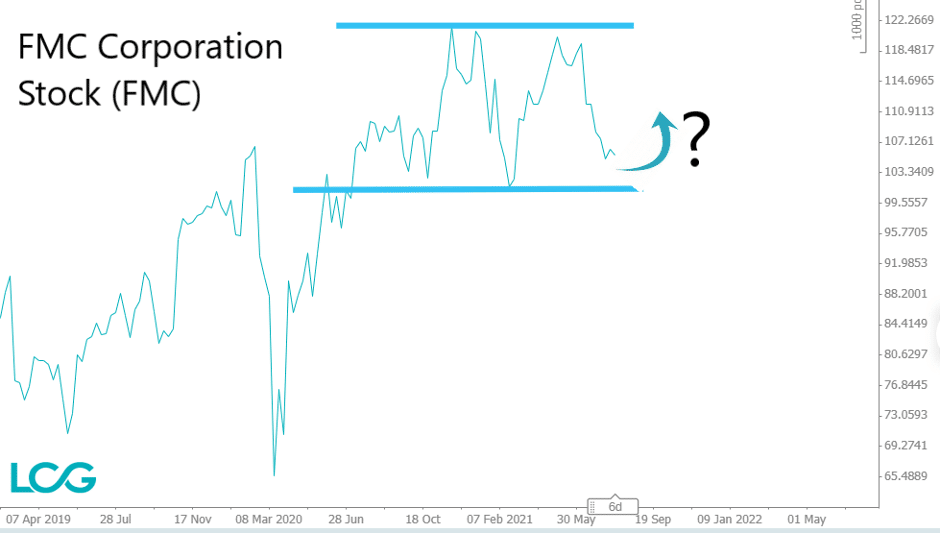

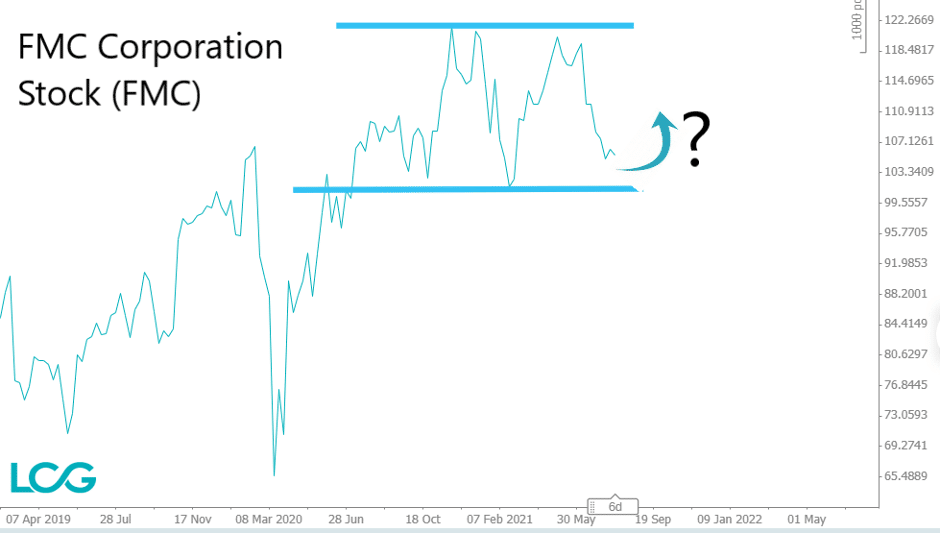

3. FMC Corporation FMC

Similarly, the chemical company FMC Corporation, which is involed in the production of Lithium for batteries, has been cycling for around one year. The , s.

Past performance is not an indicator of current or future performance

Open a free demo account with charting tools here

The world is changing at an ever-faster pace, and while it is impossible to predict which technologies will rise the most, electric car batteries continue to be worth watching.

Spread betting and CFD trading carry a high level of risk to your capital and can result in loss of your deposits. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Please note that 68% of our retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing money.

The information provided within this communication has been prepared by London Capital Group Limited (LCG) and is intended for informative purposes only. It is not intended for investment, or commercial advice or an offer or solicitation for the purchase or sale of any financial instrument. Any opinions, news, research, analysis, prices, other information, or links to third-party contained within this communication is provided as general market commentary and does not constitute investment advice and is not intended for any form of commercial use. LCG shall not accept liability for any loss, damage including, but without limitation, to any loss or profit which may arise directly or indirectly from use of or reliance on such information.

The information in this article is not directed at residents of EU as well as Australia, Belgium, Canada, New Zealand, Singapore or the United States, and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

London Capital Group (LCG) is a company registered in England and Wales under registered number: 3218125. LCG is authorised and regulated by the Financial Conduct Authority (FCA) under the firm reference number of: 182110. The registered address for LCG is: 80 Cheapside